News

Audit Exposes Sh39 Billion Fake Supplier Bills Under Sakaja

Having come into office promising transparency and fiscal responsibility, the unexplained removal of nearly Sh40 billion from the county’s books without proper documentation raises serious questions about financial governance under his leadership.

A comprehensive audit has uncovered what appears to be one of the largest financial discrepancies in Nairobi County’s history, with Sh39.8 billion mysteriously removed from the county’s pending bills register, raising serious questions about the authenticity of supplier claims under Governor Johnson Sakaja’s administration.

The Controller of Budget, Dr. Margaret Nyakang’o, has revealed an unexplained 32.7 percent reduction in Nairobi’s supplier arrears, which dropped from Sh121.8 billion to Sh86.8 billion over the year ending June 2025.

This dramatic decrease has triggered demands for a detailed explanation from the Auditor-General’s office about how such a massive amount could simply vanish from official records.

The timing of this discovery is particularly concerning as it comes amid widespread complaints from legitimate contractors who continue to wait months or even years for payments from both county and national governments.

Many small and medium-sized businesses that depend on government contracts have found themselves blacklisted by credit reference bureaus after defaulting on loans while waiting for delayed payments.

Charles Kerich, Nairobi’s County Executive Committee Member for Finance and Economic Affairs, has attempted to provide explanations for the reduction, citing the elimination of “unjustifiably high” legal fees and the removal of a disputed Sh300 million bank loan from the pending bills register.

He also mentioned that the county paid Sh1 billion in outstanding pensions and realigned contingent liabilities related to loans borrowed in the 1980s.

However, these explanations account for only Sh4 billion of the total Sh39.8 billion reduction, leaving a substantial gap that remains unexplained.

The Controller of Budget has made it clear that Nairobi County must provide a comprehensive breakdown to the Auditor-General of how this reconciliation was conducted.

This latest scandal adds to a troubling pattern of financial irregularities at City Hall. In April, the Ethics and Anti-Corruption Commission revealed court filings detailing how rogue county officials had paid Sh407 million to shadowy businesses through fraudulent transactions between 2016 and 2022.

The investigation found that senior officials approved irregular payments to 14 unprequalified business entities for supplies that were never delivered.

The broader implications of this audit extend beyond Nairobi County.

The Controller of Budget noted that the reduction in Nairobi’s pending bills caused the overall debt owed by all 47 counties to suppliers to decrease from Sh181.9 billion to Sh176.8 billion.

Despite this reduction, Nairobi still holds the dubious distinction of having the largest unpaid debts among all counties at Sh86.77 billion.

The aging analysis of Nairobi’s remaining pending bills reveals another disturbing trend.

Over 71 percent of the outstanding debts, amounting to Sh62.38 billion, have been pending for more than three years. This prolonged delay in payments has created a ripple effect throughout the business community, with many suppliers facing financial ruin while waiting for their money.

The situation has become so dire that asset seizures among government suppliers have increased significantly.

Hundreds of business owners who once eagerly sought government contracts now describe the financial pain of years-long payment delays as unbearable.

The irony is stark: while the government remains the biggest spender in the country, its payment practices are driving legitimate businesses into bankruptcy.

Dr. Nyakang’o expressed particular concern about the continued accumulation of new pending bills, noting that counties added Sh48.9 billion to their unpaid obligations between July 2024 and June 2025, despite receiving full disbursements from the Treasury.

This trend suggests systemic issues in financial management across the devolved units.

The Controller of Budget also highlighted discrepancies between the pending bills that many counties report to her office and the figures contained in their official financial statements, pointing to potential widespread irregularities in financial reporting across the country.

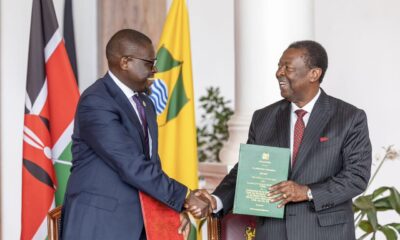

For Governor Sakaja’s administration, this audit represents a significant credibility challenge.

Having come into office promising transparency and fiscal responsibility, the unexplained removal of nearly Sh40 billion from the county’s books without proper documentation raises serious questions about financial governance under his leadership.

The demand for accountability is growing louder, with the Controller of Budget insisting that Nairobi County must provide a detailed analysis of its reconciliation process to the Auditor-General.

Until such explanations are forthcoming, the specter of fake supplier bills and fraudulent transactions will continue to hang over City Hall, undermining public trust in the county’s financial management.

As investigations continue, the people of Nairobi are left wondering how many more financial irregularities remain hidden in the county’s books, and whether the current administration has the political will to root out the systemic corruption that has plagued City Hall for years.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

News1 week ago

News1 week agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations2 weeks ago

Investigations2 weeks agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy1 week ago

Economy1 week agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Africa2 weeks ago

Africa2 weeks agoFBI Investigates Congresswoman Ilhan Omar’s Husband’s Sh3.8 Billion Businesses in Kenya, Somalia and Dubai

-

Grapevine5 days ago

Grapevine5 days agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

News2 weeks ago

News2 weeks agoTragedy As City Hall Hands Corrupt Ghanaian Firm Multimillion Garbage Collection Tender