Economy

KRA Crackdown On Taxpayers Who Filed Nil Returns But Have Income

From April 2026, the authority will apply automated checks to nil filings for 2025 to prevent false zero declarations.

The Kenya Revenue Authority (KRA) has stepped up its scrutiny of taxpayers who filed nil income tax returns but appear to have earned income.

The authority has began sending SMS messages to individuals and companies, informing them that its systems detected income linked to their PINs. The messages notify recipients that their 2025 income tax returns have already been prepopulated on the iTax portal and are ready for review and submission.

Reports show that KRA flagged more than 392,000 taxpayers in this category. Internal reviews identified 392,162 companies and individuals who declared zero income in 2024 despite records showing financial activity. In many cases, the activity appeared through withholding tax records or transactions transmitted through the Electronic Tax Invoice Management System (eTIMS).

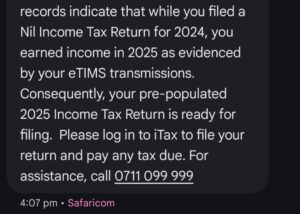

The SMS sent to affected taxpayers reads:

“Records indicate that while you filed a Nil Income Tax Return for 2024, you earned income in 2025 as evidenced by your eTIMS transmissions. Consequently, your pre-populated 2025 Income Tax Return is ready for filing. Please log in to iTax to file your return and pay any tax due.”

The message directs taxpayers to log into their iTax accounts to review the prefilled information. The system pulls data from eTIMS invoices, withholding tax records and customs imports. If the records show income that was not declared previously, KRA expects the taxpayer to account for it and settle any outstanding tax.

This enforcement drive forms part of wider reforms aimed at tightening compliance. On November 10, 2025, KRA issued a public notice outlining new validation rules. The notice stated:

“Effective 1st January 2026, it will begin validating income and expenses declared in both individual and non-individual income tax returns against the following data sources: 1) TIMS/eTIMS 2) Withholding Income Tax gross 3) Import records from Customs.”

Real-time checks introduced

Under this approach, validation takes place at the point of filing. When a taxpayer submits a 2025 return, the system checks declared income and expenses against the available electronic records. All income and deductible expenses must be supported by valid eTIMS invoices transmitted correctly, including the buyer’s PIN where required.

KRA has made clear that it will compare declared figures with data in its systems and rely on the higher verified amount when assessing undeclared income. Expenses that lack matching eTIMS documentation face automatic disallowance unless they fall under recognised exemptions.

Some exemptions exist under Section 23A of the Tax Procedures Act and the 2024 Electronic Tax Invoice Regulations. These cover items such as salaries, imports, interest income, investment allowances, airline tickets and income subject to final withholding tax. Outside these areas, taxpayers must ensure that invoices and records match what they declare.

The crackdown affects a broad range of taxpayers. Salaried employees who run side businesses must declare all income in a single return. This includes earnings from freelance work, consultancy, online services, farming or rental property. They must use their P9 forms for employment income and add any additional sources.

Sole proprietors, professionals, Turnover Tax payers, landlords and partnerships also fall within the scope of the new checks. Non-employed individuals must declare income outside the Turnover Tax regime where applicable.

KRA recently reinstated the option to file nil returns after upgrading its systems, but it has introduced stricter screening. From April 2026, the authority will apply automated checks to nil filings for 2025 to prevent false zero declarations.

Previously, taxpayers could file returns first and address discrepancies during audits later. The new system validates information immediately, leaving limited room for corrections after submission.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine1 week ago

Grapevine1 week agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Lifestyle2 weeks ago

Lifestyle2 weeks agoThe General’s Fall: From Barracks To Bankruptcy As Illness Ravages Karangi’s Memory And Empire

-

Grapevine6 days ago

Grapevine6 days agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

Investigations3 days ago

Investigations3 days agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Investigations2 weeks ago

Investigations2 weeks agoEpstein’s Girlfriend Ghislaine Maxwell Frequently Visited Kenya As Files Reveal Local Secret Links With The Underage Sex Trafficking Ring

-

News2 weeks ago

News2 weeks agoState Agency Exposes Five Top Names Linked To Poor Building Approvals In Nairobi, Recommends Dismissal After City Hall Probe

-

Economy2 days ago

Economy2 days agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoM-Gas Pursues Carbon Credit Billions as Koko Networks Wreckage Exposes Market’s Dark Underbelly