Business

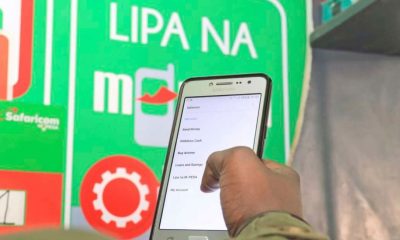

Safaricom’s Fuliza Service Crippled as Automatic Repayment System Crashes

Safaricom’s track record on service reliability has generally been solid, though not unblemished.

Telecommunication giant scrambles to fix mysterious system failure affecting millions, but tight-lipped response fuels speculation

Kenya’s telecommunications behemoth Safaricom PLC found itself in damage control mode Tuesday as its flagship Fuliza overdraft service experienced what the company tersely described as a “temporary disruption”—corporate speak that belies the scale of chaos unleashed on millions of customers unable to repay their mobile loans.

The crisis, which emerged on September 30, 2025, has effectively paralyzed the automatic repayment mechanism that forms the backbone of Fuliza’s operations, leaving users stranded and raising uncomfortable questions about the vulnerability of Kenya’s increasingly digitized financial infrastructure.

What Safaricom isn’t saying speaks louder than its carefully calibrated public statements, and the silence has tongues wagging across the industry about whether this is merely a technical hiccup or something far more serious.

“There is an issue with the repayment of Fuliza and resolution is underway. Our team is working in resolving the same. Sorry for the inconvenience caused,” read the company’s boilerplate response to anxious customers flooding social media with complaints—a statement so deliberately vague it could mean anything from a simple software bug to a full-blown security breach.

The evasiveness is typical of a corporation caught flat-footed by a crisis it doesn’t fully understand or doesn’t want to explain.

Industry insiders suggest that the specificity of the failure affecting only Fuliza repayments rather than the entire M-Pesa ecosystem points to either a targeted attack on the system or a catastrophic failure in a critical component of the service architecture. Safaricom, predictably, isn’t confirming either scenario.

What makes this disruption particularly alarming is the central role Fuliza has assumed in Kenya’s financial landscape since its January 2019 launch.

Born from a partnership between Safaricom, NCBA Bank, and KCB Bank, the overdraft facility has morphed from a convenient add-on into an essential lifeline for millions of Kenyans who routinely rely on it to bridge the gap between paychecks, emergencies, and everyday expenses.

The service’s genius lies in its simplicity and automation.

When your M-Pesa wallet runs dry mid-transaction whether you’re sending money to a relative, paying a bill, or buying groceries—Fuliza seamlessly tops up the shortfall, up to your pre-approved limit.

The borrowed amount, plus fees, is then automatically recovered from your next incoming deposit. It’s financial duct tape for a cash-strapped nation, and on Tuesday, that tape came unstuck.

The implications ripple far beyond individual inconvenience.

Businesses using Fuliza ya Biashara, the commercial iteration that extends overdrafts up to Ksh 400,000 to merchant tills, now find themselves in a peculiar bind.

They can still access credit to complete transactions, but the system that would normally recover those funds has gone dark.

It’s like writing checks without a clearing house—eventually, someone has to balance the books, but nobody knows when or how.

Safaricom’s track record on service reliability has generally been solid, though not unblemished.

The company has weathered scheduled maintenance windows and occasional unplanned outages, but those typically affected the broader M-Pesa platform with clear explanations and timelines for restoration.

This incident feels different.

The surgical precision with which it has disabled a specific function suggests either remarkable bad luck or a more calculated intrusion into the system’s inner workings.

Cybersecurity experts note that mobile money platforms have become increasingly attractive targets for sophisticated threat actors, even as they struggle under the weight of processing millions of transactions daily.

A successful attack on Fuliza would represent a significant escalation in the threat landscape for Kenya’s fintech sector, potentially exposing vulnerabilities that could be exploited elsewhere.

Safaricom’s reluctance to discuss technical details could indicate they’re still determining the full scope of what went wrong—or desperately trying to avoid admitting they’ve been compromised.

The financial stakes are staggering. Fuliza processes transactions worth billions of shillings monthly, touching millions of lives daily. Each hour of downtime translates to lost revenue for Safaricom and its banking partners, who collect a 1% access fee plus daily maintenance charges on outstanding balances. More critically, customers who borrowed expecting automatic repayment may now face accumulating fees, damaged credit scores, and reduced borrowing limits through no fault of their own.

The disruption also exposes the precarious nature of Kenya’s rush toward financial digitization. As more citizens abandon traditional banking for mobile money, the entire economy becomes hostage to the stability of platforms like M-Pesa and services like Fuliza. Tuesday’s failure serves as an uncomfortable reminder that digital infrastructure, for all its convenience, can fail spectacularly and without warning.

Safaricom CEO Peter Ndegwa has previously touted Fuliza as evidence of the company’s commitment to financial inclusion, noting during the 2023 launch of Fuliza ya Biashara that more than 538,000 businesses were already using the platform. “Our strategy is to now go beyond collecting payments by providing business owners with tools to manage and grow their businesses,” he declared then, promising instant, affordable credit would empower small enterprises to respond rapidly to business needs.

Those promises ring hollow today as those same businesses watch their repayment systems malfunction while Safaricom’s communications team offers nothing but platitudes about “working to resolve” the issue. No timeline. No root cause. No transparency.

As the disruption stretched beyond the initial few hours Tuesday afternoon, frustration mounted among users who depend on Fuliza not as a luxury but as a survival mechanism in an economy where informal work, irregular income, and unexpected expenses are the norm rather than the exception. For them, this isn’t about corporate efficiency or technical glitches—it’s about whether they can trust the systems they’ve been encouraged to adopt as replacements for traditional banking.

Safaricom’s failure to provide substantive updates or a clear restoration timeline only deepens suspicions that the company either doesn’t fully understand what’s broken or doesn’t want to reveal what it knows. In an era where corporate reputation can evaporate overnight on social media, this approach seems dangerously short-sighted. Kenyans have proven remarkably patient with M-Pesa over the years, but that patience isn’t infinite.

Whether this proves to be an embarrassing technical failure, evidence of deeper systemic vulnerabilities, or something more sinister that Safaricom would prefer to handle quietly, one thing is certain: millions of Kenyans went to bed Tuesday night unable to settle their debts, not because they lacked the means, but because the system designed to collect those debts had simply stopped working.

By publication time, Safaricom had not provided any meaningful update beyond its initial acknowledgment of the problem, leaving customers, businesses, and observers to wonder whether Kenya’s mobile money infrastructure is as robust as they’ve been led to believe—or whether Tuesday’s disruption is merely a preview of larger failures to come.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine1 week ago

Grapevine1 week agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoThe General’s Fall: From Barracks To Bankruptcy As Illness Ravages Karangi’s Memory And Empire

-

Grapevine5 days ago

Grapevine5 days agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

Investigations2 weeks ago

Investigations2 weeks agoEpstein Files: Sultan bin Sulayem Bragged on His Closeness to President Uhuru Then His Firm DP World Controversially Won Port Construction in Kenya, Tanzania

-

Investigations2 days ago

Investigations2 days agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Investigations2 weeks ago

Investigations2 weeks agoEpstein’s Girlfriend Ghislaine Maxwell Frequently Visited Kenya As Files Reveal Local Secret Links With The Underage Sex Trafficking Ring

-

News2 weeks ago

News2 weeks agoState Agency Exposes Five Top Names Linked To Poor Building Approvals In Nairobi, Recommends Dismissal After City Hall Probe

-

Business1 week ago

Business1 week agoM-Gas Pursues Carbon Credit Billions as Koko Networks Wreckage Exposes Market’s Dark Underbelly