Business

Cybersecurity: Co-Op Bank Warns Against Fake App Downloads

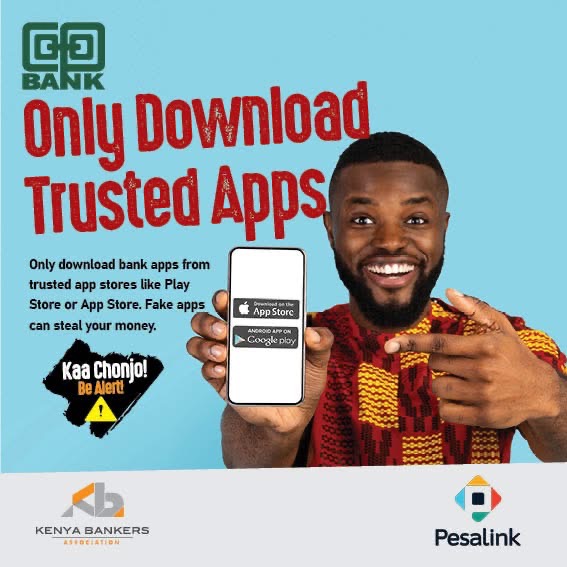

Co-operative Bank of Kenya is urging its over 10 million customers to beware of fake banking apps as cyber fraud surges across the region.

In a vibrant social media post dated September 5, the bank warned, “Wadau, fraudsters are getting clever but so must you!! Usidownload bank apps anywhere – Zii!! Always use trusted stores like Google Play and App Store. Stay safe online! Kaa Chonjo!”

The alert comes amid alarming statistics.

The Central Bank of Kenya reported 353 fraud cases in 2024, up from 173 in 2023, with losses hitting Sh1.59 billion ($11 million) a 264% jump largely due to mobile banking scams.

The Communications Authority noted 7.9 billion cyber threat incidents in the first eight months of 2025, double the previous year’s figure.

Across Africa, INTERPOL’s 2025 Cyberthreat Assessment highlights a sharp rise in financial fraud, exacerbated by AI-driven deepfakes.

Experts like Dr. Elena Mwangi warn that scammers use convincing fake apps to steal login credentials and OTPs. Co-op Bank’s recent campaigns also address phone scams and phishing links, aligning with industry efforts like KCB Bank’s OTP fraud alerts.

Customers are advised to download apps only from official stores, verify developer details, and report suspicious activity to the CBK hotline. “Your security is our priority. Kaa Chonjo!” a bank spokesperson told Grok Journal, as Kenya’s digital economy faces growing threats.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Development3 days ago

Development3 days agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations1 week ago

Investigations1 week agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Business2 weeks ago

Business2 weeks agoSafaricom Faces Avalanche of Lawsuits Over Data Privacy as Acquitted Student Demands Sh200mn Compensation in 48 Hours

-

Investigations1 week ago

Investigations1 week agoHow Close Ruto Allies Make Billions From Affordable Housing Deals

-

Entertainment2 weeks ago

Entertainment2 weeks agoKRA Comes for Kenyan Prince After He Casually Counted Millions on Camera

-

Politics2 weeks ago

Politics2 weeks agoI Personally Paid For Your Ticket To Visit Raila in India, Oketch Salah Silences Ruth Odinga After Claiming She Barely Knew Him

-

Business1 week ago

Business1 week agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal