News

DCI Kinoti Goes After 130 Bank Hackers

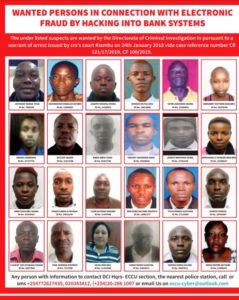

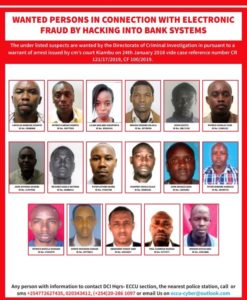

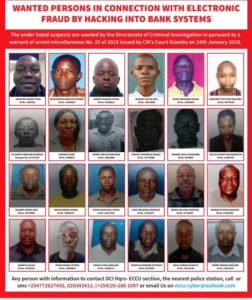

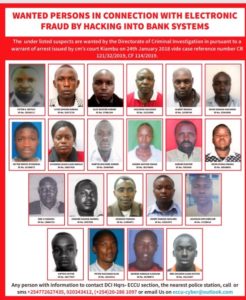

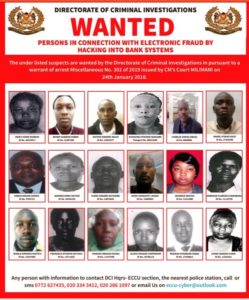

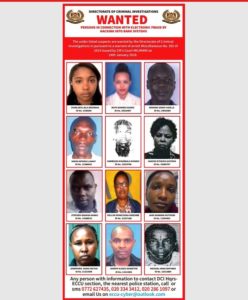

DCI has released 130 photos of suspected criminals engaged in hacking banking systems in Kenya. This doesn’t come as a surprise with recent visit to Kenya by Interpol heads and previously FBI who’ve marked Kenya as a hub for cyber criminals and need for combined efforts to contain them.

According to a Cyber Security report by Serianu which also reveals that Africa lost Sh350 billion to cybersecurity with financial institutions most affected. Kenya lost approximately Sh21.2 billion to cybersecurity in 2017, second only to Nigeria which lost Sh65.5 billion.

The report showed that over Sh18 billion was withdrawn from victim accounts with banks compensating nearly the same amount.

Overall, banks and financial institutions in 10 of the African countries surveyed lost $248 million in 2017 with governments losing $204 million.

The highest cost and threats for financial institutions in relation to cyber crimes came from insider threats, investments in anti-cybercrime technologies, banking malware and ATM skimming.

According to the Communications Authority of Kenya’s latest findings, the National Kenya Computer Incident Response Team Coordination Centre (KE-CIRT-CC) analysed and validated 4,589 cyber threats.

CA’s Second Quarter Statistics Report for the 2017/2018 financial year (October-December 2017), said 539 cyber threats were resolved.

System misconfigurations, largely ride on weaknesses where users access their company portals using default 0000 passwords that are not regularly changed (updated) from any gadget at any level.

While most Kenyan companies remained mute over attacks on their individual portals, albeit to protect their business interests, CA’s report said 140 malware attacks (malicious software) were reported with the 2017 prolonged political period blamed for 104 incidents of impersonation, which were reported.

Dozens of sites belonging to the Kenyan and Nigerian governments have been hacked in recent years, highlighting their vulnerability. CA’s website was defaced in 2017 while, National Bank reported thwarting an online bid to transfer Sh29 million from its accounts by an unknown hackers to mobile money accounts, a technique at the heart of massive bank theft locally and internationally.

Banks and internal-revenue authorities are getting hit the most, especially through their web apps. Nairobi and the bigger cities in particular have become highly exposed to cyber crime targeting individuals as residential internet connection rises phenomenally.

With 130 persons now facing imminent arrest, could this be the breakthrough into the the murky underworld of cybercrime? Here are the listed suspects.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Development4 days ago

Development4 days agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Business2 weeks ago

Business2 weeks agoSafaricom Faces Avalanche of Lawsuits Over Data Privacy as Acquitted Student Demands Sh200mn Compensation in 48 Hours

-

Investigations1 week ago

Investigations1 week agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Investigations2 weeks ago

Investigations2 weeks agoHow Close Ruto Allies Make Billions From Affordable Housing Deals

-

Entertainment2 weeks ago

Entertainment2 weeks agoKRA Comes for Kenyan Prince After He Casually Counted Millions on Camera

-

Business1 week ago

Business1 week agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

Investigations2 weeks ago

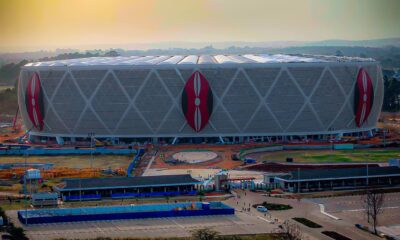

Investigations2 weeks agoTalanta Stadium Construction Cost Inflated By Sh11 Billion, Audit Reveals