Business

Expert Analysis: Interest Rates Capping, A Populist Move By President Uhuru Built On Sand Disastrous To The Economy In Long Run

Published

9 years agoon

By Philip Makokha

That same day Jesus went out of the house and sat by the lake.2 such large crowds gathered around him that he got into a boat and sat in it, while all the people stood on the shore. 3 Then he told them many things in parables, saying: “A farmer went out to sow his seed. 4 As he was scattering the seed, some fell along the path, and the birds came and ate it up. 5 Some fell on rocky places, where it did not have much soil. It sprang up quickly, because the soil was shallow. 6 But when the sun came up, the plants were scorched, and they withered because they had no root. 7 Other seed fell among thorns, which grew up and choked the plants. 8 Still other seed fell on good soil, where it produced a crop—a hundred, sixty or thirty times what was sown.

The above text comes from the book of Matthew chapter 13. It piqued my interest because, government policies are like seed. The sower is the government- legislature, judiciary and executive. Assuming, an ordinary man immediately appeared after the seeds had started germinating, he would have been thrilled by the seeds sown on rocky ground that had sprung up quickly. I bet, he would even thank the sower.

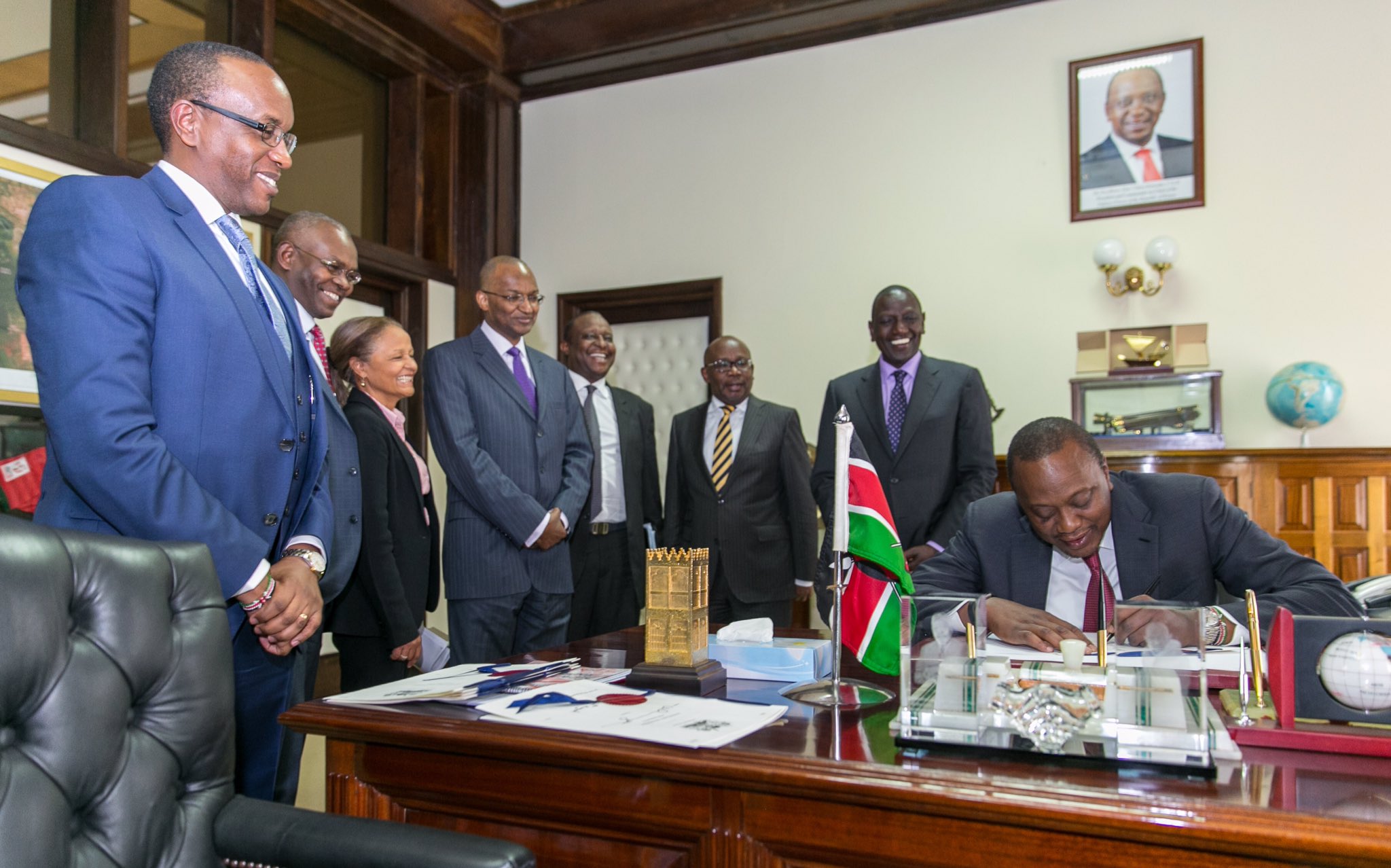

It is human nature, to live in the present and enjoy facades, which are our daily lives. On August 24, 2016, H.E President Uhuru Kenyatta assented to the Banking amendment Act (2015) which among other things introduces interest rate ceilings and floors. In his statement after signing the law, the president says “…Upon weighing carefully all these considerations, on balance, I have assented to the Bill as presented to me. We will implement the new law, noting the difficulties that it would present, which include credit becoming unavailable to some consumers and the possible emergence of unregulated informal and exploitative lending mechanisms.

First, let us start from the very basics. Interest is the price charged on money. Since it is presented as a percentage, we refer to it as a rate. Interest rate ceilings/restrictions/caps refer to the maximum interest rate charged by the lender to the borrower. On the other hand, interest rate floor refers to the minimum interest paid on bank deposits i.e. deposit rate. The difference between the two is the SPREAD.

Ordinarily, these interest rates are driven by market forces- demand and supply. Market forces work best in a perfect competition market. This is a market where among other features; it has many buyers and sellers. Other markets are monopoly, oligopoly etc. It is not possible in practice, to find a market that is 100% its type e.g.100% perfect competition or oligopoly. Ordinarily, we characterize a market as perfect competition if the features of a pure competition dominate features of alternative market structures. Other than markets, we also need to look at different types of economies. An economy can be Command, free or mixed. Generally, Kenya is a free market economy. As to whether, the banking sector in Kenya is oligopoly or pure competition, I do not know. Theoretically however, it is a pure competition. The Kenyan economy is majorly free enterprise where an owner of capital can put it in any sector and await returns. Of course, there are regulations governing each of the sectors that an entrepreneur may venture into. These regulations are not necessarily barriers to entry.

INTEREST RATE AS PRICE FOR MONEY AND ITS DETERMINATION

Let us throw this animal called interest rate out of the window for a moment. Let us talk about and ordinary good-sugar. How is price for sugar determined? In any business transaction, there are two parties involved. The buyer (demand) and the seller (supply). The buyers want to buy at the lowest possible prices while the sellers want to sell at the highest possible price. So how is the price determined? The sellers will set a price that covers their production costs plus a mark up. The buyer wants to buy at a price that gives them value for money. In a market with only one seller and many buyers, the seller is likely to exploit the buyers while in a market with only one buyer and many sellers, the buyer is likely to benefit. In practice, there exist many buyers and sellers and therefore prices of items are determined at an equilibrium point. On a graphical presentation, this is the level where quantity demanded equals to quantity supplied. QUANTITY DEMANDED IS NOT DEMAND! The prices will generally hang in this range. The interest rate is determined in a similar manner.

BANKING IN KENYA: OLIGOPOLY OR PERFECT MARKET?

The answer to the above question depends on who you ask. Generally speaking, financial industry is a pure competition. There are many sellers and information is readily available. For example, you can easily know what Bank X charges as interest rate compared to Bank Y. Thanks to the Central bank of Kenya. Some people argue that banking industry is an oligopoly- there is a small number of sellers who control the market. To some extent, this is true. Kenya is dominated by less than 10 banks even though we have in excess of forty banks in operation. These banks, it is argued work in a cartel-like manner thereby charging unnecessarily high interest rates. What high interest rate is, am yet to understand.

WHY INTEREST RATE CEILING AND ‘FLOORS?’

Hon. Jude Njomo, having studied the cartel-like behavior of commercial banks and their high interest rates, deemed it appropriate to regulate the interest rates that banks charge in order to cushion the common man-Wanjiku. From what I gather, Wanjiku is a group of people at the bottom of the economic pyramid. Members of parliament therefore, deem it unfair and predatory for the banks to continue exploiting these members of the society. The attempt to cap interest rate is a third one since the last two decades. The other two attempts having been made by the former mp Joe Donde and Hon. Jakoyo Midiwo. The bill, now the Act addresses many things, among them interest rate capping. This is what this article is about. Many countries have tried capping interest rates including Zambia in 2013. The law has since been abolished. Around the world, approximately 76 countries have some sort of interest rate capping. Some sort because, not all interest rate capping work as the one we have enacted.

A study by Samuel Munzele Maimbo and Claudia Alejandra Henriquez Gallegos titled,

‘Interest Rate Caps around the World Still Popular, but a Blunt Instrument’ reports:

‘In this exercise, we found that the main reasons for using interest caps on loans were to protect consumers from excessive interest rates, to increase access to finance, and to make loans more affordable. Most countries regulate interest rates with the broad aim of protecting consumers, as in the case of Spain. Other countries provided more specific objectives, such as protecting the weakest parties (Portugal); shielding consumers from predatory lending and excessive interest rates (Belgium, France, the Kyrgyz Republic, Poland, the Slovak Republic, and the United Kingdom); stopping the abuses arising from too much freedom (Greece); controlling over-indebtedness (Estonia); and decreasing the risk-taking behavior of credit providers (the Netherlands). Similarly, in Thailand authorities stated that the purpose of the caps was to make finance affordable for low-income borrowers.3 Finally, Zambia’s authorities introduced the caps to mitigate the perceived risk of over indebtedness and the high cost of credit, as well as to enhance access to the underserved.

The Zambia law was abolished three months later.

WHAT INTEREST RESTRICTIONS WILL DO

There are two probable things that restricting interest rates will do. One, what the government tells us that will happen and the second happening is what economic theory supports. I will talk about both cases.

According to the government and the supporters of the law, low interest lending rates will increase access to credit by Micro, small and medium enterprises. It will also increase access to credit by families that could not afford credit facilities under a regime without the caps. This will boost productivity and ultimately improve economic growth. Jobs will be created and we shall be a few steps away from achieving a million jobs a year as promised by Jubilee. The government will also achieve greater financial inclusion rates for the Kenyan citizen.

On the other hand, interest rate floors set for saving deposits (deposit rate) will encourage a savings culture thereby ultimately, boosting our economic growth. After all, a saving economy is a growing economy. It is however, misleading to think that limiting deposit rates at 70% of CBR will encourage savings. According to the Central bank, the deposit rate as of April 2016 was 6.92% .With the new low; it will be at least 7%. I do not think a marginal increase of 0.08 will do anything to encourage savings. With the 6.92% of deposit rate, our saving rate is at a mere 1.4%. The interest rate floor will thus, have negligible effect, if any. Low lending rates encourage investment as well as consumption and both these activities are good for economic growth. By controlling deposit rates, the government will be able to arrest any inflationary pressure that would have occurred because of availability of cheap loans. Whereas these arguments are convincing, they are flawed.

However, according to economic theory, two scenarios are more likely to occur. First, availability of cheap loans will increase liquidity in the economy. The question that begs is what is the effect of an increase in money in circulation? An increase in money in circulation will automatically increase consumption. If the increase in money is not accompanied by a commensurate increase in production, as is likely to be the case in Kenya, there is likely to be inflation.

There will be too much money chasing too few goods! This inflationary pressure will lower the purchasing power of our money. The real value of our shilling will be eroded. For example, Ksh.1000 will buy less than it could have bought prior to interest rate restriction. As a result of this pressure, workers will demand more pay. This will cause industrial unrest and production will plunge further because of time wasted on pay negotiations.

If employers will agree to increase salaries, the cycle will continue. This policy therefore, creates a vicious cycle that is a zero-sum game.

The second likely event to occur according to economic theory is credit rationing. A key component of interest rate is the risk aspect. Banks generally weigh the risk profile of a client and adjust the rate accordingly before advancing a facility.

A client either has low risk profile or high risk profile. A client with a good credit history and a regular stream of income is less risky than a client who is probably borrowing for the first time. In a regime where interest rates have no upward limit, banks will accommodate the riskier client by adjusting the rates accordingly. On the other hand, if the rate has a cap, and the risk profile of a client cannot fit within this regime, the best alternative is to deny that client the facility all together.

These clients are SMEs and Wanjiku. Apparently, the very people this legislation intends to protect. From my experience, when someone wants money, the cost is not their priority. The priority is AVAILABILITY. And this is why; Shylocking is a thriving business in Kenya. This ‘locking out’ of potential borrowers, will lead to establishment of more informal lending businesses that are likely to exploit the public much more. The president notes this in his statement. Kenyans will be exploited much more by the unregulated sector of shylocks!

WHAT WORKS?

Spain is among the few countries that have a law similar to what the president assented to on August 24, 2016. Does it work? Whereas interest rates are low in Spain, studies show that it boasts of notoriously high charges. This means, what the banks cannot make through interest, they make through other charges. This is also a possibility. If these charges too, are capped, the banking industry is going to be a no-go zone for investors. Investors like to put their money where it generates the highest possible returns. Since the major role of management is to maximize shareholder value, caps limiting their ability to achieve this goal can only mean one thing: COST REDUCTION.

A huge percentage of total costs for many businesses are labour related and thus, banks may be forced to freeze hiring of new staff or reduce their workforce so as to continue making profits. Is this job creation? Banks are henceforth going to invest much more in technology and less in human labour in order to return value to shareholders.

The best alternative of handling the high interest rates would have been more of moral than legislative. For example, the government through CBK would have advised bank executives to set aside some percentage of their loan portfolio for SMEs and Wanjiku. This alternative accompanied by threats of legislation would have yielded much better results in the long run. We can think of this as setting up of EPZ in the manufacturing industry. In fact, the government could even decide to tax income generated from this portfolio at a lower rate or give it a tax holiday. This would boost credit access to the marginalized without interfering with the banks’ independence. This is more likely to stimulate economic growth and development. Controlling interest rates is sowing on a rock; the seeds will spring quickly because the soils are shallow. They will however, not live for long as they have no roots. Let’s sow in deep fertile soils. It may take long for the seeds to germinate, but when they do…they will grow to maturity and yield maybe thirty times or more of what we sow!

Finally, s I conclude, I would like to paraphrase Dr, Ndii, no amount of growling at critics is going to make foolish policy wise.

The writer Is a degree holder in Commerce, specializing in Finance from JKUAT And a hustler with ideas that can change the world.

Twitter: @pcmakokha | Facebook: PC Makokha | IG: PC Makokha

Disclaimer: This article expresses the author’s opinion only. The views and opinions expressed here do not necessarily represent those of Kenya Insights or its Editors. We welcome opinion and views on topical issues. Email:[email protected]

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

Kenya West is a trained investigative independent journalist and a socio-political commentator on matters Kenya and Africa. Do you have a story, Scandal you want me to write on? Send me tips to [[email protected]]

You may like

-

NEWS ANALYSIS: Kenyatta Family Voices Support for Youth Leadership Amid Political Tensions With Ruto

-

Gachagua Challenges Ruto: Stop Sending Proxies to Insult Uhuru—Confront Him Directly If You’re Man Enough

-

“Stop Laughing At Us. You Left Us With These Deals,” Governor Mutula Kilonzo Fires Back at Uhuru Over Trump’s Foreign Aid Freeze

-

2027 Presidential Race: Inside Uhuru’s Strategic Plot to Regain Influence

-

‘Trump Has No Reason To Give You Anything, You Don’t Pay Taxes In The US’ Uhuru Urges Africa Leaders To Stop Complaining and Take Responsibility On Aid Freeze

-

Ruto Unhappy About Secret Meeting Between Kindiki and Kenyatta

Intelligence Report Reveals How County Officials Fraudulently Award Tenders to Proxies

List of Shame: Opposition Leaders Call on the Public to Boycott Businesses Owned by Persons Linked to Kenya Kwanza

EXPLAINER: Why #WeAreAllKikuyus Hashtag Is Top Trending

Why Young Campus Girl Took My Husband, But Took Him Back

US Scraps Shoe Removal at Airport Screening

Isiolo Governor Guyo Survives Impeachment In Senate

Saba Saba Aftermath: Death Toll Rises To 31 As 500 Arrested

Moses Kuria Resigns from Kenya Kwanza Government

South Sudan Embassy in Nairobi Faces Legal Action Over Four Years of Unpaid Salaries

Court Denies Sarah Wairimu After Finding Out She Obtained A Second Passport

From Billionaire to Broke: The Fall of Humphrey Kariuki’s Empire

How NCBA Software Engineer Opened Floodgates For Mobile Banking System Fraud

Investigation Exposes Alleged Sex Crimes at Alliance Girls High School Amid Institutional Cover-Up

EXCLUSIVE: How Corruption and Mismanagement Have Brought Kenyatta National Hospital to Its Knees

Housing PS Charles Hinga Entangled in Sh 2B Tender Scam

Kenya to Start Commercial Oil Production in 2026 after Tullow Exit, CS Wandayi Confirms

WATCH: New CCTV Footage Reveals Police Brought Ojwang to Hospital Already Dead

Inside the Kibaki Estate Dispute: Power, Bloodlines & the Unfolding Legal Drama

Details Emerge In How ‘Death Squad’ Hatched Plan To Keep Dark Ojwang’s Interrogation Secret in Cell Ending in Death

New Details Reveal How Ojwang Was Tortured into a Coma in Karura Forest in the Presence of a Senior Officer

Most Popular

-

Investigations5 days ago

Investigations5 days agoInvestigation Exposes Alleged Sex Crimes at Alliance Girls High School Amid Institutional Cover-Up

-

Business2 weeks ago

Business2 weeks agoHumphrey Kariuki: The Kenyan Billionaire Who Lost State Privileges After Alleged Multibillion Tax Evasion

-

News2 weeks ago

News2 weeks agoHeavy Police Presence As All Roads Heading To State House Are Blocked

-

Grapevine1 week ago

Grapevine1 week agoCS Alfred Mutua Embroiled in Custody Battle After A ‘Quick’ Moment With Kenyan Girl in Dubai

-

News2 weeks ago

News2 weeks agoPolice Cordon Parliament with Razor Wire Ahead of Gen-Z Anniversary Protests

-

News1 week ago

News1 week agoOle Kina Fragrance Sets Kenyan Market Abuzz with Million-Shilling Expansion

-

News2 weeks ago

News2 weeks ago“I Knew Going to State House Was a Wrong Decision,” Omtatah Confesses

-

Opinion1 week ago

Opinion1 week agoWhy Ruto Dumped Isiolo Governor Abdi Guyo: A Political Betrayal in the Making