Economy

Kenya pays Sh1.7bn to bag foreign loans

The Controller of Budget (COB) Mrs. Margret Nyakango has flagged the National Treasury for Sh1.65 billion paid to secure future loans arguing that borrowings should now be cancelled to ease the burden of payment on taxpayers.

The amount is paid as commitment fees charged on borrowers for credit that has not been advanced as a way of guaranteeing that a lender will keep the funds. Nyakango told Parliament that the loans are being sought to undertake 17 projects including road construction, expansion of Jomo Kenyatta International Airport (JKIA), power connections and construction of a dam to smoothen water supply to Nairobi and road construction.

Treasury headed by CS Ukur Yatani paid the fees for loans to Chinese, Japanese and European banks at the end of June piling pressure on the country’s bulging debt which now stands at more than Sh7 trillion.

Nyakango’s red flag on loan applications comes at a time Kenya’s maturing debt has piled pressure on the country’s expenditure plans and sliced funds meant for development projects.

“We recommend that these loans should be cancelled and this will reduce the loan book balance and consequently save taxpayers payments on the commitment fees,” Nyakango said.

Her call also comes after Yatani’s docket had committed Sh225.08 million to secure loans meant for funding the installation underground power transmission lines in up market estates of Westlands, Kileleshwa, Riverside and Parklands. The Treasury also committed Sh21.447 million to secure loans for construction of a second runaway at the JKIA.But on top of the list are fees to secure loans for an underground electricity transmission line to State House, Ngong Road and neighboring areas at Sh393.8 million and Sh304.58 million for construction of the second phase of Ruiru dam.

Mrs Nyakango blamed the ineptitude of government agencies tasked with implementing the projects as the reason for the hefty commitment fees as she urged the State to ensure all projects are executed shield Kenyans from losing funds.

Commitment fees hugely contribute to the fees the country’s growing loan repayment burden. More debts are also falling due to deficits in the budgetary allocations as the pandemic continues to ravage the economy.

Kenya secured deals to suspend debt service with rich countries and other creditors including China in January and has budgeted Sh1.169 trillion which is 36.6% towards debt repayment in the year to June. The amount represents the highest component of spending for the financial year.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Investigations19 hours ago

Investigations19 hours agoCity Tycoons, MD Under Probe Over Multibillion Kenya Power Tender Scam

-

Development6 days ago

Development6 days agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations2 weeks ago

Investigations2 weeks agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Investigations2 weeks ago

Investigations2 weeks agoHow Close Ruto Allies Make Billions From Affordable Housing Deals

-

Entertainment2 weeks ago

Entertainment2 weeks agoKRA Comes for Kenyan Prince After He Casually Counted Millions on Camera

-

Investigations2 weeks ago

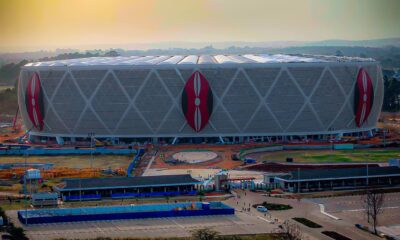

Investigations2 weeks agoTalanta Stadium Construction Cost Inflated By Sh11 Billion, Audit Reveals

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal