Business

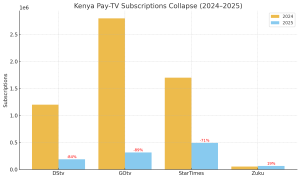

DStv, GOtv Shed 1.2m Kenyan Subscribers in 12 Months as Pay-TV Market Collapses

MultiChoice’s repeated price hikes have accelerated churn at a time when disposable incomes are already under strain.

MultiChoice is facing an exodus of Kenyan households from its pay-TV services, with its flagship platforms DStv and GOtv shedding a combined 1.2 million subscribers in just 12 months, according to fresh data from the Communications Authority of Kenya (CA).

DStv subscriptions stood at just 188,824 by June 2025, a sharp fall from 1.2 million the previous year. GOtv, which had dominated the low-cost digital terrestrial TV segment, tumbled to 314,520 from 2.8 million.

Together, the two accounted for the bulk of a 77 percent contraction in the country’s broadcasting market—the steepest decline on record.

The rout was particularly brutal in the digital terrestrial TV segment, where GOtv competes with StarTimes.

Subscriptions in the category fell 89 percent year-on-year, with StarTimes itself plunging to 492,330 from 1.7 million. Direct-to-home satellite TV, dominated by DStv, also shrank 67 percent.

Only Wananchi Group’s Zuku bucked the trend, growing its cable TV customer base by 20 percent to more than 64,000 subscribers.

Analysts point to runaway pricing as a major trigger. MultiChoice has raised its tariffs five times in three years, pushing DStv Premium—the top bouquet to KES 11,700 ($91) a month, up from KES 7,500 ($58) in 2022.

Many households now find the service unaffordable, especially against the backdrop of high living costs.

“Take away the bars, restaurants, a few offices, and the neighbourhood football shacks, and there’s no one left,” said Paminus Osike, a former DStv customer who abandoned the service earlier this year.

Streaming alternatives are intensifying the pressure. Netflix, whose plans start at just KES 200 ($1.55) for mobile users, has rapidly grown as a go-to option for general entertainment, despite lacking live sports.

Showmax, also owned by MultiChoice charges KES 520 ($4) for its entertainment plan, but the shutdown of Showmax Pro in early 2024 alienated football fans who preferred watching matches on their TV screens rather than on mobile devices.

Piracy adds another headache.

Football matches and premium shows are widely streamed illegally through apps and websites, eroding demand for expensive pay-TV subscriptions.

MultiChoice’s Premier League rights, which expire this year, have also drawn criticism from Kenyan fans who argue that constant renewals merely translate into higher bills with little additional value.

Bars and hotels remain among the last bastions of DStv viewership, but even they are experimenting with cheaper or unauthorised solutions as margins narrow.

The mass customer flight coincides with MultiChoice’s change of control.

French broadcaster Groupe Canal+ recently closed its takeover of the Johannesburg-listed firm, securing 46 percent ownership with more acceptances expected. The merger gives the combined company over 40 million subscribers across nearly 70 countries.

Kenya’s sharp decline, however, illustrates the daunting task ahead: convincing value-conscious consumers to stay loyal to premium satellite television in a market that is shifting decisively toward streaming, free-to-air programming, and piracy.

Market Watch: What DStv, GOtv Collapse Means for Kenya’s Entertainment Market

Kenya’s broadcasting sector is undergoing a seismic shift as pay-TV loses ground to cheaper and more flexible alternatives. The collapse of DStv and GOtv subscriptions is not merely a MultiChoice problem—it points to structural change in how Kenyans consume entertainment.

The contraction of 77 percent in broadcasting subscriptions within a year highlights the vulnerability of business models built on premium sports rights and expensive bouquet packaging.

Industry insiders note that MultiChoice’s repeated price hikes have accelerated churn at a time when disposable incomes are already under strain.

Streaming platforms, both legal and illegal, are filling the vacuum.

Netflix, Showmax, and a growing universe of pirated apps now cater to households that once depended on set-top boxes.

With mobile data penetration climbing and smartphones becoming cheaper, the shift toward streaming looks irreversible.

The pain is not evenly shared.

Cable operator Zuku is emerging as a niche winner, growing 20 percent in the past year.

Its fixed-broadband customers are increasingly bundling pay-TV into internet subscriptions, offering better value. Analysts say this convergence of internet and entertainment could define the next phase of Kenya’s media market.

For advertisers, the collapse of pay-TV limits mass-audience reach but amplifies the value of free-to-air TV and digital platforms. Meanwhile, the looming expiry of MultiChoice’s Premier League rights could trigger a reset in sports broadcasting, with questions over whether local players or pirate operators will capture disillusioned football fans.

The broader takeaway: Kenya’s entertainment market is moving toward affordability, accessibility, and flexibility. Pay-TV, once a symbol of middle-class aspiration, is fast becoming obsolete.

By the Numbers: Kenya’s Pay-TV Meltdown

The collapse of traditional TV subscriptions has left MultiChoice scrambling to hold on to its Kenyan customers.

Kenya’s pay-TV market shrank sharply between 2024 and 2025, with DStv losing 84% of its subscribers and GOtv 89%. StarTimes dropped 71%, while Zuku was the only provider to record growth, up 20%.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations2 weeks ago

Investigations2 weeks agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations7 days ago

Investigations7 days agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners