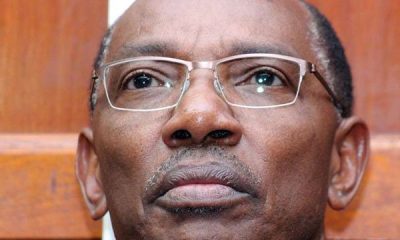

Gautam Adani, the billionaire chair of Indian conglomerate Adani Group and one of the world’s richest people, has been indicted in New York over his role in an alleged multibillion-dollar bribery and fraud scheme, U.S. prosecutors said on Wednesday.

Authorities said Adani and seven other defendants, including his nephew Sagar Adani, agreed to pay about $265 million in bribes to Indian government officials to obtain solar energy supply contracts expected to yield $2 billion of profit over 20 years.

According to an indictment, some conspirators referred privately to Gautam Adami with the code names “Numero uno” and “the big man,” while Sagar Adani allegedly used his cellphone to track specifics about the bribes.

Prosecutors also said the Adanis and another executive at Adani Green Energy, Vneet Jaain, raised more than $3 billion in loans and bonds for that company by concealing the corruption from lenders and investors.

The case involves alleged violations of the Foreign Corrupt Practices Act, a U.S. anti-bribery law.

India’s embassy in Washington did not immediately respond to requests for comment. Lawyers for the defendants could not immediately be identified.

Gautam Adani, 62, is worth $69.8 billion according to Forbes magazine, making him the world’s 22nd richest person and India’s second-richest person behind Reliance Industries Chair Mukesh Ambani.

Among the other defendants are Ranjit Gupta and Rupesh Agarwal, respectively a former chief executive and former chief strategy and commercial officer of Azure Power Global, and Cyril Cabanes, a director there.

The other defendants, as well as Cabanes, also worked for a Canadian institutional investor, prosecutors said.

Seven of the defendants are Indian citizens who lived in India during the relevant period, while Cabanes is a dual French-Australian citizen who lived in Singapore, prosecutors said.

According to court records, a judge has issued arrest warrants for Gautam Adani and Sagar Adani, and prosecutors plan to hand those warrants to foreign law enforcement.

The U.S. Securities and Exchange Commission filed related civil charges against Gautam Adani, Sagar Adani and Cabanes.

Last week, Gautam Adani said in a post on social media platform X that his conglomerate planned to invest $10 billion in U.S. energy security and infrastructure projects, creating a potential 15,000 jobs, without providing a timetable.

Adani announced the investment while also congratulating U.S. President-elect Donald Trump on his election win.

Trump has pledged to make it easier for energy companies to drill on federal land and build new pipelines.

In January 2023, the U.S.-based short-seller Hindenburg Research accused Adani Group of using offshore tax havens improperly, a charge the company denied. The report sparked an approximately $150 billion meltdown in Adani Group stocks.

The charges were announced hours after Adani on Wednesday raised $600 million from a sale of 20-year “green” bonds.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

Investigations2 weeks ago

Investigations2 weeks ago

Investigations2 weeks ago

Investigations2 weeks ago

Investigations2 weeks ago

Investigations2 weeks ago

Investigations1 day ago

Investigations1 day ago

Investigations2 weeks ago

Investigations2 weeks ago

Investigations2 weeks ago

Investigations2 weeks ago

Investigations2 weeks ago

Investigations2 weeks ago

Business1 week ago

Business1 week ago