Business

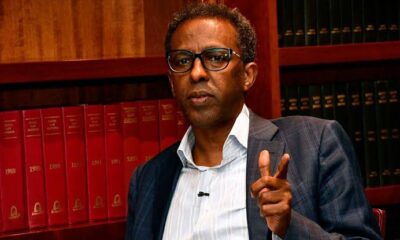

Ahmednasir’s Law Firm Caught Up in the Middle of Zakhem’s Debt Row

Prominent advocate’s firm finds itself at center of Sh485 million legal battle as cargo handler pursues Lebanese construction company

The law firm of one of Kenya’s most prominent advocates, Ahmednasir Abdullahi, has found itself unwittingly drawn into a complex debt recovery battle involving millions of shillings, highlighting the intricate web of commercial disputes that often ensnare even legal practitioners.

Ahmednasir Abdullahi Advocates LLP is now at the center of a High Court case where cargo handler Multiple ICD (Kenya) is attempting to attach Sh485 million held by the law firm on behalf of Lebanese construction company Zakhem International Construction.

The dispute stems from an August 2020 consent judgment where Multiple ICD secured a $3.2 million (Sh412.8 million) award against Zakhem International Construction.

However, the cargo handling company, which operates an inland container depot in Mombasa, claims the debt has ballooned to $5 million (Sh645 million) with accrued interest and remains unpaid.

What makes this case particularly intriguing is how Ahmednasir’s firm became embroiled in the dispute.

According to court documents, Zakhem International Construction had won a separate case and was awarded Sh485 million.

The court then ordered Equity Bank to transfer this money to Ahmednasir Abdullahi Advocates LLP’s account at UBA Kenya Bank.

Multiple ICD learned of this windfall and moved swiftly to court, seeking to attach the funds being held by the law firm as a way to satisfy their outstanding judgment.

The company argued that Zakhem could “at any moment dispose of and transfer the money awarded,” making urgent intervention necessary.

“The judgment debtor/respondent can at any moment dispose of and transfer the money awarded,” Multiple ICD stated in their application, underlining the urgency of their request.

The case underscores how financial institutions and law firms can become unwitting participants in commercial disputes.

Multiple ICD sought orders compelling UBA Kenya Bank, Ahmednasir Abdullahi Advocates LLP, and Equity Bank to produce bank statements showing accounts holding funds for Zakhem’s benefit.

However, Justice Moses Ado declined to issue the interim orders on Tuesday, citing the positions taken by the various parties.

The case has been adjourned to July 23 for mention.

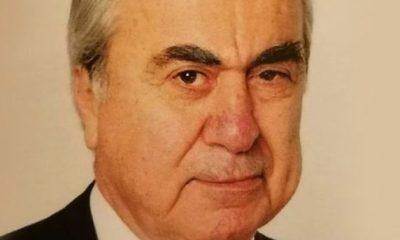

For its part, Zakhem International Construction has mounted a vigorous defense, terming Multiple ICD’s application “an abuse of the court process and without merit.”

The Lebanese construction company argues that it doesn’t maintain accounts with any of the three institutions named in the garnishment application.

“Given that the first, second, and third garnishees do not hold any account or funds on behalf of the judgment debtor, this court cannot compel them to render the accounts as sought,” Zakhem stated in its opposition.

The construction company further argues that Multiple ICD has failed to demonstrate that there’s actually a debt due from the bank, law firm, or other financial institutions that could be attached.

This latest legal battle is part of a broader pattern of financial difficulties facing Zakhem International Construction.

The company has been the subject of multiple debt recovery cases, with various creditors pursuing substantial amounts.

The involvement of Ahmednasir Abdullahi Advocates LLP – a firm known for high-profile cases and commercial litigation – as a stakeholder rather than legal counsel adds an unusual dimension to the proceedings.

The firm finds itself in the uncomfortable position of holding funds that multiple parties are claiming.

The case raises important questions about the role of law firms as stakeholders in commercial disputes.

When courts order funds to be held by legal practitioners, those firms can find themselves caught between competing claims, potentially exposing them to additional litigation risks.

For Ahmednasir’s firm, known for its aggressive litigation style and high-profile clientele, being on the receiving end of legal action rather than driving it represents an unusual position.

The firm’s involvement appears to be purely procedural – holding funds as directed by court order rather than any substantive role in the underlying dispute.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Development5 days ago

Development5 days agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations2 weeks ago

Investigations2 weeks agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Investigations2 weeks ago

Investigations2 weeks agoHow Close Ruto Allies Make Billions From Affordable Housing Deals

-

Entertainment2 weeks ago

Entertainment2 weeks agoKRA Comes for Kenyan Prince After He Casually Counted Millions on Camera

-

Investigations2 weeks ago

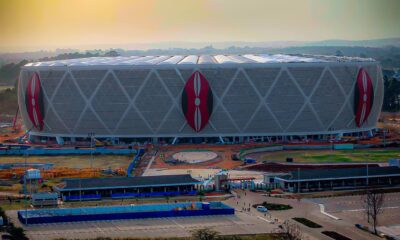

Investigations2 weeks agoTalanta Stadium Construction Cost Inflated By Sh11 Billion, Audit Reveals

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

Investigations2 weeks ago

Investigations2 weeks agoGOLD RUSH TO GOLD DUST: How a Nairobi Forex Trader Scammed a Lawyer of Sh32 Million in a Phantom Gold Scheme