Nigeria swore in a new president on Monday during an elaborate ceremony that was attended by dignitaries from around the world. Bola Ahmed Tinubu, 71, took...

Kisumu High Court has today upheld the judgement by Winam Magistrates Court against an appeal by Italian national Paolo Camelini on the grounds that the appeal...

The motion to impeach Siaya County Deputy Governor William Oduol has been approved by the County Assembly. The motion was tabled by East Ward Member of...

Road Safety Association of Kenya has sued the National Transport and Safety Authority (NTSA) board over speedy and unprocedural return of Mr George Njao, the director-general...

The National Assembly Committee on Lands has commenced investigations to resolve disputes over more than 12,000 acres piece of land in Vipingo, Kilifi County, in contention...

Confusion is rife as to when exactly the Teachers Service Commission (TSC) Secretary/CEO, Dr. Nancy Njeri Macharia would be leaving office following two sets of rules...

Before he was jailed for 100 years for defilement, Stephen Nzuki Mutisya was the director of Save the Children Reconciliation Education and Assistant Mission (Scream), which...

The Ethics and Anti-Corruption Commission (EACC) says the process to recover 26 acres of land that hosts Nyabola Girls Secondary School in HomaBay County is nearing...

Three politicians, a journalist, a bank and several members of a syndicate are under probe after a Brazilian national was conned Sh9 billion in what is...

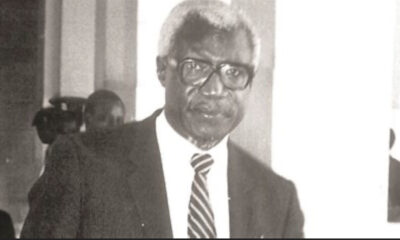

By Michael Mundia Kamau Silvanus Melea Otieno (S.M. Otieno), was a renowned Kenyan criminal lawyer, who shared the rostrum of top criminal lawyers in Kenya with...

The desperation of Uganda-based Sarrai Group senior executives to avoid a possible 6-month jail term sentencing has landed them in even more trouble after their dirty...

A Kenyan-based Nigerian preacher Pastor Wealth Ochelle Alias Apostle Wealth of Cogic International Church of God domiciled at Shanzu in Mombasa has been charged with conspiracy...

Kenya has termed a news article published by Reuters as sponsored propaganda. Through a statement on Thursday, the Principal Secretary for Internal Security and National Administration...

Chief Registrar of Judiciary Anne Amadi‘s link to the Sh130 million gold scam has in the recent times out the reputation of the Kenyan judiciary in...

Armed with explosives, Somalia-based Al-Shabaab militants overrun an African Union military base in Somalia on Friday morning, eyewitnesses said, causing massive destruction of infrastructure and possible...

Elon Musk’s neurotechnology company Neuralink announced Thursday that it has received approval from the US Food and Drug Administration (FDA) for its first-in-human clinical study of...

Africa is in intense heat to receive once again one of the countries with the largest economy and influence in the world, Russia. The difference that...

A Canadian missionary has been charged with Sh60 million land fraud. Sheppard Nelson Jason appeared before Milimani Chief Magistrate Lukas Onyina and denied the charges. Sheppard...

Reuters: Chinese hackers targeted Kenya’s government in a widespread, years-long series of digital intrusions against key ministries and state institutions, according to three sources, cybersecurity research...

Chief Registrar of Judiciary Anne Amadi who’s now fighting for her reputation has denied any links to the Sh130 million gold scandal that saw her personal...