Business

Bad News For Credit Bank As Nyachae’s Succession Battle Spills in Court

Auditors from PricewaterhouseCoopers didn’t mince words in their reports, raising serious doubts about the bank’s ability to survive as a going concern.

Nairobi’s Family Court has slammed the door on Kenneth Bitange Nyachae’s ruthless power grab, crushing his desperate attempt to boot his own siblings and stepbrothers out of the helm of their late father’s sprawling multibillion-shilling empire, including the embattled Credit Bank!

This explosive family feud, pitting brother against brother in a vicious tug-of-war over the legacy of the legendary Simeon Nyachae, has now spilled into the open, threatening to unravel the very foundations of one of Kenya’s most powerful dynasties and push the already teetering Credit Bank over the edge into financial oblivion.

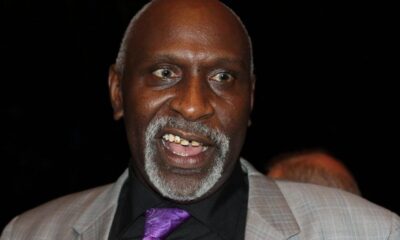

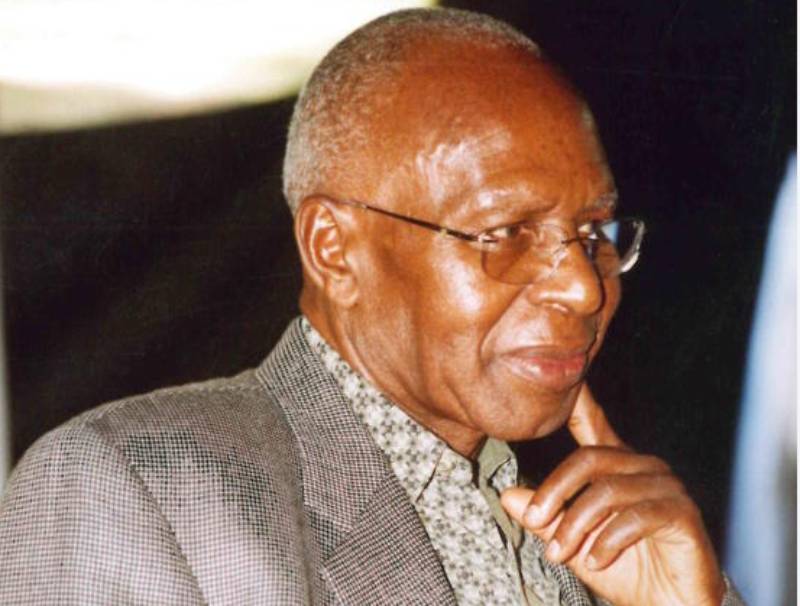

The late Simeon Nyachae, the iron-fisted former Cabinet minister, provincial administrator, and financial mogul who built an untouchable fortune through sheer grit and political muscle, passed away in February 2021, leaving behind a treasure trove of assets estimated in the billions.

At the heart of this glittering prize?

The Sansora Group, a behemoth holding company that includes Credit Bank PLC, where profits once flowed like the Nile but now risk drying up completely amid this savage sibling showdown and a cascade of self-inflicted financial wounds that have auditors screaming for the lifeboats.

Digging into the archives reveals a bank in deep crisis long before the latest court drama.

Back in 2024, Credit Bank posted a staggering loss after tax of Sh1 billion, but that was just the tip of the iceberg.

By the end of that year, accumulated losses had ballooned to a jaw-dropping Sh2.18 billion, painting a picture of a lender hemorrhaging cash at an alarming rate.

Auditors from PricewaterhouseCoopers didn’t mince words in their reports, raising serious doubts about the bank’s ability to survive as a going concern.

With a capital black hole of Sh1.7 billion, core capital languishing at a pitiful Sh1.28 billion against the Central Bank of Kenya’s looming Sh3 billion minimum requirement by December 2025, the institution is staring down the barrel of potential license revocation or forced takeover.

And the rot runs deeper. Non-performing loans have skyrocketed to a catastrophic 60 percent, meaning three out of every five borrowers have simply stopped paying back, one of the worst delinquency ratios in Kenya’s entire banking sector.

Liquidity is another nightmare, dipping to a dangerous 15.1 percent, well below the statutory 20 percent floor, leaving the bank scrambling to stay afloat.

Whispers of insider fraud echo through the halls, with allegations of dubious loan procedures, collateral mishandling, and even money laundering schemes tied to high-profile figures like former Deputy President Rigathi Gachagua.

One explosive case saw a businesswoman allegedly swindled out of Ksh 36.5 million through forged documents and insider collusion, sparking investigations by the Directorate of Criminal Investigations.

Tied inextricably to the Nyachae family, Credit Bank’s woes are compounded by internal divisions between old-school banking ethics and questionable deals pushed by board members with family connections.

Archives show frantic moves to plug the gaps: in February 2025, the bank won court clearance to sell off a stalled skyscraper project in a bid to claw back KSh 1.2 billion in bad debts after a brutal legal scrap with Jabavu Village Ltd.

By June, desperate plans emerged to list shares on the unquoted securities platform, a Hail Mary pass to lure fresh investors amid a bear market.

But with NPLs festering and losses mounting, critics argue these are band-aids on a gaping wound, especially as the family feud distracts management from the real fight for survival.

Picture this: Kenneth Bitange Nyachae, son of Nyachae’s first wife Martha Mwango, storms into court with guns blazing, demanding the ouster of executors Eric Maina, Angela Nyarangi, and even his own brother, former East African Court Judge Charles Ayako Nyachae.

His target? Stepbrother Leon Nyandusi Nyachae, the architect-turned-tycoon who’s been calling the shots as Managing Director of Sansora Group and a key director at Credit Bank since 2018, back when the patriarch was still alive and kicking!

Bitange accuses them of squandering the family jewels, wasting assets in a frenzy of incompetence and favoritism.

“This is personal anarchy!” his camp thunders, painting a picture of a once-united clan now fractured by greed.

But Justice Eric Ogola wasn’t buying the drama. In a scathing judgment that had the courtroom buzzing, he ruled that Bitange’s May 19, 2023, originating summons was a misguided sideshow, one that dared to challenge the validity of Nyachae’s sacred will outside the main succession battlefield.

“This reeks of overreach!” Ogola essentially declared, ordering the case consolidated into the ongoing succession saga to “expedite justice.”

No alternate executors, no exclusions, especially not for Leon, who’s been steering the ship through these stormy financial waters.

Bitange’s dreams of a clean sweep? Shattered like glass under a judge’s gavel.

The fireworks didn’t stop there.

Enter the Commercial Court sideshow, where brother Michael Moragia Nyachae files a blistering suit in the name of their ailing mother, Martha Mwango Nyachae, who’s been battling dementia since 2021 and can’t even manage her own affairs.

The goal? Yank Leon from his throne across all family companies, including Credit Bank. But under the relentless cross-examination by senior lawyer Philip Murgor, Charles Ayako squirmed like a man on trial for his soul.

“You didn’t enjoy that pride of place in your father’s heart, so now you’re waging war from the grave!” Murgor roared, accusing Charles of posthumous revenge against those closer to the old man.

Charles fired back: “This isn’t about property, it’s to protect my mother’s interests!” Yet, when pressed on what exactly Mama wanted, he punted to Michael, dodging like a pro.

Murgor didn’t let up, grilling Charles on Leon’s rise: “How could someone 23 years your junior snag a directorship? You’re just jealous!” Charles admitted Leon’s role predated their father’s death but insisted the fight was all about Mama’s shares, shares whose origins he cryptically warned, “You do not know how she got them.” Ouch! And in a jaw-dropping twist from earlier filings, Michael’s been slapped with his own lawsuit for allegedly flogging a family property worth over KSh 35 million for a measly KSh 8 million right after Dad’s demise.

Talk about fire sale suspicions!

Archives also uncover Michael’s entanglement in a separate suit over Associated Auto Centre, another family-linked firm drowning in debts, including Sh82 million owed to none other than Credit Bank, highlighting how family mismanagement is bleeding into the bank’s already toxic loan book.

This isn’t just family gossip, it’s a ticking time bomb for Credit Bank, the crown jewel of the Nyachae portfolio now tarnished by scandal and shortfall.

Founded by the patriarch himself, the bank has weathered storms before, but with Leon’s leadership under siege and the institution’s survival in question, investors are sweating bullets.

Will the bank’s boardroom become a battlefield?

Could this infighting trigger a run on deposits, scare off big clients, or invite regulatory hammers? Sources whisper that the Central Bank of Kenya is watching closely, as any shake-up could ripple through Kenya’s financial sector.

“It’s bad news all around,” one insider confided. “When families feud over billions and banks bleed red ink, economies tremble.”

The Nyachae saga is far from over. With multiple wives, Martha, Grace Wamuyu, and even claimant Margaret Kerubo Chweya, and a horde of children from different bloodlines, the courts are jammed with twists. Charles recently bombed out in his bid for IEBC chairman, adding fuel to his fire.

As the dust settles on this latest defeat, one thing’s crystal clear: Simeon Nyachae’s empire, built on power and prestige, is now crumbling under the weight of his heirs’ hatred and a bank’s financial apocalypse. Stay tuned, this bloodbath is just heating up!

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Investigations2 weeks ago

Investigations2 weeks agoDEATH TRAPS IN THE SKY: Inside the Sordid World of West Rift Aviation’s Deadly Corruption Cartel

-

Business4 days ago

Business4 days agoSAFARICOM’S M-SHWARI MELTDOWN: TERRIFIED KENYANS FLEE AS BILLIONS VANISH INTO DIGITAL BLACK HOLE

-

Grapevine2 weeks ago

Grapevine2 weeks agoEX–YOUTH FUND BOSS GOR SEMELANG’O JAILED IN DUBAI OVER MONEY LAUNDERING LINKS

-

Politics2 weeks ago

Politics2 weeks agoRuto’s Reshuffle Storm As Moi, Ida Odinga Tipped To Join His Cabinet

-

Business1 week ago

Business1 week agoEquity Bank CEO James Mwangi Kicked Out of Sh1 Billion Muthaiga Mansion

-

Investigations2 weeks ago

Investigations2 weeks agoWhose Drugs? Kenya Navy Seizes Drug Ship In Mombasa Carrying Sh8.2 Billion Meth

-

Grapevine2 weeks ago

Grapevine2 weeks agoEX-YOUTH FUND BOSS GOR SEMELANG’O JAILED IN DUBAI FOR DEFRAUDING BUSINESSWOMAN

-

News1 week ago

News1 week agoBLOOD IN THE SKIES: Eleven Dead as West Rift Aviation’s Chickens Come Home to Roost in Kwale Horror Crash