The director of Elite Earth Movers limited has been charged with stealing over Sh71.5 million from the company. Parminder Singh Manku appeared before Milimani Senior Principal...

The company behind the ChatGPT app that churns out essays, poems or computing code on command released Tuesday a long-awaited update of its artificial intelligence (AI)...

DIB Bank Ltd has suffered a blow after the High Court rejected an application seeking to block the police from investigating a customer’s bank account. Justice...

In a case before the legal education appeals tribunal, Mr Antony Waziri Kitsao is putting up a fight against Kenya School of Law(KSL) and Council of Legal...

An anti-corruption court has put former Nyandarua County Governor Daniel Waithaka Mwangi and five former top county officials on their defence after finding that the State...

Twenty four Congolese and international civil society organizations have written in an open letter to Secretary of State Antony Blinken and Secretary of the Treasury Janet Yellen, urging them not to...

After failing to reach an agreement to develop three commercial ports with the Kenyatta administration, Emirati firm Dubai Port World (DP World) has now expressed interest...

In 2018, Trinity Energy lodged a case against Mr. Biswick Tiyamalu Kaswasa a Malawian citizen who was the time it’s Chief Finance Officer “CFO” in criminal case No...

By Alvin Mwangi The last two months have been characterized by a lot of “events” surrounding the queer community in Kenya. From loosing a fierce fashion...

Three Safaricom subscribers have taken on the giant telco accusing the company of among others, transfer pricing by unlawfully removing money belonging to M-Pesa account holders...

Rumor mill has been abuzz lately following gossip published on Daily Nation that a senior government official linked to a major scamming scandal. “A senior government...

President on Thursday announced that the government will subsidise the cost of the 6kg gas cylinder by Sh2,000. Currently, a 6kg cylinder costs about Ksh2,800, and...

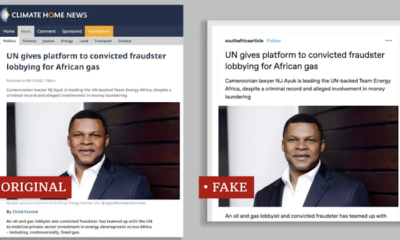

Journalists have been forced to temporarily take down articles critical of powerful oil lobbyists due to the exploitation of US copyright law, according to a new...

In March last year, Safaricom Ethiopia tweeted out an interesting claim: that 50% of Kenya’s GDP is processed through their M-Pesa ecosystem. This was no idle...

Samburu Governor Jonathan Lelelit is on the receiving end following intelligence reports from agencies linking him to banditry that has consumed the North Rift region prompting a...

Trade Cabinet Secretary Moses Kuria now wants China Square out of the Kenyan market. Via Twitter on Friday night, the CS said he has put up...

A businessman has accused a bank of causing the loss of his land title so as to charge him more interest over a Sh58 million loan....

The Kenya Urban Roads Authority (KURA) has been in the news lately after the release of a report by the Auditor General. The report details several...

JP Morgan’s entry into Kenya’s market has raised eyebrows due to its controversial past and scandals. JP Morgan, the largest bank in the United States by...

LOS ANGELES (AP) — A Los Angeles judge on Wednesday sentenced the man convicted of gunning down rapper Nipsey Hussle to 60 years to life in...