Business

Hackers Target NCBA Account Holders

NCBA Group appears to have come under cyberattack according to information shared by a custom. In what looks like a phishing email, the hackers using [email protected], are baiting Loop users with links that easily compromise their bank accounts and sweep clean their accounts.

Once you click on the fraudulent link and input your password, they take control of the account and change passwords.

If you bank with Loop and come across this email, don’t act on it.. my paranoia had me calling the bank first to confirm whether they sent this. Kumbe once you do, they get access to your bank account and withdraw everything.. pic.twitter.com/oVtQmj2Sup

— Vionna (@Kurlycheeks) June 22, 2023

The bank has however responded to the concerns.

Hello @difremkare, thank you for contacting us. We have forwarded this to the relevant team for investigations to be done. Please note that LOOP will never ask you to log into an online page to validate your account. Report any suspicious communication or links on 0709714444. ^LL

— LOOP_KE (Formerly NCBALoop) (@LOOP_KE) June 22, 2023

Cases of customers losing money have been in the social media for sometime.

I lost $4000 from my NCBA account it taken over 2years without any resolution. date 24/04/2018. Account no 440000018708 kindly tweet until I reaches the bank for action.@NCBABankKenya

— kevin kimani mungai (@kevinkimaniz) July 23, 2020

They have not refunded her money!!. I would trip if someone even took my hard earned 100bob pic.twitter.com/dgp5xyypYt

— Nyarari? (@fantasianelly) July 21, 2020

For one full week I’ve been trying to get answers as to why there are credits and debits on my statement that I did not make.

In October I only loaded a few hundred dollars and less than 15,000 bob. @NCBABankKenya hasn’t been able to answer my question. pic.twitter.com/ve5JckVzbH

— . (@Trackmann2) November 16, 2022

Another lady had claimed to have been hacked and lost Sh1 million.

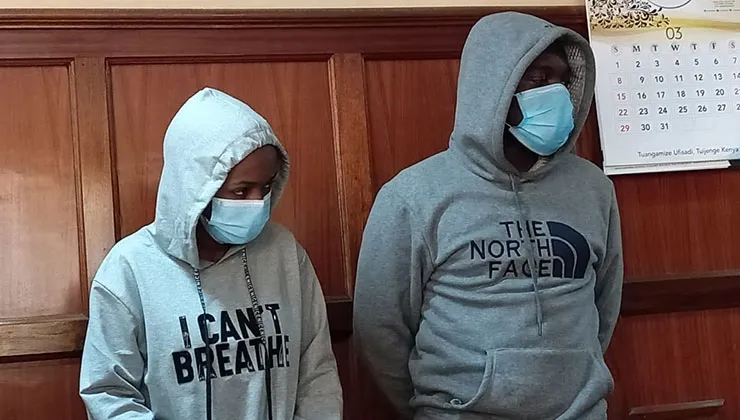

In 2020, two second-year students at Jomo Kenyatta University of Agriculture and Technology (JKUAT) were charged at Milimani Law Courts with stealing Sh25 million NCBA (K) Bank through hacking.

Anthony Mwangi and Ann Wambui were accused of committing the offense on or before October 20, 2020, jointly with others not before the court.

Apparently, it is Mwangi who informed the bank that there was a system breach through Twitter and was subsequently summoned to appear at the bank for an inquiry.

Ms Ann Wambui and Mr. Anthony Mwangi at a Nairobi court on October 26, where they were charged with hacking and stealing Sh25m from bank.

Extra info

Even though @Nendo254 has been featured in the @NYTimes twice, we bought an ad in Kenya's leading business newspaper @BD_Africa. Why?

To raise the alarm on social media fraud with bank executives in a place they read. Every hour, tens of thousands of #KOT* comment and complain… pic.twitter.com/7GSpMdSkxg

— Mark Kaigwa (@MKaigwa) June 22, 2023

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business1 week ago

Business1 week agoEastleigh Businessman Accused of Sh296 Million Theft, Money Laundering Scandal

-

Investigations1 week ago

Investigations1 week agoInside Nairobi Firm Used To Launder Millions From Minnesota Sh39 Billion Fraud

-

Business1 week ago

Business1 week agoMost Safaricom Customers Feel They’re Being Conned By Their Billing System

-

News1 week ago

News1 week agoUnfit for Office: The Damning Case Against NCA Boss Maurice Akech as Bodies Pile Up

-

Business1 week ago

Business1 week agoEXPLOSIVE: BBS Mall Owner Wants Gachagua Reprimanded After Linking Him To Money Laundering, Minnesota Fraud

-

News1 week ago

News1 week agoTax Payers Could Lose Millions in KWS Sh710 Insurance Tender Scam As Rot in The Agency Gets Exposed Further

-

News1 week ago

News1 week agoPastor James Irungu Collapses After 79 Hours Into 80-Hour Tree-Hugging Challenge, Rushed to Hospital

-

News1 week ago

News1 week agoDeath Traps: Nairobi Sitting on a Time Bomb as 85 Per Cent of Buildings Risk Collapse