News

Serial Fraudster Willis Wasonga Arraigned After Sh28 Million Gold Scam Linked to Rogue Lawyer Michael Owano

NAIROBI, Kenya — A man described by detectives as a seasoned con artist has been hauled before a Nairobi court after allegedly masterminding a sophisticated gold scam that robbed an American businessman of USD 217,900, approximately Sh28 million, in what investigators are calling one of the most brazen cases of money laundering and fake gold dealing to hit the capital in recent memory.

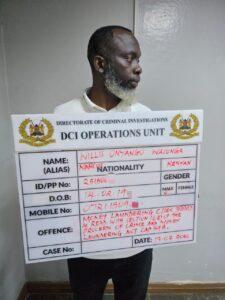

Willis Onyango Wasonga, who allegedly goes by the street alias “Marcus,” was arraigned at Milimani Law Courts where he pleaded not guilty and was released on a bond of Ksh 1 million with two sureties, or an alternative cash bail of Ksh 350,000.

His freedom, however, may be short-lived. Detectives are still closing in on multiple accomplices, and the case returns to court on March 3, 2026.

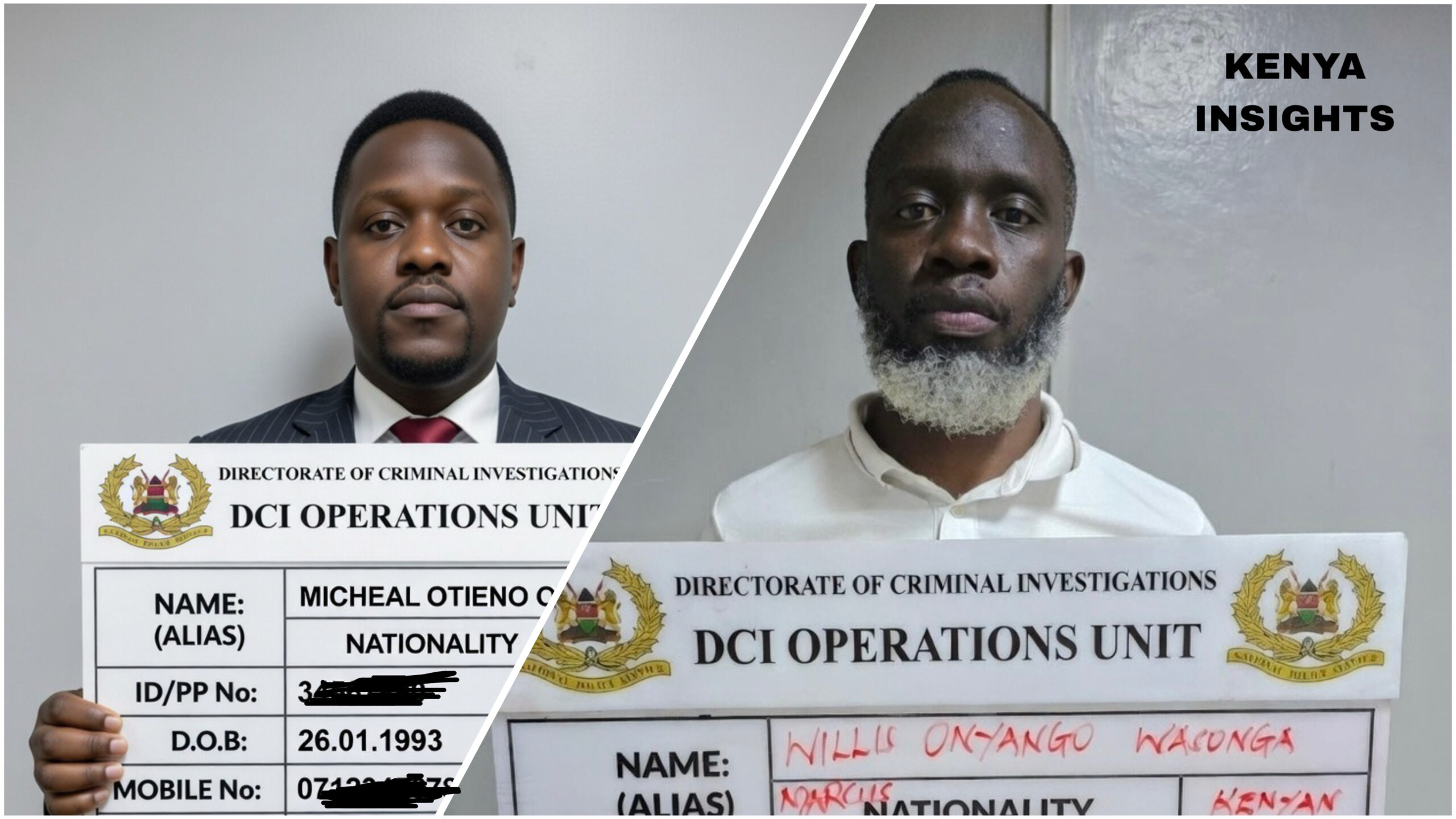

What makes this case particularly explosive is the reappearance of a name that Kenyan authorities know all too well: Nairobi advocate Michael Otieno Owano of MOAC Advocates, a lawyer who has now found himself at the center of not one, not two, but three separate fraud investigations spanning foreign victims from the United States, Canada, and beyond.

Owano, it appears, has turned the sacred trust of legal practice into a personal criminal enterprise.

The scheme began innocuously enough.

A Russian national, Gershonov Oleg, first visited Kenya in September 2025 to pursue a gold transaction that, from the very beginning, was nothing but a carefully constructed illusion.

During that trip, he was introduced to Wasonga, the man investigators now identify as the principal architect of the fraud.

Wasonga, charming and calculated, groomed Oleg and his American business partner John Sodipo with the kind of confidence that only a practiced swindler possesses.

Negotiations between Sodipo and Wasonga for the purchase and subsequent chartering of 495 kilograms of gold to Dubai soon followed.

The deal was dressed up in the language of legitimacy: agreed timelines, formal terms, and crucially, an escrow arrangement funnelled through none other than Owano’s law firm.

Sodipo deposited the agreed chartering fees into what he believed was a secure escrow account handled by a licensed advocate. Oleg flew back to Kenya to personally oversee the shipment.

The gold, of course, never came.

As the agreed shipment deadline came and went, excuses piled up. Pressure mounted. And then, as investigators describe it with chilling precision, it dawned on the two foreigners that they had been dealing with what the DCI report characterises as “seasoned Machiavellian scammers with dark triad characteristics,” men for whom manipulation is not a tactic but a way of life, men entirely detached from the human consequences of their actions.

Investigators tore apart the syndicate’s methods with forensic determination.

At the heart of their operation was SRK Logistics Limited, a logistics company that allegedly misrepresented its entire capacity to supply gold.

Fictitious legal representation agreements were manufactured wholesale to give the fraud a veneer of respectability, with MOAC Advocates falsely presented as handling legitimate commercial transactions.

Most damningly, detectives established that the funds deposited by the victims were rapidly moved between company accounts before being spirited overseas in a pattern that investigators say bears every hallmark of money laundering, including the layering and concealment of the proceeds of crime.

This is not Owano’s first brush with such accusations, and that fact deserves to be stated plainly.

In November 2024, the same lawyer was arrested by DCI detectives in connection with a Ksh 182 million fake tender scheme that targeted an American company, Underground Pipeline Rehabilitation Company.

In that case, Owano’s firm received USD 90,000 in purported legal fees while his victim was deceived into paying a staggering USD 1,617,200 for fictitious government tenders, including fabricated contracts from the Kenya Civil Aviation Authority and the Kenya Meteorological Department.

He was released on cash bail while the Office of the Director of Public Prosecutions reviewed the matter.

Then in August 2025, Owano was arrested again, this time by the Operations Support Unit of the DCI, in connection with a Sh79 million fake gold scheme targeting a Canadian investor.

In that operation, a Proforma Invoice of USD 318,400 was issued by a company called EAI Logistics, with funds wired directly into Owano’s law firm account.

The victim was also pressured into sending USDT 300,000 to a cryptocurrency wallet. No gold arrived.

That case linked Owano to a syndicate that included a Cameroonian national, Francis Ouafo, described as the mastermind of the operation.

The pattern is unmistakable and deeply disturbing.

A licensed advocate, bound by the Law Society of Kenya to uphold the highest ethical standards, has allegedly made his law firm a revolving door for criminal proceeds targeting foreign investors.

Three cases. Three sets of foreign victims. Hundreds of millions of shillings alleged to have passed through his accounts. And yet the man remains in practice.

As for Wasonga, he demonstrated one notable instinct for self-preservation.

As investigations tightened around him, he ran to the High Court and secured anticipatory bail before voluntarily presenting himself at DCI Headquarters on February 13, 2026, to record a statement.

It was a move that speaks less to innocence and more to a man who understood exactly what was coming.

The DCI has confirmed that investigations are ongoing and that more suspects are being pursued.

The syndicate behind these scams, which has now claimed victims from the United States, Canada, and Gabon, represents a sophisticated criminal network that has turned Kenya into a hunting ground for foreign investors lured by the promise of gold, government contracts, and profitable deals.

For every legitimate businessperson seeking opportunity in Kenya, these men and their networks are a stain on the country’s reputation. For Owano and Wasonga, the courts now await.

The case returns for mention on March 3, 2026.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine1 week ago

Grapevine1 week agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Lifestyle1 week ago

Lifestyle1 week agoThe General’s Fall: From Barracks To Bankruptcy As Illness Ravages Karangi’s Memory And Empire

-

Grapevine3 days ago

Grapevine3 days agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

Investigations2 weeks ago

Investigations2 weeks agoEpstein Files: Sultan bin Sulayem Bragged on His Closeness to President Uhuru Then His Firm DP World Controversially Won Port Construction in Kenya, Tanzania

-

Business2 weeks ago

Business2 weeks agoKRA Can Now Tax Unexplained Bank Deposits

-

Investigations1 week ago

Investigations1 week agoEpstein’s Girlfriend Ghislaine Maxwell Frequently Visited Kenya As Files Reveal Local Secret Links With The Underage Sex Trafficking Ring

-

News1 week ago

News1 week agoState Agency Exposes Five Top Names Linked To Poor Building Approvals In Nairobi, Recommends Dismissal After City Hall Probe

-

Investigations16 hours ago

Investigations16 hours agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy