News

NCBA Bank CEO John Gachora Attacks Ruto Over New Taxes

The CEO is now warning that Ruto’s government risks plunging Kenya into a foreign exchange crisis with the introduction of the new charges which he claims will not only kill the vibrant banking industry in Kenya but also alienate major transactions.

NCBA Bank CEO John Gachora has come out guns blazing in posts criticizing the proposed taxes in the Financial Bill 2024.

Gachora has specifically attacked the administration for the proposed transaction charges describing it as ‘unnecessary taxation’ and ‘introduction of both Tobin Tax and Robinhood Tax through the scrapping of VAT exemptions for banking transactions’.

Mr. Gachora has accused the government of scheming to kill the banking industry with proposed bill, and the risk of sending many back to ‘matress banking’, “it will make basic banking expensive, raise cost of credit, and drive people to the black market.” He said.

Foreign exchange crisis

The CEO is now warning that Ruto’s government risks plunging Kenya into a foreign exchange crisis with the introduction of the new charges which he claims will not only kill the vibrant banking industry in Kenya but also alienate major transactions.

“Kenya has been a leading light in financial inclusion globally. A unnecessary tax on banking transactions will make us uncompetitive. Large FX transactions will be offshored. Completely unnecessary!” He posted on X.

Reject

Furthermore, Mr. Gachora has urged the MPs to reject the proposals made by the government.

“Urging our MPs to do the right thing. Keep Kenya a leading light when it comes to banking and finance – reject this attempt to tax you for simple act of paying for goods and services.” He added.

Finance Bill 2024

National Treasury in the Finance Bill 2024 to raise the excise duty levied on fees charged on transactions on mobile wallets and bank accounts.

The Bill wants to raise the excise on fees charged for mobile money transfers between wallets to 20 percent from the current 15 percent.

Similarly, the Bill raises the excise on fees charged for such transactions in banks, money transfer agencies and other financial service providers like Saccos to 20 percent, from 15 percent.

The proposals effectively reverse the cuts that had been made on money transfer charges in the 2023 Finance Act, a move that was meant to cushion Kenyans from higher costs of transacting cash in a tough economic climate.

In 2023, the tax on airtime, data and bank cash transfers had been cut by five percent, while that on mobile wallet transfers had been increased from 12 percent.

In addition to the excise changes, the National Treasury is also proposing to introduce value added tax (VAT) on financial services, including forex transactions and cheque processing.

Other financial services targeted for VAT, which is levied at 16 percent, include the issuance of securities for money such as bills of exchange, promissory notes, money and postal orders.

Financial institutions will also levy VAT during the issuance of credit and debit cards if the proposals receive the nod of Parliament.

Government’s targets

The measures are part of a wider effort by the government to improve its tax collection performance, which has lagged behind target for the current fiscal year.

Overall, the government is targeting tax collections worth Sh2.94 trillion in the next fiscal year, up from Sh2.62 trillion in the current year. By the end of March, the government had collected total revenue of Sh1.86 trillion, against a pro-rated target of Sh2.13 trillion.

In the current fiscal year, the State’s target from excise duties stands at Sh350 billion, which is expected to go up to Sh400 billion in the 2024/2025 fiscal year.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations1 day ago

Investigations1 day agoSOLD TO THE BULLET: How the Bodyguard Handed MP Ong’ondo Were to His Killers

-

Investigations1 week ago

Investigations1 week agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations2 weeks ago

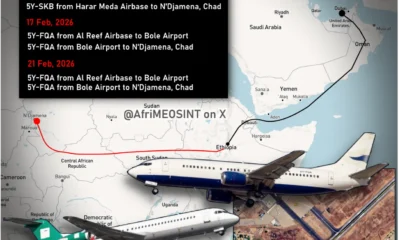

Investigations2 weeks agoTracker Identifies Kenyan-Registered Flights Allegedly Running Errands for RSF