Business

Customer Claims Internal Link in Safaricom Heist

As the nation hurtles toward a cashless future, Safaricom’s throne wobbles.

Nairobi: A furious M-Pesa customer has blown the lid off what he describes as a brazen inside job at Safaricom, where rogue employees allegedly collude with street-level SIM card hustlers to plunder wallets in the dead of night.

David Macharia, a hardworking Kenyan whose life savings vanished in a heartbeat, is pointing fingers straight at the heart of Safaricom’s operations, demanding answers for a heist that reeks of betrayal from within.

It started like any other scam story but quickly spiraled into a nightmare of epic proportions.

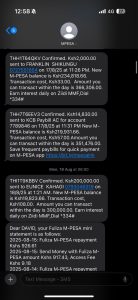

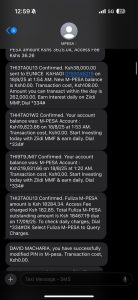

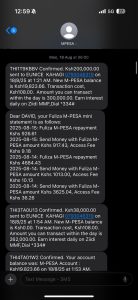

On August 18, 2025, at the ungodly hour of 1:21am, Macharia’s phone lit up with confirmations of two massive transfers: a whopping Sh200,000 followed minutes later by another Sh38,000, both rocketing to the same recipient, Eunice Kahagi on number 0793046319.

His M-Pesa balance plummeted from Sh19,823 to zero, transaction costs gnawing away even as Fuliza overdrafts piled on mysteriously in the preceding days, with mini-statements showing frantic borrowings and repayments totaling thousands.

“Who has access to my M-Pesa back-end? Is it the police or does it start with Safaricom?” Macharia thunders, his voice dripping with rage after poring over screenshots that paint a picture of orchestrated theft.

But here’s the kicker: Macharia didn’t fall for a phishing link or a fake call. No, this was surgical precision, the kind only insiders could pull off.

Fuliza loans disbursed without his knowledge, funds siphoned via “Send Money with Fuliza” right before the big hits, access fees charged like clockwork.

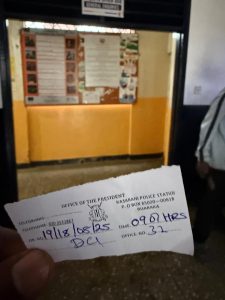

He raced to Ruaka Police Station that very day, filing an Occurrence Book under the Office of the President on September 9 at 09:09 hours, ticket number 31.

Detectives zeroed in on a sprawling cartel: illegal SIM card peddlers lurking in Githunguri’s shadowy markets feeding data to Safaricom staff who flip the switch on unsuspecting accounts. 0

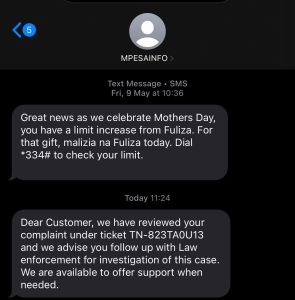

Safaricom’s response?

A masterclass in buck-passing. After six agonising weeks of silence on complaint ticket TN-823TAOU13, their curt reply arrived: “We have reviewed your complaint… advise you follow up with law enforcement.”

Law enforcement? When Safaricom holds the keys to every transaction log, every backend trail? Macharia explodes: “Someone is not doing their job or portraying ignorance and incompetence! We stop beating around the bush. Narrow down to the internal fraud initiator!”

Today, nearly three months later, his wallet remains a ghost town while the telecom behemoth hides behind police reports.

This isn’t isolated chaos; it’s a flashing red alert in Safaricom’s hall of shame. Just weeks ago, the company axed 113 employees in financial year 2025 for fraud, a 20 percent spike from the prior year, with insiders busted for policy breaches, identity theft, and worse.

Echoes of the infamous Sh450 million Fuliza mega-heist rip through, where syndicates armed with fake SIMs gorged on overdrafts before cops swooped.

Githunguri’s black-market SIM lords have long been the spark, but it’s the corporate moles who fan the flames, swapping lines and greenlighting loans from the shadows.

Experts tracking Kenya’s cyber underbelly nod grimly: M-Pesa’s invincibility is cracking under the weight of human greed.

“Safaricom controls the ecosystem; pushing victims to police is a dodge,” says one seasoned investigator who spoke off-record.

“They trace every centavo internally yet feign helplessness?” Macharia’s saga screams cover-up, a telecom titan prioritising reputation over restitution while cartels laugh all the way to the bank.

As the nation hurtles toward a cashless future, Safaricom’s throne wobbles.

Will CEO Peter Ndegwa summon the guts to purge the rot, refund Macharia, and hunt the traitors? Or will this heist join the pile of forgotten scandals, leaving millions exposed?

One thing’s crystal clear: trust in M-Pesa just took a Sh238,000 gut punch, and the reckoning is overdue. Daily Nation demands full disclosure, now.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine1 week ago

Grapevine1 week agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoThe General’s Fall: From Barracks To Bankruptcy As Illness Ravages Karangi’s Memory And Empire

-

Grapevine4 days ago

Grapevine4 days agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

Investigations2 weeks ago

Investigations2 weeks agoEpstein Files: Sultan bin Sulayem Bragged on His Closeness to President Uhuru Then His Firm DP World Controversially Won Port Construction in Kenya, Tanzania

-

Business2 weeks ago

Business2 weeks agoKRA Can Now Tax Unexplained Bank Deposits

-

Investigations1 week ago

Investigations1 week agoEpstein’s Girlfriend Ghislaine Maxwell Frequently Visited Kenya As Files Reveal Local Secret Links With The Underage Sex Trafficking Ring

-

News1 week ago

News1 week agoState Agency Exposes Five Top Names Linked To Poor Building Approvals In Nairobi, Recommends Dismissal After City Hall Probe

-

Investigations17 hours ago

Investigations17 hours agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy