Investigations

Lodge Director Faces Court Over Alleged Sh48.8M Share Scam

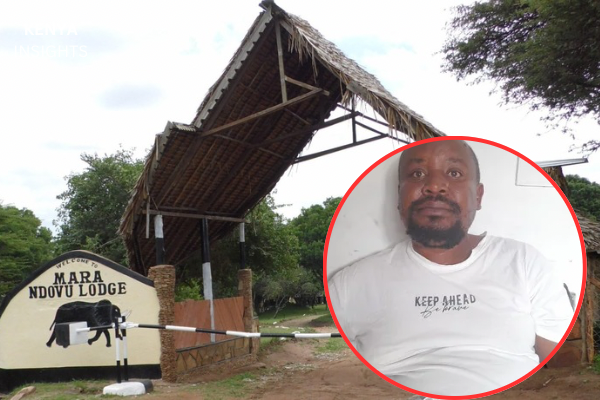

George Maina Muriithi, director of Mara Ndovu Lodge Limited, has been charged with defrauding an investor of Sh48.8 million in what prosecutors describe as a sophisticated share purchase scam.

The case, which has exposed vulnerabilities in Kenya’s investment sector, began in October 2022 when Muriithi allegedly approached the complainant with an enticing business proposition at his lodge company.

Court documents filed at Milimani Law Courts reveal that Muriithi presented himself as selling 48,800 ordinary shares in Mara Ndovu Lodge Limited, each valued at Sh1,000.

The total investment package was worth Sh48.8 million.

What distinguished this case from typical investment fraud was the level of legal formality involved.

On December 22, 2022, a comprehensive share purchase agreement was drafted by Otieno & Ambrose Advocates, acting on Muriithi’s behalf.

The agreement appeared legitimate, detailing the sale of 48,800 ordinary shares at the agreed price.

The complainant, convinced by both the professional presentation and legal documentation, proceeded to transfer the funds in two separate installments through the suspect’s law firm.

However, despite fulfilling his financial obligations, the promised share certificates never materialized.

Parklands Police Station detectives launched an investigation after the complainant filed a formal report.

Their probe revealed a pattern of behavior that suggested deliberate deception rather than a business dispute.

“The suspect became elusive immediately after receiving the funds,” a source familiar with the investigation told this reporter.

“Despite having proper legal representation and formal agreements, no shares were ever transferred.”

The investigation uncovered that while the legal documentation appeared authentic, Muriithi had no intention of honoring the share transfer agreement.

When Muriithi appeared before Milimani Law Courts, he entered a plea of not guilty to the fraud charges.

However, the prosecution successfully opposed his bond application, arguing that the suspect posed a flight risk.

The court agreed with the prosecution’s concerns, ordering Muriithi to remain in custody at Capitol Hill Police Station pending a bond hearing scheduled for July 15, 2025.

The bond hearing on July 15 will determine whether Muriithi remains in custody or is released pending trial.

For the complainant, who invested nearly Sh49 million, the legal process represents the only hope of recovering the substantial sum lost in what authorities describe as a calculated investment scam.

The case serves as a stark reminder for investors to conduct thorough due diligence, even when presented with professional legal documentation and seemingly legitimate business opportunities.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News2 weeks ago

News2 weeks agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Grapevine1 week ago

Grapevine1 week agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Politics2 weeks ago

Politics2 weeks agoPresident Ruto and Uhuru Reportedly Gets In A Heated Argument In A Closed-Door Meeting With Ethiopian PM Abiy Ahmed

-

Investigations1 week ago

Investigations1 week agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Business2 weeks ago

Business2 weeks agoSafaricom Faces Avalanche of Lawsuits Over Data Privacy as Acquitted Student Demands Sh200mn Compensation in 48 Hours

-

Development2 days ago

Development2 days agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations1 week ago

Investigations1 week agoHow Close Ruto Allies Make Billions From Affordable Housing Deals

-

Entertainment2 weeks ago

Entertainment2 weeks agoKRA Comes for Kenyan Prince After He Casually Counted Millions on Camera