Business

Kenya To Pay Adani Group Billions As Compensation For Contract Cancellation

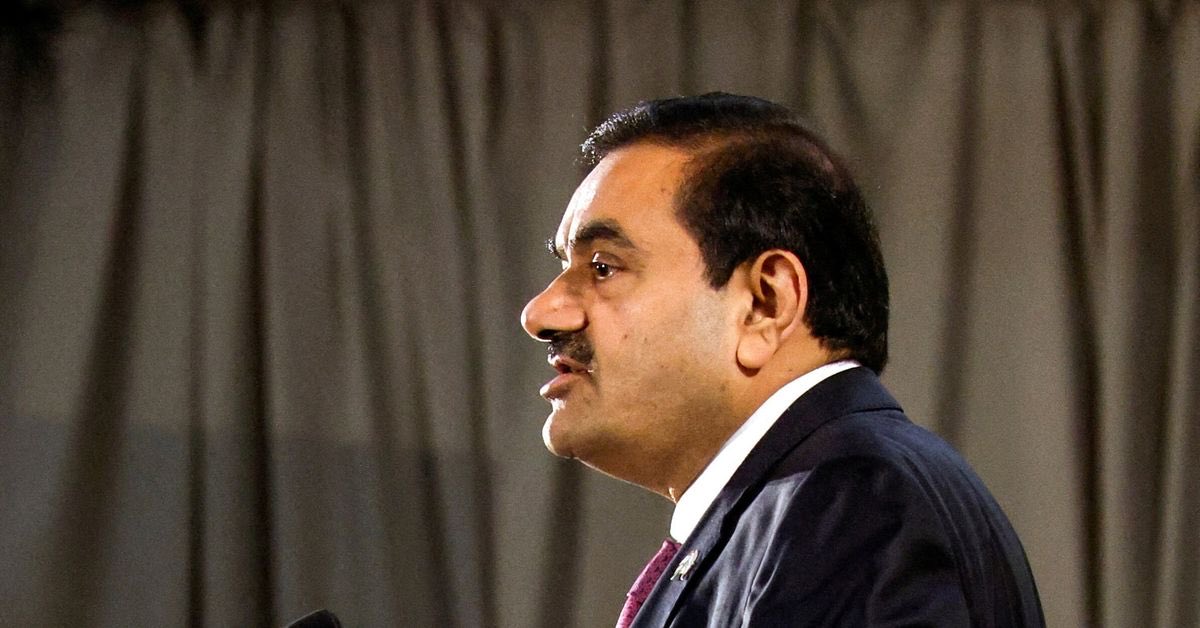

President Ruto ordered the hasty cancellation after Adani Group founder Gautam Adani and his nephew Sagar were indicted by United States authorities on bribery and fraud charges.

The Kenyan government finds itself trapped in a financial quagmire as it scrambles to negotiate a compensation package with India’s Adani Group following the dramatic cancellation of a Sh96 billion electricity transmission deal that has turned into a taxpayer nightmare.

Treasury’s Public-Private Partnership Directorate has confirmed that delicate negotiations are underway to determine how much Kenyans will fork out to compensate the Indian conglomerate after President William Ruto verbally cancelled the 30-year contract in November last year without issuing formal termination papers.

The government is now walking a financial tightrope, desperately seeking what it calls a mutual separation agreement to avoid the crushing costs of formal contract termination, which legal experts estimate could saddle taxpayers with at least Sh5 billion in compensation.

Documents reveal that Kenya has deliberately avoided issuing formal termination notices because it favours the less costly route of a negotiated settlement, a move that exposes the country’s vulnerability in dealing with powerful multinational corporations.

The cancelled deal would have seen Adani Energy Solutions construct critical power infrastructure including a 206-kilometre transmission line from Gilgil to Konza and substations that were meant to boost electricity supply around Nairobi and extend high-voltage power to previously underserved areas.

Under the original contract signed in October last year, the Adani Group was positioned to rake in a staggering Sh634 billion over three decades before handing over the infrastructure to Kenya. This translates to Sh21.2 billion in annual revenues that would have been extracted from Kenyan households through a controversial wheeling charge added to monthly electricity bills.

President Ruto ordered the hasty cancellation after Adani Group founder Gautam Adani and his nephew Sagar were indicted by United States authorities on bribery and fraud charges.

American prosecutors alleged the billionaire duo paid bribes to secure power supply contracts and deliberately misled investors during fundraising activities.

But in a stunning twist that has complicated Kenya’s position, the election of President Donald Trump has dramatically shifted the political landscape. Trump’s administration has shown willingness to entertain representations from Adani officials seeking dismissal of the criminal charges. Trump even paused prosecutions under the Foreign Corrupt Practices Act, the very law that formed the backbone of the case against the Indian billionaire.

This softening of America’s stance has emboldened the Adani Group and weakened Kenya’s negotiating position, forcing Nairobi into what sources describe as uncomfortable discussions about compensation for a deal that was cancelled over corruption allegations.

The PPP unit has remained tight-lipped about the progress of negotiations, with Director-General Kefa Seda deflecting questions to the Kenya Electricity Transmission Company, the state agency that originally contracted Adani. This silence has only deepened concerns about transparency in the settlement talks.

Legal experts warn that Kenya’s position is precarious because there are no extraordinary grounds in the project agreement that would justify unilateral termination without compensation.

Lawyers intimate that Adani could push for significantly higher payouts given the lack of concrete evidence directly linking the Kenya project to the American indictment.

The Adani saga adds to Kenya’s growing graveyard of cancelled contracts that have already cost taxpayers dearly.

The government paid Israeli firm SBI International Holdings Sh6.19 billion for contract breaches, shelled out Sh8.9 billion to Chinese contractors over the cancelled JKIA second terminal, and recently agreed to compensate French contractors Sh6.2 billion for terminating a Sh190 billion roads project.

This pattern of cancellations followed by massive compensation payments has raised serious questions about the competence of government officials in contract negotiations and the wisdom of entering into agreements without proper due diligence.

The Adani deal itself was shrouded in controversy from the start, with city law firm IC Law LLP unsuccessfully demanding disclosure of competing bidders and financial health details of the Adani subsidiary.

Questions about the adequacy of public participation and the quality of legal advice from the Attorney-General’s office remain unanswered.

As negotiations drag on, Kenyans are left wondering how much they will ultimately pay for a project that was cancelled before a single metre of transmission line was erected, adding another costly chapter to the country’s troubled history of infrastructure deals gone wrong.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business1 week ago

Business1 week ago‘They’re Criminals,’ Popular Radio Presenter Rapcha The Sayantist Accuses Electric Bike Firm Spiro of Fraudulent Practices

-

News2 weeks ago

News2 weeks agoTemporary Reprieve As Mohamed Jaffer Wins Mombasa Land Compensation Despite Losing LPG Monopoly and Bitter Fallout With Johos

-

Business5 days ago

Business5 days agoIt’s a Carbon Trading Firm: What Kenyans Need to Know About Spiro’s Business Model Amid Damning Allegations of Predatory Lending

-

Business4 days ago

Business4 days agoManager Flees Safaricom-Linked Sacco As Fears Of Investors Losing Savings Becomes Imminent

-

Investigations2 weeks ago

Investigations2 weeks agoFrom Daily Bribes to Billions Frozen: The Jambopay Empire Crumbles as CEO Danson Muchemi’s Scandal-Plagued Past Catches Up

-

Investigations1 week ago

Investigations1 week agoDisgraced Kuscco Boss Arnold Munene Moves To Gag Media After Expose Linking Him To Alleged Sh1.7 Billion Fraud

-

Sports1 week ago

Sports1 week ago1Win Games 2025: Ultimate Overview of Popular Casino, Sports & Live Games

-

Business2 weeks ago

Business2 weeks agoHass Petroleum Empire Faces Collapse as Court Greenlights KSh 1.2 Billion Property Auction