Investigations

Equity Bank Warning: Beware of Fake Online Security Checks as Scammers Use AI and Social Media to Steal Card Details and Drain Bank Accounts

It looks like help, sounds like help — but it’s a scam in disguise. A dangerous new type of online fraud is sweeping across Kenya, targeting customers of Equity Bank and other financial institutions.

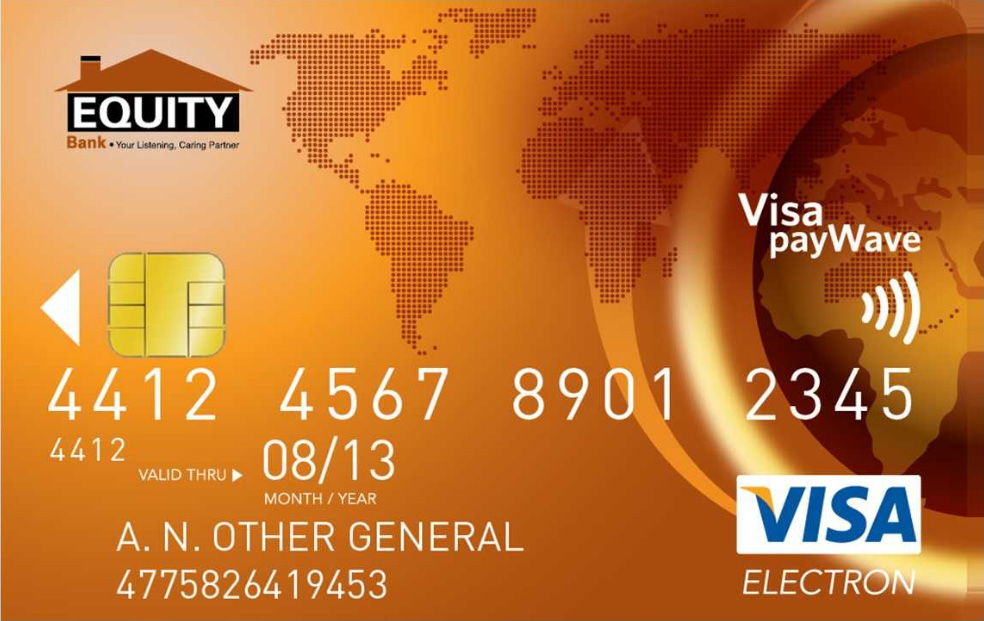

Criminals are tricking people with fake “security checks” that appear to offer protection after a data breach. But instead of helping, they steal your card details and empty your account.

These fraudsters are smart and fast and are now using artificial intelligence (AI) to make their scams even more convincing.

This article dives into how the scam works, who’s behind it, and what you can do to protect your money.

Equity Bank Warning: Beware of Fake Online Security Checks as Scammers Use AI and Social Media to Steal Card Details and Drain Bank Accounts

Equity Warning as AI-Powered Fraud Hits Kenyan Banks

A massive warning has been issued by Equity Bank following a recent fraud attack that cost the bank a shocking Sh290 million. On April 16, 2024, detectives arrested 19 suspects linked to a syndicate that used fake online “security checks” to gather debit card information from unsuspecting customers.

These scammers didn’t just stop there — they employed AI tools to create highly realistic messages and websites that fooled hundreds of people. The fraud involved 551 Equity Bank account holders whose accounts were swept clean between April 9 and 15.

These victims had either clicked on fake links or responded to scammers pretending to be bank officials. Equity Bank’s risk department flagged the spike in suspicious activity and alerted the Directorate of Criminal Investigations (DCI).

The DCI’s Banking Fraud Investigation Unit moved swiftly to arrest the culprits, some of whom were deported to Nigeria after being caught with fake cards.

This was no small-time scam. Fraudsters used AI to create deepfake audio calls that mimicked real bank agents and built clone websites that mirrored Equity Bank’s official site.

Others used social media platforms like Facebook and Instagram to share posts offering “free security checks” and “card breach assistance.” Once the victims clicked and shared their card details — including CVV numbers and one-time passwords — the scammers struck fast.

How Scammers Use Social Media to Fool You

Social media has become the new hunting ground for cybercriminals. Scammers know people trust information that looks polished and comes from familiar platforms. Here’s how they do it:

- Fake Posts That Look Real

Fraudsters run ads or viral posts saying things like:

“Is your card safe? Check now for free!”

The posts use Equity Bank branding and urge people to click a link “for your security.” These links redirect to clone sites that ask for card details. - Impersonated Customer Support

Some scammers post fake Equity Bank “support numbers” and ask customers to call in for help. Victims who call are asked to “verify” their card details and OTPs — unknowingly handing over control of their accounts. - Urgency Triggers Fear

The scam relies on panic. Posts often say, “Act now or risk losing your money!” That emotional nudge makes people less cautious and more likely to fall into the trap.

Equity Warning as Scammers Use AI to Launch Faster, Smarter Bank Frauds

What makes these scams more dangerous is the use of AI. Criminals are now using machine learning tools to:

- Generate realistic emails with correct grammar, local language, and bank terminology.

- Create fake websites that look exactly like the official bank pages.

- Mimic voice calls using AI-generated audio that sounds like real customer care agents.

- Run chatbot scams that simulate real-time conversations with bank representatives.

These tricks are designed to make you believe you’re talking to your bank. But one small mistake — sharing your card info, PIN, or OTP — is all it takes to lose everything.

Equity Bank’s Response and Safety Advice

Equity Bank has issued clear guidelines to protect its customers:

- Never share your PIN, CVV, or OTP with anyone.

- Don’t click on links asking for personal information — especially if they come from social media.

- Only trust calls from the official number: 0763 000 000.

- Report any suspicious messages to 333 — a toll-free service for fraud cases.

Banking officials have also warned that many of the arrested suspects had fake documentation and were operating across multiple countries. As investigations continue, more arrests are expected.

Kenyan agencies have been urged to boost their cybersecurity measures and cooperate internationally to dismantle these criminal networks.

Stay Alert, Stay Safe

The digital age has brought speed and convenience, but it has also opened the door to high-tech thieves. Scams are no longer sloppy or easy to spot. With AI and social media, fraudsters are now operating at a level that makes even tech-savvy users vulnerable.

The next time you see a post claiming to “check your card’s safety,” think twice. No real bank will ever ask for your card number or OTP through social media or unsolicited calls.

Protect your financial future by being cautious, staying informed, and always contacting your bank directly when in doubt. Equity Bank’s message is clear: Don’t take the bait. Your security starts with you.

Key Takeaways:

- Scammers use fake online “security checks” to steal card data.

- AI helps them make scams look real and target more victims.

- Equity Bank lost Sh290 million in a single fraud wave.

- Always verify calls, avoid suspicious links, and never share sensitive info online.

Equity warning: Stay vigilant. The next scam could be targeting you.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine1 week ago

Grapevine1 week agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoThe General’s Fall: From Barracks To Bankruptcy As Illness Ravages Karangi’s Memory And Empire

-

Grapevine4 days ago

Grapevine4 days agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

Investigations2 weeks ago

Investigations2 weeks agoEpstein Files: Sultan bin Sulayem Bragged on His Closeness to President Uhuru Then His Firm DP World Controversially Won Port Construction in Kenya, Tanzania

-

Investigations1 day ago

Investigations1 day agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Investigations1 week ago

Investigations1 week agoEpstein’s Girlfriend Ghislaine Maxwell Frequently Visited Kenya As Files Reveal Local Secret Links With The Underage Sex Trafficking Ring

-

News2 weeks ago

News2 weeks agoState Agency Exposes Five Top Names Linked To Poor Building Approvals In Nairobi, Recommends Dismissal After City Hall Probe

-

Business1 week ago

Business1 week agoM-Gas Pursues Carbon Credit Billions as Koko Networks Wreckage Exposes Market’s Dark Underbelly