News

Govt Defends Diverting Ksh6.5 Billion of Public Money From eTA to a Swiss Account

A recent exposé by the Daily Nation shook the country with claims that Ksh6.5 billion collected through Kenya’s Electronic Travel Authorization (eTA) system was quietly funneled into a Swiss account.

The explosive report sparked memories of the 2014 Eurobond saga, reigniting fears of misappropriation of public funds. However, in a swift rebuttal, the government clarified the situation, attributing the transfer to a “pilot phase” of a partnership with a Swiss tech firm.

But is that all there is to it? Here’s a closer look into the government’s justification and the scrutiny surrounding the ETA to Swiss Account saga.

Why Money Was Diverted: The Government’s Justification for the ETA to Swiss Account

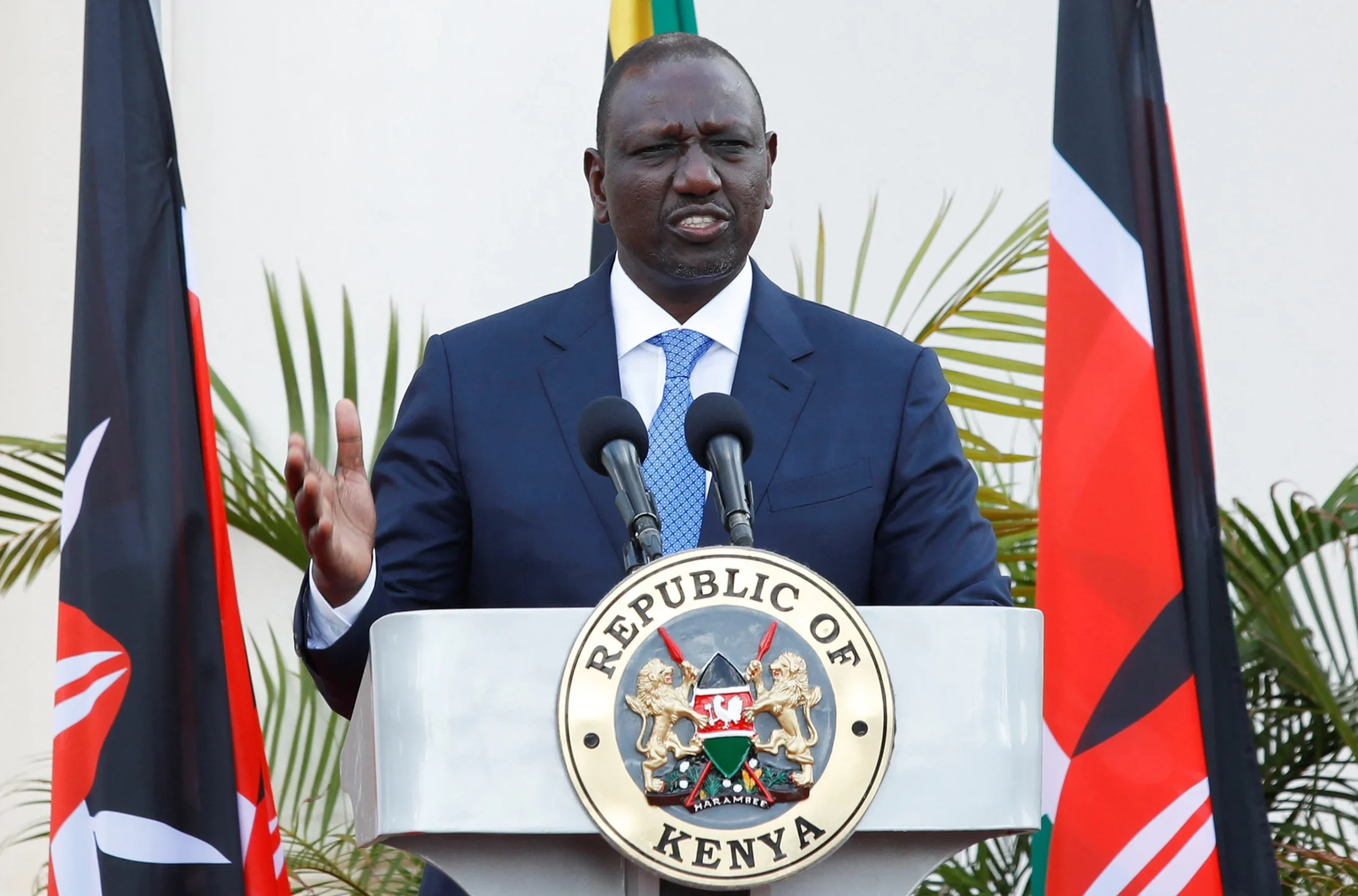

The Kenyan government, through its official spokesperson Isaac Mwaura, issued a clarification on April 14 following media reports accusing state officials of shady financial dealings related to the eTA programme.

The focal point of the allegations was that Ksh6.5 billion in public funds, collected from foreigners applying to travel to Kenya between August 2024 and February 2025, was allegedly siphoned off to a Swiss account operated by a foreign company.

According to Mwaura, this wasn’t a case of corruption or financial mismanagement but rather part of a controlled piloting phase of the new eTA system.

He emphasized that the Swiss firm involved had been contracted by the government to operate and manage the electronic visa system on a temporary basis.

During this phase, the firm collected Ksh6.5 billion in revenue from applicants and was compensated with Ksh1.5 billion—roughly 23 percent—for the provision of its services.

Mwaura defended the partnership, stating that the outsourcing was designed to help Kenya benefit from the Swiss company’s technological expertise and infrastructure, especially as the country transitioned into the fully digital eTA era.

He further clarified that the pilot phase had officially ended and that all subsequent eTA payments are now processed through the eCitizen platform and remitted directly into Kenya’s Consolidated Fund.

Despite this explanation, the government’s move has been met with criticism, especially from transparency advocates and legal experts who argue that allowing a foreign firm to not only collect but also temporarily hold public revenue—outside the official national account—could set a dangerous precedent.

Legal Concerns, Public Outcry, and Lingering Doubts

The controversy surrounding the ETA to Swiss Account stems not just from the amount of money involved but also from broader legal and governance issues.

Kenya’s Constitution, under Article 206(1), stipulates that all money raised or received by or on behalf of the national government must be paid into the Consolidated Fund, unless specifically authorized otherwise.

Critics argue that routing funds through an overseas entity contradicts this requirement and opens the door to abuse.

Adding fuel to the fire were recent allegations by former Public Service Cabinet Secretary Justin Muturi. He claimed that President William Ruto had pressured him to approve a separate Ksh130 billion grant from foreign donors—a move he says was outside the legal frameworks established under the Public Finance Management Act.

Muturi’s refusal to greenlight the grant has added to public suspicion regarding how the executive branch is handling foreign deals and financial transactions.

Moreover, the Daily Nation investigation highlighted a pattern of opacity in financial management practices, raising questions about other possible revenue streams being kept outside the purview of Kenya’s financial oversight institutions.

To date, while the government’s explanation regarding the eTA revenues has helped cool immediate public outrage, it has not fully erased the doubts.

Transparency International Kenya and other watchdogs have called for a full audit of the pilot phase, including details on how the Swiss firm was selected, the exact terms of the contract, and whether alternative local providers had been considered.

While Mwaura maintains that the transition to eCitizen is now complete and more secure, the episode has reminded Kenyans of past financial scandals where similar justifications were used to mask misappropriations.

As such, the government may need to go beyond statements and deliver concrete transparency measures to restore public confidence.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine7 days ago

Grapevine7 days agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Lifestyle1 week ago

Lifestyle1 week agoThe General’s Fall: From Barracks To Bankruptcy As Illness Ravages Karangi’s Memory And Empire

-

Grapevine3 days ago

Grapevine3 days agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

Investigations2 weeks ago

Investigations2 weeks agoEpstein Files: Sultan bin Sulayem Bragged on His Closeness to President Uhuru Then His Firm DP World Controversially Won Port Construction in Kenya, Tanzania

-

News2 weeks ago

News2 weeks agoAUDIT EXPOSES INEQUALITY IN STAREHE SCHOOLS: PARENTS BLED DRY AS FEES HIT Sh300,000 AGAINST Sh67,244 CAP

-

Business2 weeks ago

Business2 weeks agoKRA Can Now Tax Unexplained Bank Deposits

-

Investigations1 week ago

Investigations1 week agoEpstein’s Girlfriend Ghislaine Maxwell Frequently Visited Kenya As Files Reveal Local Secret Links With The Underage Sex Trafficking Ring

-

News1 week ago

News1 week agoState Agency Exposes Five Top Names Linked To Poor Building Approvals In Nairobi, Recommends Dismissal After City Hall Probe