News

MPs Reject Finance Bill 2025 Controversial Clause Allowing KRA Access to Kenyans’ Bank Accounts and Personal Data

The MPs specifically cited Article 31(c) and (d) of the Kenyan Constitution, which guarantees every citizen the fundamental right to privacy.

Parliamentary Committee Cites Constitutional Violations and Privacy Concerns in Landmark Decision

NAIROBI, Kenya – The National Assembly Finance Committee has delivered a significant blow to the Kenya Revenue Authority’s (KRA) controversial bid to access Kenyans’ personal financial data, recommending the removal of Clause 52 from the Finance Bill 2025 that would have granted the tax authority sweeping surveillance powers.

The contentious provision, which sought to repeal Section 59A(1B) of the Tax Procedures Act, would have eliminated current legal protections preventing KRA and other tax bodies from compelling businesses to share sensitive customer information, including bank statements, mobile money transactions, and other private financial data.

In a comprehensive report released today, the Finance Committee, chaired by Molo MP Kuria Kimani, concluded that the proposed clause fundamentally violated Kenya’s constitutional framework.

“The provision does not meet the constitutional threshold… and contradicts Section 51 of the Data Protection Act, which provides clear guidelines for exemptions to data protection,” the committee stated in its official findings.

The MPs specifically cited Article 31(c) and (d) of the Kenyan Constitution, which guarantees every citizen the fundamental right to privacy.

The committee referred to Section 51 of the Data Protection Act, which outlines specific conditions for exemptions, noting that Section 60 of the Tax Procedures Act already grants KRA the power to access data with a warrant.

The parliamentary committee emphasized that existing legal frameworks already provide adequate mechanisms for tax enforcement while maintaining constitutional protections.

“Protecting personal privacy and adhering to judicial oversight not only reinforces public trust but also aligns Kenya’s approach with international best practices in data protection,” the committee noted.

The controversial clause triggered an unprecedented wave of opposition from various sectors of Kenyan society.

The Law Society of Kenya (LSK) and audit firm KPMG East Africa are among entities that have opposed a clause in the Finance Bill 2025, which seeks to grant the Kenya Revenue Authority automatic access to trade secrets and personal data.

Professional bodies, civil society organizations, and data protection advocates united in their criticism, warning that the provision would erode due process and fundamental rights.

The opposition highlighted concerns about potential surveillance overreach and the absence of judicial oversight in the proposed data access mechanism.

During public participation hearings, stakeholders appearing before MPs during public hearings also opposed the removal of tax rebates for companies that build at least 100 mass residential units, while consistently voicing strong opposition to provisions granting KRA broad data access powers.

Government Defends Controversial Proposal

Despite the overwhelming opposition, key government officials maintained their support for the clause throughout the legislative process.

Treasury Cabinet Secretary John Mbadi repeatedly defended the proposal as essential for enhancing tax compliance and addressing revenue collection challenges.

Speaking on national television, Mbadi acknowledged significant compliance issues in Kenya’s tax system, pointing to widespread under-declaration of income even among high earners. His arguments centered on the need for more robust enforcement mechanisms to ensure tax compliance.

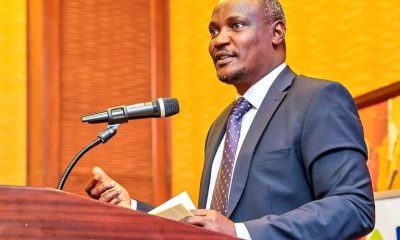

The Kenya Revenue Authority (KRA) chairman, Ndiritu Muriithi, has defended the Finance Bill 2025 proposal to give KRA access to personal data held by businesses.

Muriithi highlighted concerning statistics about tax compliance, noting that of the 20 million Kenyans with KRA Personal Identification Numbers (PINs), only 10 million file tax returns, with most filing nil returns.

“We must find a way to bring more people into the tax net,” Muriithi argued, emphasizing the need to close what he described as gaping tax evasion loopholes in the current system.

Legal experts and constitutional scholars raised significant concerns about the proposed clause’s implications for Kenya’s data protection framework. According to tax expert Alex Kanyi, the 2025 Finance Bill proposes scrapping that section of the Act to allow KRA to obtain transactional data collected by businesses in real time, even if it contains private customer details.

The proposal would have fundamentally altered the balance between tax enforcement and privacy protection, potentially setting a precedent for other government agencies seeking expanded data access powers.

Parliamentary discussions revealed deep concerns about constitutional compliance.

“While it is important to enhance tax compliance, this provision would be in breach of Article 31 of the Kenyan Constitution, which guarantees the right to privacy for all individuals, and could be open to abuse,” stated Turkana South MP John Ariko during committee proceedings.

This marks the second consecutive year that similar provisions have faced significant opposition in Kenya’s Finance Bill.

The Finance Committee has dropped the controversial clause 63 of the Finance Bill 2024 which would have exempted Kenya Revenue Authority (KRA) from the Data Protection Act.

The recurring nature of these proposals indicates the ongoing tension between revenue generation imperatives and constitutional protections for citizen privacy rights.

The committee’s decision aligns Kenya with international best practices in data protection and privacy rights. Global trends in tax enforcement increasingly emphasize the importance of maintaining judicial oversight and constitutional protections even while enhancing compliance mechanisms.

The committee’s emphasis on warrant requirements ensures that Kenya’s approach remains consistent with democratic principles and rule of law standards observed in other constitutional democracies.

With the Finance Committee’s recommendation in place, the fate of Clause 52 now moves to the full Parliamentary debate and voting process expected in the coming weeks.

The committee’s strong constitutional arguments provide a solid foundation for potential rejection by the broader Parliamentary body.

The decision represents a critical juncture for Kenya’s approach to balancing tax enforcement needs with fundamental constitutional rights.

The outcome could establish important precedents for future legislative attempts to expand government data access powers.

The committee’s decision reinforces Kenya’s commitment to robust data protection standards established under the Data Protection Act.

The ruling sends a clear message that constitutional protections for privacy cannot be easily circumvented, even in the pursuit of legitimate government objectives like tax collection.

The decision also highlights the growing sophistication of Kenya’s legislative process in addressing complex issues that intersect technology, constitutional law, and public policy.

The National Assembly Finance Committee’s rejection of Clause 52 represents a significant victory for privacy advocates and constitutional protections in Kenya.

By upholding the principle that tax enforcement must operate within constitutional bounds and existing legal frameworks, the committee has reinforced the importance of judicial oversight and due process.

As Parliament prepares for the final debate on the Finance Bill 2025, this decision could mark a pivotal moment in Kenya’s ongoing efforts to balance effective governance with fundamental rights protection.

The outcome will likely influence future legislative approaches to data access and privacy protection across multiple sectors of government.

The committee’s emphasis on existing legal mechanisms that already permit warranted data access suggests that effective tax enforcement can be achieved without compromising constitutional protections—a principle that could guide future policy development in Kenya’s digital age.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

News1 week ago

News1 week agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations1 week ago

Investigations1 week agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy1 week ago

Economy1 week agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Africa2 weeks ago

Africa2 weeks agoFBI Investigates Congresswoman Ilhan Omar’s Husband’s Sh3.8 Billion Businesses in Kenya, Somalia and Dubai

-

Grapevine4 days ago

Grapevine4 days agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Politics2 weeks ago

Politics2 weeks agoSifuna, Babu Owino Are Uhuru’s Project, Orengo Is Opportunist, Inconsequential in Kenyan Politics, Miguna Says