Business

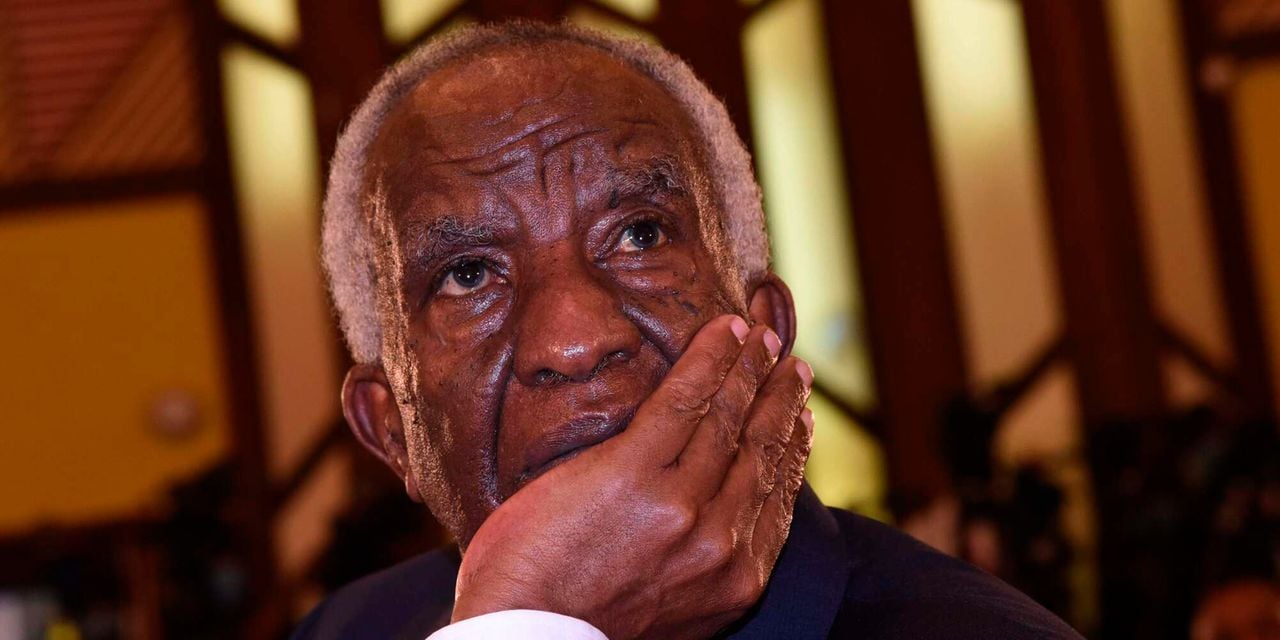

Munga’s Wife Sues ABC Bank as Businessman Fails to Stop Share Auction

The wife’s case is expected to be heard in the coming weeks, potentially creating further delays in ABC Bank’s efforts to recover the outstanding loan.

Family dispute emerges over Sh604 million Britam shareholding amid ongoing debt recovery battle

Billionaire businessman Peter Munga’s financial woes have taken a new twist after his wife moved to court seeking to prevent ABC Bank from auctioning his 75 million Britam shares, even as the High Court rejected the tycoon’s own bid to block the sale.

The development comes just days after Justice Alfred Mabeya dismissed Munga’s application for a permanent injunction, clearing the way for ABC Bank to proceed with the auction of shares valued at Sh604 million to recover a Sh433.76 million defaulted loan.

According to court documents, Munga’s wife has filed a separate legal challenge against ABC Bank, ABC Capital, and Equatorial Nut Processors, arguing that the proposed share sale would adversely affect family property rights and seeking orders to protect her interests in the matrimonial assets.

The wife’s legal intervention adds another layer of complexity to what has become one of Kenya’s most closely watched debt recovery cases involving a prominent businessman.

Her application reportedly seeks to permanently bar ABC Bank from transferring, pledging, charging, or otherwise dealing with the 75 million ordinary shares in Britam Kenya Plc without her explicit consent as a matrimonial property stakeholder.

Legal sources familiar with the matter indicate that the wife’s case centers on several key arguments.

First, she contends that the use of the shares as security was done without her consent as required under matrimonial property law.

Second, she argues that any disposal, charge, or lien registered against the shares after [a specific date] constitutes a breach of statutory provisions governing matrimonial rights.

The wife also seeks damages for breach of statutory duty and constitutional rights, claiming that ABC Bank’s actions threaten to deprive the family of valuable assets without following due process.

The case has drawn attention from Kenya’s banking sector, with industry observers noting that it could set important precedents for how lenders handle security interests where matrimonial property is involved.

“This case highlights the complex intersection between banking law and family law in Kenya,” said a senior banking lawyer who requested anonymity.

“Banks will be watching closely to see how courts balance lender rights against matrimonial property protections.”

ABC Bank, through its legal team, is expected to oppose the wife’s application, likely arguing that proper procedures were followed when the shares were pledged as security, and that the bank acted within its rights as a secured creditor.

The Equity Bank co-founder has faced increasing financial pressures in recent years. In 2023, three properties linked to him were set for auction to recover unpaid debts.

He previously averted the auction of five Nairobi houses worth Sh400 million in 2017 through a last-minute payment to what was then Jamii Bora Bank.

Despite these challenges, Munga remains a significant player in Kenya’s business landscape, with direct and indirect holdings in Britam worth over Sh3.26 billion through various investment vehicles including EH Venture Capital and EHL 2022.

The wife’s case is expected to be heard in the coming weeks, potentially creating further delays in ABC Bank’s efforts to recover the outstanding loan.

The bank may need to navigate both the original debt recovery proceedings and the new matrimonial property challenge.

Meanwhile, Equatorial Nut Processors, the company at the center of the original loan default, continues to operate from its base near Maragua town, processing macadamia nuts, peanuts, and cashews for both local and international markets.

The outcome of these intertwined legal battles will likely have significant implications for how secured lending is conducted in Kenya, particularly where high-value assets and matrimonial property rights intersect.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

News7 days ago

News7 days agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations1 week ago

Investigations1 week agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy1 week ago

Economy1 week agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Africa1 week ago

Africa1 week agoFBI Investigates Congresswoman Ilhan Omar’s Husband’s Sh3.8 Billion Businesses in Kenya, Somalia and Dubai

-

Grapevine3 days ago

Grapevine3 days agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Politics2 weeks ago

Politics2 weeks agoSifuna, Babu Owino Are Uhuru’s Project, Orengo Is Opportunist, Inconsequential in Kenyan Politics, Miguna Says