Business

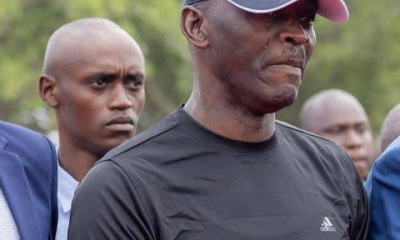

Equity Bank CEO James Mwangi and Wife Kicked Out of Sh1 Billion Muthaiga Mansion

The court has given the power couple just 30 days to vacate or face the indignity of being physically evicted by police officers from Gigiri and Muthaiga stations.

Equity Bank Group CEO James Mwangi and his wife Jane Wangui Mundia have been ordered to pack their bags and vacate their sprawling Muthaiga estate property after losing a bruising court battle over ownership of the contested Sh1 billion parcel.

The humiliating defeat comes with a stinging Sh10 million penalty for trespass, marking a rare public stumble for one of Kenya’s most celebrated banking titans who has built an empire on the back of microfinance and now finds himself on the wrong side of a property dispute that has exposed murky dealings in one of Nairobi’s most exclusive neighborhoods.

Justice Oscar Angote of the Environment and Land Court delivered the crushing blow, declaring that businessman Anverali Amershi Karmali, through his firm Mount Pleasant Ltd, is the rightful owner of the three-acre prime property that Mwangi claimed to have purchased from retired President Daniel arap Moi for Sh306 million back in 2013.

The court has given the power couple just 30 days to vacate or face the indignity of being physically evicted by police officers from Gigiri and Muthaiga stations.

In what amounts to a complete erasure of their claim to the property, Justice Angote further ordered the Chief Land Registrar to expunge and cancel all entries, conveyances and titles relating to Mwangi’s purported ownership and to nullify the amalgamation of the subdivided parcels into a single title.

The ruling paints a picture of a property saga riddled with what the judge termed “significant anomalies” and “numerous procedural and documentary irregularities” that cast a dark shadow over how the banking mogul came to possess the contested land in the first place.

At the heart of the dispute lies a tangled web of ownership claims stretching back nearly two decades.

Mount Pleasant Ltd insists it purchased the property from Moi-era Finance Minister Arthur Magugu and his wife Margaret Wairimu in July 2006 for Sh130 million, a full seven years before Mwangi claims to have bought it from Moi himself.

But the plot thickens. Court documents reveal that Magugu had initially charged the property to National Bank in the late 1980s through a company called MDC Holdings Ltd to secure a loan of Sh10.5 million. When the company defaulted, the bank moved to recover its money, eventually striking a deal in October 2002 where the property would be sold for Sh90 million to settle the debt and compensate Magugu.

Karmali alleges that after he purchased the property in good faith, someone began tampering with land registry records, making it difficult to trace the chain of ownership.

In a move straight out of a thriller, the businessman claims that when he went to the Ministry of Lands to conduct a search, the file containing the property’s history had mysteriously vanished into thin air.

The situation descended into what can only be described as a turf war in June 2020 when Mwangi allegedly showed up at the property accompanied by police officers who removed Karmali’s security guards and replaced them with their own.

This audacious move prompted the businessman to rush to court seeking orders to reclaim his property.

Justice Angote noted that while the Directorate of Criminal Investigations had not made any conclusive forensic determination on claims of forgery, the documentary evidence assessed on the balance of probabilities revealed troubling discrepancies.

The judge stopped short of directly accusing Mwangi of fraud, noting that such a finding would require a higher standard of proof than the ordinary civil threshold, but made it clear that the irregularities surrounding the conveyance, amalgamation and registration of the banker’s title were sufficient grounds to invalidate it.

Mount Pleasant’s version of events claims its guards remained on the property from 2013, when they were briefly arrested but later released, until March 2020 when they were finally kicked out by the Mwangis.

This directly contradicts the CEO’s assertion that he took possession immediately after the title was issued in 2013.

The court’s decision to award Sh10 million in damages for trespass takes into account the property’s premium location in Muthaiga, its three-acre size, the duration of the alleged trespass spanning several years, and its current valuation of Sh1 billion according to 2022 reports.

Adding another layer of intrigue to the saga, Karmali claims that both parties somehow ended up with certificates from the land registry showing they were the registered owners of the same property, raising serious questions about the integrity of the land registration system and whether officials were complicit in creating duplicate ownership documents.

The property’s troubled history also includes an attempted subdivision by Magugu into two parcels before he sold it to Karmali, plans that were later abandoned.

However, Karmali alleges he was shocked to discover that someone had surrendered the titles to these subdivided properties to the Registrar and amalgamated them into a single parcel now known as LR 214/832, even though Mount Pleasant never authorized such a move and still holds the original conveyance documents.

For Mwangi, whose rags-to-riches story has made him a poster child for African entrepreneurship and whose leadership has transformed Equity Bank from a struggling building society into a regional banking powerhouse, this legal defeat represents an embarrassing personal setback.

The CEO, who has cultivated an image of financial prudence and ethical business practices, now faces uncomfortable questions about how he came to occupy a property with such a contested ownership history.

The case also shines an unflattering spotlight on Kenya’s chaotic land ownership system where titles can be duplicated, files can disappear from government offices, and rival claimants can both produce seemingly legitimate documents proving ownership of the same piece of land.

As the 30-day deadline ticks down, all eyes will be on whether Mwangi will vacate quietly or mount an appeal to higher courts in a bid to salvage what remains of his claim to the Muthaiga property.

Either way, the damage to his reputation has already been done, with the court record now permanently documenting his occupation of another man’s land and the Sh10 million penalty hanging over his head as a costly reminder that even banking royalty is not above the law.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News1 week ago

News1 week agoPlane Carrying Raila Odinga Becomes World’s Most Tracked Flight as Kenya Airways Honors Him With Special Call Sign ‘RAO001’

-

Business5 days ago

Business5 days agoSafaricom’s Sh115 Trillion Data Breach Scandal: How Kenya’s Telecom Giant Sold Out 11.5 Million Customers

-

Business1 week ago

Business1 week agoBillionaire: Inside Raila Odinga’s Vast Wealth

-

News1 week ago

News1 week agoI Used To Sleep Hungry, But Today I Employ The Same People Who Once Laughed At My Poverty

-

Investigations2 days ago

Investigations2 days agoDEATH TRAPS IN THE SKY: Inside the Sordid World of West Rift Aviation’s Deadly Corruption Cartel

-

News1 week ago

News1 week agoMaurice Ogeta, Raila’s Bodyguard: The Shadow Who Became The Story

-

News2 weeks ago

News2 weeks agoInside 17 Minutes: CCTV Footage Reveals Murdered State House Guard Was Well Known to The Killer

-

News2 weeks ago

News2 weeks agoCourt Fines Orengo’s Law Firm For Wrongful Dismissal of Lawyer