Economy

IMF and Kenya: Protests, Debt, and the Struggle for Stability

Kenya, once East Africa’s beacon of economic development and democratic stability, now faces political and financial turmoil.

Massive protests erupted after parliament passed a bill hiking taxes on essential goods, further burdening an already struggling population.

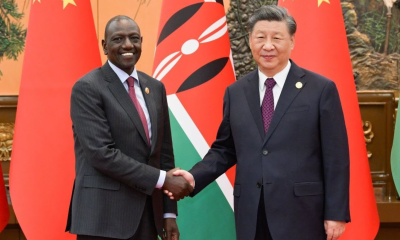

The violent crackdown on protesters and subsequent deaths have deepened the crisis. President William Ruto’s refusal to sign the controversial tax bill to address Kenya’s staggering $80 billion debt has left the country’s future uncertain.

The International Monetary Fund (IMF), a key player in Kenya’s economic policies, faces fierce criticism for its austerity measures.

As Kenya navigates these turbulent waters, questions about its political and economic stability intensify.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

News1 week ago

News1 week agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations1 week ago

Investigations1 week agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy1 week ago

Economy1 week agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Africa2 weeks ago

Africa2 weeks agoFBI Investigates Congresswoman Ilhan Omar’s Husband’s Sh3.8 Billion Businesses in Kenya, Somalia and Dubai

-

Grapevine4 days ago

Grapevine4 days agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Politics2 weeks ago

Politics2 weeks agoSifuna, Babu Owino Are Uhuru’s Project, Orengo Is Opportunist, Inconsequential in Kenyan Politics, Miguna Says