Business

CMA Fines Former Chase Bank Managers Millions Over 2015 Bond Scandal

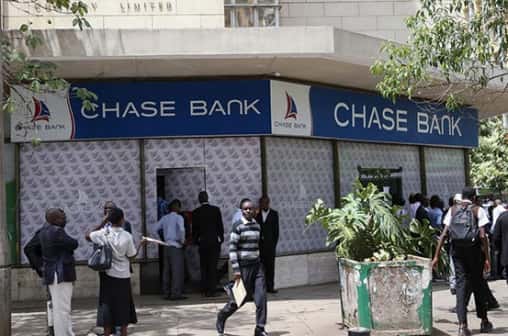

The Capital Markets Authority has imposed hefty penalties on three former senior managers of Chase Bank Kenya Limited following a protracted investigation into irregularities surrounding the lender’s failed Sh10 billion bond issue in 2015, just months before its dramatic collapse.

Former chairman Zafrullah Khan was fined Sh5 million and banned from holding director or key personnel positions in any capital markets entity for 10 years.

The CMA Board Ad Hoc Committee found that Khan failed to exercise effective oversight over Chase Bank’s management, leading to the preparation and publication of false financial statements in the Information Memorandum that was issued to investors.

The investigation uncovered serious governance lapses, including a particularly egregious conflict of interest.

Khan paid himself a Sh1 billion bonus in a lump sum, contrary to board resolutions that stipulated the payment should be spread over five years.

Part of this bonus was used to purchase Chase Bank shares for directors who sat on the committee that approved his compensation .

Makarios Agumbi, who served as General Manager Finance, received a Sh3.5 million fine and a five-year disqualification.

The committee found that Agumbi facilitated the preparation of false and misleading financial statements published in the Information Memorandum and unprocedurally paid bonuses contrary to board resolutions .

James Mwaura, the former General Manager Corporate Assets, was fined Sh2.5 million with a two-year disqualification.

Mwaura facilitated the preparation of false and misleading 2014 financial statements that contained misclassification and misrepresentation regarding non-disclosure of related party loans and advances .

The enforcement action stems from Chase Bank’s listing of a Sh4.8 billion medium-term note on the Nairobi Securities Exchange on June 22, 2015, the first tranche of what was intended to be a Sh10 billion fundraising exercise.

Less than 10 months later, on April 7, 2016, the Central Bank of Kenya appointed the Kenya Deposit Insurance Corporation as receiver for Chase Bank for 12 months following liquidity difficulties .

A CMA investigation revealed that cash and balances at the Central Bank of Kenya were overstated in the published Information Memorandum by Sh2.15 billion, which inaccurately enhanced the bank’s liquidity position and materially influenced investors’ decisions to subscribe to the medium-term note .

Chase Bank collapsed after depositors withdrew Sh8 billion in one day following reports that auditors had discovered problems with its accounting.

The failure locked up Sh95 billion belonging to depositors , making it one of Kenya’s most significant banking failures alongside Imperial Bank and Dubai Bank.

The three executives initially challenged the CMA’s enforcement proceedings by filing a case at the Capital Markets Tribunal.

However, the Tribunal ruled on February 2, 2024, ordering the trio to appear before the Ad Hoc Committee to conclude its administrative proceedings .

Following administrative hearings concluded in November 2025, the Ad Hoc Committee determined that Khan, Agumbi and Mwaura breached capital markets regulations regarding the use of funds raised during the 2015 medium-term note issuance.

Beyond the three senior managers, the CMA also fined other board members and directors.

Anthony Gross, chair of the audit and risk committee, and committee members Laurent Demey, Muthoni Kuria and Rafiq Sharrif received fines, while another director, Richard Carter, was fined Sh1 million. Audit firm Deloitte and Touche was fined Sh10 million .

All three penalized executives have been directed to attend corporate governance training before they can be considered for appointment as board members or key personnel in Kenya’s capital markets.

In 2018, Mauritian lender SBM Bank carved out 75 percent of certain assets and liabilities from Chase Bank, including deposits, staff and branches, merging them with its Kenyan subsidiary.

The remaining assets and liabilities were transferred to the Kenya Deposit Insurance Corporation for liquidation, marking the end of a bank that once positioned itself as a dynamic financial services provider targeting youth, women and investment groups.

The case underscores the importance of robust governance and transparency in Kenya’s capital markets, particularly for institutions seeking to raise funds from public investors.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News5 days ago

News5 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud

-

Development1 week ago

Development1 week agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

Politics1 week ago

Politics1 week agoNIS Kismu Hotel Secret Tape That Sealed Gachagua’s Fate and MP Ng’eno Death in A Chopper Crash

-

News1 week ago

News1 week agoInvestor Sued Over Sh30,000 Fee to Access Runda Road

-

Investigations2 weeks ago

Investigations2 weeks agoDid Festus Omwamba Take the Fall? The Puzzle of a Senator’s Ouster and a Call to the CS

-

Investigations7 days ago

Investigations7 days agoI Swore Never To Hire The Chopper Again, Author Recalls Harrowing Experience in Helicopter That Killed MP Ng’eno Alleges Poor Maintenance By Owners

-

Investigations2 weeks ago

Investigations2 weeks agoBaraton College Russia Labour Programme Accused of Recruiting Kenyans into Ukraine War