Investigations

How Scammers Are Using Facebook To Prey On People In Kenya

By Odanga Madung

Buzzfeednews

Early last year, Elizabeth, a salon owner in Nairobi, needed business supplies but didn’t have enough money to buy them. She thought she had found an answer when she came across a sponsored post on Facebook from a page called KWFT Loans Kenya.

“I saw the post had a sponsored sign and there was a Kenya Women Microfinance Bank logo. I thought to myself that this is probably the actual KWFT,” she told BuzzFeed News, referring to the Kenya Women Microfinance Bank, a reputable microfinance institution that provides loans to women.

It wasn’t KWFT.

But the page did offer unsecured loans delivered via mobile phone with an annual interest rate far lower than typical personal bank loans in Kenya, which range from 13% to 20%, or the terms offered by unregulated and often predatory mobile loan apps, a popular source of financing used by close to 20 million people in Kenya.

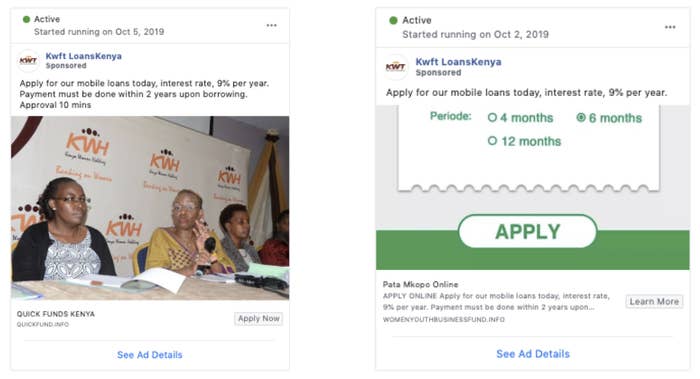

Scam ads seen on Facebook

The link brought Elizabeth (not her real name) to a Google Form that asked her for her name and identification card number, a unique ID that Kenyans use for official activities like registering their SIM cards, opening bank accounts, and obtaining government services. She sent what the form called a loan fee of 310 Kenyan shillings ($3) via a mobile transfer to a man named Anthony Muriungi, who claimed to be a “loans agent officer.”

She soon realized she’d been scammed.

“I remember calling them a few times and getting no response. I then realized these were probably conmen, but since I hadn’t lost a lot of money, I let it go.”

A KWFT spokesperson confirmed that it was a scam, telling Buzzfeed News the page didn’t belong to the bank and that it had been warning the public about fake pages using its name. While the company does offer loans, it’s a service it offers through its app and on mobile phones through USSD, no payment is required to either access or process the loans that it gives.

The Facebook scammers weren’t done with Elizabeth.

A few days after paying the fee, she received a call from a person claiming to be a customer service representative with her phone carrier, Safaricom, carrying out a “security check” on her SIM card, claiming it had been damaged. To establish their credibility, the person read out her full name and identification card number and referred to the recent transaction she had made. They asked her to confirm her identity by stating her date of birth, her latest mobile money transactions, and her SIM card’s PIN. That kicked off the second part of the scam, which saw the fraudsters use this bounty of personal information to open a new phone account under her name and take out loans with three different mobile loan providers, destroying her rating with Kenya’s Credit Reference Bureaus.

A Safaricom spokesperson told Buzzfeed News that they were aware of these forms of social engineering, as customers had been reporting cases to them. The spokesperson said Safaricom does not call to ask for personal information from its customers. “We monitor, detect, and take action against any numbers found to be involved in phishing or smishing activities,” they said. “We work very closely with law enforcement agencies in investigation of noted fraudulent activities.”

But what started as a small scam she dismissed as bad luck left her in financial ruin — because Elizabeth still needed the money.

“Given that I was in an emergency and couldn’t go to a bank for a loan, I ended up at a [loan shark’s] office in the central business district. He charged me about 20% interest in exchange for my laptop as security. I struggled to pay back the amount I had borrowed within a month, but in the end I paid an exorbitant amount just to get my property back.”

Elizabeth was the victim of a long-running, widespread scam that has exploited Facebook’s advertising system to steal money from struggling Kenyans. The country’s economic struggles, its high rate of Facebook use, and an innovative and widely used mobile payment system create the perfect conditions for scammers.

An investigation by BuzzFeed News has identified 52 scam loan and recruitment Facebook pages with more than 245,000 followers, targeting people in Kenya. Some were created as early as 2017; some as recently as Aug. 2. They have titles like “Tuskys supermarket jobs” and “Equity Mobile Loans.” One ad claims “NEW YEAR JOB RECRUITMENT Urgent Mass Recruitment at Tuskys supermarkets. To apply,kindly click on this link to apply.” Another claims, “JOYWO loans give you an opportunity to apply for an Unsecured Online Loan No paperwork No long procedures We are committed to arranging Cash Assistance for Women borrowers and youths living in Kenya.”

The scam pages falsely claim to belong to well-known banks, supermarkets, gas stations, and other companies known to give loans or recruit large numbers of people. They leverage the credibility of real brands to entrap people like Elizabeth into applying for fake loans or for nonexistent jobs that require real fees.

And these ads appear to be working. The Tuskys supermarket fraud, which asked for 350 Kenyan shillings in order to be short-listed for a job interview had 24,772 interactions. Another supermarket fraud, using the Naivas brand name, which requested 370 Kenyan shillings in order to be short-listed for a job as well, had 6,576 interactions, according to analytics data provided by CrowdTangle. In total, BuzzFeed News found 78,936 interactions from the 52 forms. Going by current engagement rates on Facebook, this means that the fraudsters could have reached millions of Kenyans with the help of the platform’s ad program.

Both Naivas and Tuskys supermarkets told BuzzFeed News that the campaigns weren’t theirs. This isn’t the first time such ads had been brought to their attention. In 2017 and 2019, Naivas raised the alarm about the same scam to its customers, letting them know that it only conducts recruitment processes at its head office and not via Google Forms. Tuskys also flagged the ads to its customers 2017and 2018.

In both instances, the comments sections of the cautionary posts reveal a flurry of people who’ve already been ripped off complaining about losing their money to the scammers.

Despite the scale of the rip-offs, those pages remain active. One that purports to provide KWFT loans, different from the one that ensnared Elizabeth, had at least 85 comments from people who said they had been ripped off. It remains online, as do four fake KWFT loan pages that are still active as of this writing.

A Facebook spokesperson in Kenya said the company invests heavily in trying to tackle scams and bad actors.

“We’re putting significant resources towards tackling these kinds of ads,” they said a statement. “It’s important to us that ads on Facebook are useful to people and not used to promote deceptive behavior, like using images of public figures and organizations to mislead people. We remove pages that violate our advertising policies.”

The spread of COVID-19, which has risen to 27,425 cases in Kenya since March 13, inspired scammers to create new variations.

Frederick, another victim who declined to give his real name, is a waiter who lost his job in the wake of the pandemic. He fell for a coronavirus volunteer recruitment version of the scam, where he paid a “registration fee” to get short-listed for a job but never heard back from the recipient. He blamed the legitimate-looking nature of the pages and the desperation of his situation.

“At the time I was really desperate for a job and the cash I sent them was the chunk of the little I had. It’s a shame as you can imagine how many people they have stolen from,” he said.

Noah Miller, a cybersecurity researcher and cofounder of the Sochin Research Institute in Nairobi, said the high usage of Facebook in Kenya has led people to trust it. “Facebook is a trusted zone for communication for many Kenyans. In this environment, people’s first instinct is to trust what they see,” he told BuzzFeed News. ”You will trust it more than an email that comes to you directly, and therefore it’s easier for scammers to get to you there instead of sending you an email.”

Since 2016, Facebook has invested in artificial intelligence and human fact-checkers and reviewers. Of the company’s estimated 30,000 global content reviewers, 130 are based in Nairobi, the company’s only sub-Saharan Africa content review center. It is run by Samasource, a company headquartered in San Francisco that provides data labeling services for AI technologies.

Facebook has also partnered with Pesacheck, AFP, Africa Check, France 24 Observers, and Dubawa to perform fact-checking in sub-Saharan Africa. Alphonce Shiundu of Africa Check said they deal with scams in addition to their primary work debunking falsehoods.

But Facebook and its regional partners seem powerless to stop the scams.

“This is a widespread problem that we’ve been facing on Facebook. We have been seeing a lot of these scams,” Shiundu said. “It’s been a game of whack-a-mole with these scammers on Facebook. When we spot one and rate it as false, they open another one and another one. We have basically been chasing them around Facebook.”

The scams have also caught the attention of Kenya’s authorities, who have repeatedly warned of an increase in such scams as COVID-19 has made people more desperate for jobs and loans. Peter Mbatha, a cyber forensics expert at the Directorate of Criminal Investigations (DCI), said when asked during a webinar in June that DCI collaborates with Facebook, but did not say whether or not they work together to combat scams. “The DCI is able to communicate with them, and we can make requests on any criminal aspects touching on individuals who have used their platforms. They usually respond when they are called upon to handle such matters and issues.”

Shiundu said automated systems and algorithms aren’t enough to catch the scammers early on.

“If we leave it to algorithms, which is what they use to flag [content] to fact-checkers, then that becomes slow, algos cannot answer everything and we find a lot of false positives,” he said.

Robin Busolo, a lawyer who handles regulatory affairs at the Communications Authority of Kenya, the body that regulates Kenya’s communications industry, told BuzzFeed News that Facebook had a responsibility to deal with crimes taking place on its platform.

“I doubt whether Facebook can be absolved from their culpability in the case where harm is meted out on their platform,” he said. But he was also frank that “we have no jurisdiction over them.”

That leaves victims of crimes that happen on Facebook like Elizabeth with no hope of seeing it reined in or penalized in Kenya, leaving caution as the only option.

“People need to be careful about how they use these online platforms,” she said. “It’s not as safe as most of us might like to think. What happened to me has probably happened to many vulnerable people, and it could’ve been a lot worse.”

This article was developed with the support of the Money Trail project.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business4 days ago

Business4 days agoCooking Fuel Firm Koko Collapses After Govt Blocks Sh23bn Carbon Deal

-

Business3 days ago

Business3 days agoABSA BANK IN CRISIS: How Internal Rot and Client Betrayals Have Exposed Kenya’s Banking Giant

-

Politics2 weeks ago

Politics2 weeks agoYour Excellency! How Ida’s New Job Title From Ruto’s Envoy Job Is Likely to Impact Luo Politics Post Raila

-

Business2 weeks ago

Business2 weeks agoMinnesota Fraud, Rice Saga, Medical Equipment Deal: Why BBS Mall Owner Abdiweli Hassan is Becoming The Face of Controversial Somali Businessman in Nairobi

-

Americas3 days ago

Americas3 days agoEpstein Files: Bill Clinton and George Bush Accused Of Raping A Boy In A Yacht Of ‘Ritualistic Sacrifice’

-

News2 weeks ago

News2 weeks agoKenya Stares At Health Catastrophe As US Abandons WHO, Threatens Billions In Disease Fighting Programmes

-

News2 weeks ago

News2 weeks agoDCI Probes Meridian Equator Hospital After Botched Procedure That Killed a Lawyer

-

Investigations1 week ago

Investigations1 week agoPaul Ndung’u Sues SportPesa for Sh348 Million in UK Court, Accuses Safaricom Boss of Sh2.3 Billion Conspiracy