Investigations

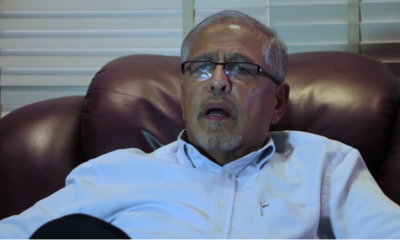

KEBS Finance Boss Adan Mohamed Under Fire as Vendors Cry Foul Over Payment Extortion Racket

Staff members describe a culture of fear where questioning the Finance Director’s decisions is professional suicide. Vendors whisper about blacklists and targeted audits.

Suppliers claim Finance Director Adan Mohamed has turned payment approval into personal fiefdom, demanding kickbacks while contracts collapse

The Kenya Bureau of Standards is reeling from explosive allegations that its Finance Director, Adan Mohamed, has weaponized his office to extract gratification from desperate vendors, turning what should be routine payment processes into an elaborate shakedown operation that has brought critical supply chains to their knees.

Documents seen by this writer and interviews with multiple sources paint a damning portrait of systematic abuse at the heart of an institution charged with safeguarding Kenya’s product quality standards. Instead of upholding integrity, Mohamed stands accused of presiding over what insiders describe as nothing short of financial terrorism against the very suppliers KEBS depends on to function.

The modus operandi is as brazen as it is crippling. Even after procurement committees have done their work and fellow directors have appended their signatures, cheques routinely disappear into Mohamed’s office drawer, only to resurface after suppliers agree to private audiences where the price of doing business with KEBS becomes painfully clear.

“You can have every approval known to man, but if Adan decides your payment doesn’t move, it simply doesn’t move,” said one vendor who spoke on condition of anonymity, fear of reprisal evident in every word. “He travels with files locked away, leaves cheques gathering dust in his office, and the entire bureau grinds to a halt.”

The pattern is consistent and calculated. Suppliers report being summoned to quiet meetings where expectations are made explicit. Pay up or watch your business crumble under the weight of delayed payments.

Those who resist find themselves marked, their subsequent transactions subjected to endless scrutiny and inexplicable delays that amount to commercial death sentences.

The human cost is staggering.

Contractors who took bank loans to fulfill KEBS tenders now watch helplessly as interest piles up while their payments languish in bureaucratic purgatory.

Several have defaulted on obligations, their credit ratings destroyed, their businesses teetering on collapse, all while Mohamed allegedly orchestrates this slow-motion catastrophe from his corner office.

What makes these allegations particularly galling is the institutional paralysis they reveal.

KEBS operates with multiple layers of oversight, yet sources indicate that Mohamed has successfully centralized payment authority to such an extent that even banking institutions must seek his personal clearance before processing transactions.

The checks and balances meant to prevent exactly this kind of abuse have been rendered meaningless by one man’s apparent determination to extract maximum leverage from his position.

The implications stretch far beyond individual hardship. KEBS carries a mandate that touches every sector of Kenya’s economy, from food safety to industrial standards.

When the guardians of quality are themselves compromised, when the protectors of standards operate without standards, the entire regulatory framework becomes suspect.

Staff members describe a culture of fear where questioning the Finance Director’s decisions is professional suicide. Vendors whisper about blacklists and targeted audits.

The message is unmistakable: bend the knee or face destruction.

Calls for intervention have grown increasingly urgent. The Ethics and Anti-Corruption Commission, the Public Service Commission, and Treasury’s oversight apparatus now face mounting pressure to investigate claims that strike at the heart of public sector integrity.

The evidence, sources insist, is there for anyone willing to look. Audit trails that stop inexplicably. Payments approved in January that remain unprocessed in October.

Suppliers driven to ruin while holding valid contracts with a government agency.

Mohamed’s reign over KEBS finances has transformed what should be a straightforward administrative function into something far darker, a protection racket masquerading as bureaucracy, where legitimate businesses are held hostage and public resources become instruments of private enrichment.

The question now is whether Kenya’s oversight bodies possess the will to confront what appears to be a textbook case of corruption hiding in plain sight, or whether Mohamed’s alleged stranglehold will continue unchallenged, leaving a trail of broken businesses and shattered trust in its wake.

For the vendors still waiting for payments owed, still servicing loans taken in good faith, still hoping that someone in authority will finally act, the answer cannot come soon enough.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business1 week ago

Business1 week ago‘They’re Criminals,’ Popular Radio Presenter Rapcha The Sayantist Accuses Electric Bike Firm Spiro of Fraudulent Practices

-

Business1 week ago

Business1 week agoIt’s a Carbon Trading Firm: What Kenyans Need to Know About Spiro’s Business Model Amid Damning Allegations of Predatory Lending

-

Business6 days ago

Business6 days agoManager Flees Safaricom-Linked Sacco As Fears Of Investors Losing Savings Becomes Imminent

-

Investigations1 week ago

Investigations1 week agoDisgraced Kuscco Boss Arnold Munene Moves To Gag Media After Expose Linking Him To Alleged Sh1.7 Billion Fraud

-

News1 week ago

News1 week agoWoman Accused in High Defamation Blames AI As Case Exposes How Mombasa Billionaire Mohamed Jaffer Allegedly Sponsored Smear Campaign Linking Joho’s Family To Drug Trafficking

-

News2 weeks ago

News2 weeks agoTemporary Reprieve As Mohamed Jaffer Wins Mombasa Land Compensation Despite Losing LPG Monopoly and Bitter Fallout With Johos

-

Investigations2 weeks ago

Investigations2 weeks agoFrom Daily Bribes to Billions Frozen: The Jambopay Empire Crumbles as CEO Danson Muchemi’s Scandal-Plagued Past Catches Up

-

Africa1 week ago

Africa1 week agoDisgraced Oil Trader Idris Taha Sneaks Into Juba as Empire Crumbles