Business

Billionaire Narendra Raval Pressures KRA to Waive Sh1.6B Tax Amid Kenya’s Economic Struggles

The dispute centers around a June 2020 undertaking allegedly made by the Treasury, which Devki claims exempted it from paying the VAT on imported equipment.

As Kenya grapples with mounting public debt and austerity measures, billionaire industrialist Narendra Raval, through his Devki Steel Mills, is locked in a high-stakes legal battle with the Kenya Revenue Authority (KRA) over a disputed Sh1.6 billion tax exemption.

The case, currently before the High Court in Mombasa, highlights growing tensions between Kenya’s business elite and tax authorities at a time when the country faces significant economic challenges.

Tax Exemption Controversy

According to court documents, Devki Steel Mills is seeking to prevent both the KRA and the National Treasury Cabinet Secretary from collecting what the tax authority describes as “Exempted VAT” on plant and machinery imported for the establishment of a major steel factory.

The dispute centers around a June 2020 undertaking allegedly made by the Treasury, which Devki claims exempted it from paying the VAT on imported equipment.

The company argues that based on this understanding, it proceeded to clear the imported machinery, establish its factory operations, and has since employed approximately 10,000 workers.

KRA Pushes Back

The KRA, however, contends that the alleged undertaking lacks the signature of the responsible Cabinet Secretary—a critical element for its validity. The tax authority has questioned the legitimacy of the document given the substantial tax amount involved.

“The absence of the signature raises concerns about the authenticity and legitimacy of the undertaking,” the KRA stated in its court filing, adding that without proper authorization, the understanding “cannot be considered a proper binding commitment.”

Timeline of Dispute

The case reveals a complex sequence of events:

– In June 2020, Devki requested tax exemptions for its major steel project

– The Treasury allegedly approved the exemption and communicated this to KRA

– KRA reportedly advised Devki to proceed with releasing the goods VAT-free

– In August 2024, KRA sent Devki a demand letter for Sh1.3 billion in unpaid VAT

– By September 2025, the amount had grown to Sh1.6 billion with interest and penalties

– In October, the Treasury reportedly withdrew its undertaking, claiming no legal provisions supported the exemption

This dispute comes amid increasing scrutiny of tax exemptions granted to wealthy businesses in Kenya.

A separate investigation by Parliament is reportedly looking into 14 companies including Raval’s companies that received tax exemptions totaling Sh15 billion.

Devki’s fears come from recent NCBA precedent, where the bank linked to former President Uhuru Kenyatta’s family, suffered a legal setback after a court ruled that the 2019 tax exemption granted for the merger of NIC Group and Commercial Bank of Africa (CBA) was unconstitutional.

The exemption, granted by the National Treasury, bypassed legal procedures. During former President Kenyatta’s administration, the Treasury had waived a Sh350 million share transfer tax for the merger.

The case raises important questions about tax policy consistency, government accountability, and whether large corporations are paying their fair share as ordinary Kenyans struggle with rising living costs.

Devki’s legal argument hinges on the principle of “legitimate expectation,” claiming that once the exemption was granted and acted upon, the government cannot legally reverse its position.

For now, the matter remains before the court, with Devki seeking both to block the tax demand and to compel the Treasury to honor what it describes as a binding commitment to settle the tax bill with KRA.

Economic Context

This legal battle unfolds against the backdrop of Kenya’s efforts to increase tax revenue collection while simultaneously attracting industrial investment. The Devki steel plant in Kwale County represents a significant industrial development, but critics question whether such tax exemptions create an uneven playing field.

As this case progresses, it will likely set important precedents regarding the government’s ability to revoke tax exemptions and the obligations of major corporations to contribute to Kenya’s tax base during challenging economic times.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Development5 days ago

Development5 days agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations13 hours ago

Investigations13 hours agoCity Tycoons, MD Under Probe Over Multibillion Kenya Power Tender Scam

-

Investigations2 weeks ago

Investigations2 weeks agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Investigations2 weeks ago

Investigations2 weeks agoHow Close Ruto Allies Make Billions From Affordable Housing Deals

-

Entertainment2 weeks ago

Entertainment2 weeks agoKRA Comes for Kenyan Prince After He Casually Counted Millions on Camera

-

Investigations2 weeks ago

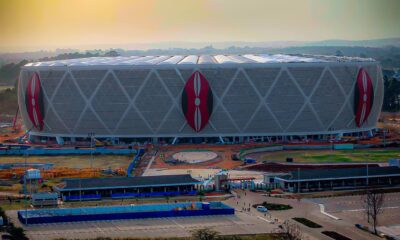

Investigations2 weeks agoTalanta Stadium Construction Cost Inflated By Sh11 Billion, Audit Reveals

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal