Business

Centum Investment Records Underwhelming Performance in Recent Stock Analysis

A recent analysis of stock performance for various Kenyan companies has revealed that Centum Investment Company PLC has underperformed compared to its peers over the period under review.

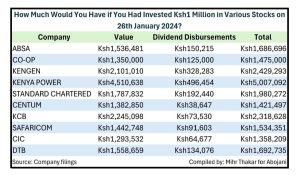

The study, which tracked the performance of a Ksh1 million investment made on 26th January 2024, highlighted Centum’s relatively low returns and modest dividend payouts.

According to the data compiled by Mihr Thakar for Abojani, Centum’s investment value grew to Ksh1,382,850, with dividend disbursements of Ksh38,647, bringing the total return to Ksh1,421,497. This performance pales in comparison to other companies in the study, such as KenGen and Kenya Power, which delivered significantly higher returns.

KenGen, for instance, saw its investment value soar to Ksh2,101,010, with dividends of Ksh328,283, resulting in a total return of Ksh2,429,293. Similarly, Kenya Power outperformed Centum by a wide margin, with an investment value of Ksh4,510,638 and dividends of Ksh496,454, culminating in a total return of Ksh5,007,092.

Centum’s underperformance has raised concerns among investors and market analysts. The company, which has traditionally been a key player in Kenya’s investment landscape, has struggled to match the robust returns seen in sectors like energy and banking. The modest dividend payout of Ksh38,647 further underscores the challenges Centum faces in delivering value to its shareholders.

Market experts attribute Centum’s lackluster performance to a combination of factors, including a challenging economic environment, increased competition, and potential missteps in its investment strategy. The company’s focus on diverse sectors such as real estate, private equity, and marketable securities may have diluted its ability to capitalize on high-growth opportunities.

As investors digest these findings, the spotlight is now on Centum’s management to reassess its strategy and take decisive steps to enhance shareholder value. With the Kenyan market evolving rapidly, the pressure is mounting for Centum to demonstrate resilience and adaptability in the face of stiff competition.

As the market continues to evolve, all eyes will be on Centum to see if it can turn the tide and reclaim its position as a leading investment powerhouse in Kenya.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine1 week ago

Grapevine1 week agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

News6 days ago

News6 days agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations1 week ago

Investigations1 week agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy6 days ago

Economy6 days agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business7 days ago

Business7 days agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Africa1 week ago

Africa1 week agoFBI Investigates Congresswoman Ilhan Omar’s Husband’s Sh3.8 Billion Businesses in Kenya, Somalia and Dubai

-

Business2 weeks ago

Business2 weeks agoM-Gas Pursues Carbon Credit Billions as Koko Networks Wreckage Exposes Market’s Dark Underbelly

-

Arts & Culture1 week ago

Arts & Culture1 week agoWhen Lent and Ramadan Meet: Christians and Muslims Start Their Fasting Season Together