Investigations

Kenyatta Family Made Billions From Nairobi Expressway via Proxies Under Uhuru

Court documents from a Tax Appeals Tribunal case reveal that the Kenyatta family, through a web of shell companies and trustees, supplied sand and provided land for the Sh88 billion expressway project, potentially earning between Sh1.8 billion and Sh2.8 billion in 2022 alone.

An investigation Exposes Complex Web of Shell Companies That Earned Billions While President Called for Conflict of Interest Laws

A damning tax dispute has exposed how the family of former President Uhuru Kenyatta earned billions of shillings from the Nairobi Expressway project through a sophisticated network of proxy companies, even as the sitting president publicly campaigned against public servants enriching themselves through government projects.

Court documents from a Tax Appeals Tribunal case reveal that the Kenyatta family, through a web of shell companies and trustees, supplied sand and provided land for the Sh88 billion expressway project, potentially earning between Sh1.8 billion and Sh2.8 billion in 2022 alone.

The Speech That Now Rings Hollow

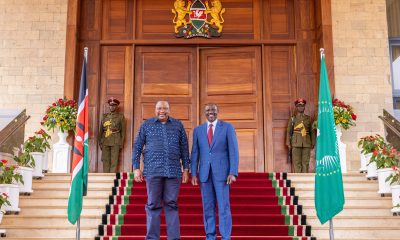

The contradiction began to take shape on December 12, 2019, during Kenya’s 56th Jamhuri Day celebrations at Nairobi’s Nyayo Stadium. President Uhuru Kenyatta, dressed in his characteristic navy blue suit with a red tie reserved for serious occasions, stepped to the podium with what appeared to be a reformist agenda. Midway through his speech, he revived a debate that had long frustrated Kenyan taxpayers—the endemic problem of public servants using government projects to line their pockets.

With characteristic authority, Kenyatta directed then Attorney-General Paul Kihara Kariuki to begin drafting the Conflict of Interest Bill, legislation he promised would lock public servants from doing business with the government and require their families to declare their wealth. The speech was hailed as a watershed moment in Kenya’s fight against corruption and conflicts of interest.

Yet barely sixteen months later, as construction of the Nairobi Expressway—a project whose importance President Kenyatta had repeatedly stressed to the public—reached high gear, his own family was quietly positioning itself to profit handsomely from the very type of arrangement he had publicly condemned.

The Proxy Arrangement Unfolds

On March 26, 2021, Rose Wamaitha Ng’ote was registered as the sole owner of Edge Worth Properties Ltd, inheriting all shares from Ropat Trust Company Ltd. The timing was hardly coincidental. Construction of the 27.1-kilometer expressway was in full swing, and opportunities for profit were materializing for those positioned to take advantage.

Not long after Ng’ote’s registration, Edge Worth Properties entered into a lucrative arrangement with Cale Infrastructure Construction Company Ltd, the Chinese firm contracted to build the toll road under a public-private partnership model worth Sh88 billion. The deal was straightforward yet highly profitable: Edge Worth Properties would surrender its land to Cale Infrastructure for sand extraction needed for the project, while also providing space for the contractor to dump construction materials.

What appeared to be a simple business transaction between two private entities was, in reality, far more complex. Behind the facade of Rose Wamaitha Ng’ote’s ownership lay a sophisticated corporate structure designed to obscure the true beneficiaries of this expressway windfall.

When Tax Demands Exposed the Truth

The carefully constructed facade began to crumble when the Kenya Revenue Authority came knocking. After conducting two separate audits of Edge Worth Properties’ books covering the 2018-2022 period, KRA issued a demand for Sh249.2 million in unpaid taxes in July 2024. The tax authority challenged several aspects of the company’s financial reporting, including land leveling costs claimed as business expenses and the tax treatment of what appeared to be interest-free loans issued to the company’s sole shareholder.

More significantly, KRA demanded taxes on Sh1 billion in dividends that Edge Worth Properties had declared as payable to its shareholder in 2022. Since corporate records showed Ng’ote as the sole owner, the tax authority naturally assumed she was the recipient of these substantial payments.

Faced with a tax bill that threatened to expose their arrangement, the Kenyatta family was forced to abandon their carefully maintained anonymity. On August 23, 2024, Edge Worth Properties challenged KRA’s demand at the Tax Appeals Tribunal, filing documents that revealed the truth behind the proxy arrangement.

The company’s defense centered on a startling admission: Rose Wamaitha Ng’ote had never been the real owner of Edge Worth Properties. Instead, she was merely a trustee holding shares on behalf of Enke Investments Ltd, the apex company in the Kenyatta family business empire.

The Family Empire Revealed

The tribunal documents pulled back the curtain on a business structure that had been decades in the making. Enke Investments Ltd, incorporated on April 26, 1989, sits at the pinnacle of the Kenyatta family’s vast commercial interests. The company’s ownership reads like a who’s who of the Kenyatta dynasty: former First Lady Mama Ngina Kenyatta, her son Muhoho Kenyatta, and Goodison Trust Corporation each hold 1.33 million shares.

Goodison Trust Corporation itself reveals the intricate web of family control. Margaret Wanjiru Gakuo, Uhuru Kenyatta’s wife and former First Lady, holds two separate blocks of shares totaling 443,400 shares. Past Business Registration Service records indicated that 253,300 of these shares were held in trust for her brother-in-law, Muhoho Kenyatta.

Mama Ngina Kenyatta maintains a symbolic one share in Goodison Trust, while Uhuru’s children, John Jomo Kamau Kenyatta and Ngina Kenyatta, each hold 253,300 shares.

This complex ownership structure served a clear purpose: to create multiple layers of separation between the Kenyatta family and their business interests, particularly those that might intersect with government projects.

The Scale of the Windfall

While the exact terms of the sand extraction deal remain closely guarded, the financial records that emerged during the tax dispute provide glimpses of its immense profitability. Edge Worth Properties declared Sh1 billion in dividends payable to Enke Investments in 2022 alone. Corporate finance experts note that companies typically distribute between 35 and 55 percent of their post-tax profits as dividends, suggesting that Edge Worth Properties generated gross revenues of between Sh1.8 billion and Sh2.8 billion that year.

These figures represent income from what was essentially a land use arrangement—allowing sand extraction and providing dumping space for construction materials. The scale of earnings suggests either vast quantities of sand were extracted or the pricing was particularly favorable, or both.

After Cale Infrastructure completed its sand extraction activities, Edge Worth Properties arranged to level the land in preparation for hay farming, treating the leveling costs as a business expense. This decision would later become one of the focal points of the tax dispute, with KRA arguing that since the leveling was part of the planned agricultural venture, it should only be considered a business expense once the hay farming began generating income.

A Pattern of Proxy Operations

The Rose Wamaitha Ng’ote arrangement was not an isolated incident but part of a broader pattern of using proxies to mask family ownership. The same individual had previously served as a founding shareholder and director of Southbrook Holdings in 2016 before being replaced by Ropat Nominees, another entity in the Kenyatta family’s corporate network.

Southbrook Holdings itself tells another story of strategic land acquisition. The company paid Sh20 million for 1.5 acres of land opposite the Kenyatta family home in Ichaweri, Kiambu County. The disputed property now hosts apartments occupied by General Service Unit officers tasked with guarding the family residence. The purchase has sparked a legal battle with the original landowner’s children, who argue that Southbrook Holdings did not seek their consent before entering into the sale agreement with their mother.

Ropat Trust Company Ltd, which originally held the Edge Worth Properties shares before transferring them to Ng’ote, has its own complex history. While official records show it is owned by Robert Kimani Ndung’u and Patrick Kamau Gacheru, the company has appeared in multiple Kenyatta family business ventures. It previously owned 5.37 percent of NCBA Bank before exiting the shareholder list. Meanwhile, a foreign entity with a remarkably similar name, Ropat Nominees, owns 22.5 percent of NCBA and has previously held shares in Edge Worth Properties in trust for Enke Investments.

The Tribunal’s Verdict

The Tax Appeals Tribunal’s February 28, 2025 ruling largely vindicated Edge Worth Properties’ position while inadvertently validating the proxy arrangement. The tribunal agreed that Enke Investments was the beneficial owner of Edge Worth Properties and was therefore exempt from dividend taxation under Section 7(2) of the Income Tax Act, which exempts companies controlling at least 12.5 percent of another company from tax on dividends received.

The ruling also ended KRA’s tax claim on shareholder loans, since the tribunal accepted that the loans had been properly issued to Enke Investments rather than to Ng’ote personally. However, the tribunal did agree with KRA that some land leveling costs should be subject to corporation tax.

The Silence of Key Players

The revelation has been met with a wall of silence from the key participants. Despite multiple follow-ups over two weeks, Kanze Dena Mararo, former President Kenyatta’s spokesperson, did not respond to queries about the potential conflict of interest inherent in the Edge Worth Properties-Cale Infrastructure business arrangement.

Cale Infrastructure has similarly remained silent on how it selected Edge Worth Properties as a supplier and whether company officials were aware of the true ownership structure behind their business partner. This silence is particularly noteworthy given that transparency in vendor selection is a cornerstone of good governance in public-private partnerships.

Broader Implications for Governance

The Edge Worth Properties revelation represents the second major tax controversy involving Kenyatta family businesses since the Kenya Kwanza administration assumed office in 2022. Earlier, in April 2024, the High Court quashed a Sh384.5 million tax waiver that KRA had granted during the merger of NIC and CBA Banks to form NCBA Bank, following a case filed by Busia Senator Okiya Omtatah.

The expressway case underscores the persistent challenges Kenya faces in implementing effective conflict of interest regulations. Despite President Kenyatta’s public commitment in 2019 to strengthen such laws, the Conflict of Interest Bill remains incomplete, leaving gaps that sophisticated corporate arrangements can exploit.

More troubling is the precedent this case sets for future public-private partnerships. If families of senior government officials can structure proxy arrangements to benefit from major infrastructure projects while maintaining plausible deniability, it raises fundamental questions about the integrity of such partnerships and the effectiveness of existing oversight mechanisms.

The Unfinished Business

The Kenyatta family’s business empire spans multiple sectors including agriculture, real estate, financial services, hospitality, education, and media. The Edge Worth Properties case suggests that the true extent of this empire’s intersection with government projects may only come to light through similar tax disputes or legal challenges.

Edge Worth Properties continues to operate in the extractives industry alongside Gituamba Stones Ltd, another Kenyatta family-owned business. Both companies represent the family’s deep involvement in construction materials supply, raising questions about other potential government project connections that have yet to be examined.

The Nairobi Expressway, once hailed as President Kenyatta’s flagship infrastructure achievement, now stands as a complex symbol of how private interests can intertwine with public projects. While the road undoubtedly serves important transportation needs, the revelation of hidden family profits casts a shadow over its legacy and raises uncomfortable questions about the true costs of Kenya’s infrastructure development.

As the country continues to grapple with transparency and governance challenges, the Edge Worth Properties case serves as a stark reminder that even the most public calls for integrity can ring hollow when those making them find ways to benefit from the very system they claim to reform.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News1 week ago

News1 week agoTemporary Reprieve As Mohamed Jaffer Wins Mombasa Land Compensation Despite Losing LPG Monopoly and Bitter Fallout With Johos

-

Business3 days ago

Business3 days ago‘They’re Criminals,’ Popular Radio Presenter Rapcha The Sayantist Accuses Electric Bike Firm Spiro of Fraudulent Practices

-

Sports6 days ago

Sports6 days ago1Win Games 2025: Ultimate Overview of Popular Casino, Sports & Live Games

-

Investigations1 week ago

Investigations1 week agoFrom Daily Bribes to Billions Frozen: The Jambopay Empire Crumbles as CEO Danson Muchemi’s Scandal-Plagued Past Catches Up

-

Business1 week ago

Business1 week agoHass Petroleum Empire Faces Collapse as Court Greenlights KSh 1.2 Billion Property Auction

-

News1 week ago

News1 week agoShanta Gold’s Sh680 Billion Gold Discovery in Kakamega Becomes A Nightmare For Community With Deaths, Investors Scare

-

Investigations3 days ago

Investigations3 days agoDisgraced Kuscco Boss Arnold Munene Moves To Gag Media After Expose Linking Him To Alleged Sh1.7 Billion Fraud

-

Investigations2 weeks ago

Investigations2 weeks agoHow SportPesa Outfoxed Paul Ndung’u Of His Stakes With A Wrong Address Letter