Business

Where Did Sh250 Billion Eurobond Vanish To?

On paper, the plan was elegant: use the proceeds for infrastructure development, provide budgetary support, and retire expensive domestic debt. In practice, it became a masterclass in how public resources can vanish without a trace.

In the annals of Kenya’s financial history, few controversies have proven as enduring or as damaging to public trust as the mystery surrounding the Sh250 billion Eurobond that vanished into the labyrinthine corridors of government bureaucracy.

Eight years after former President Uhuru Kenyatta’s solemn promise to “spend this money prudently,” the question remains: where did Kenya’s largest single foreign borrowing disappear to?

Grand promise that turned into a nightmare

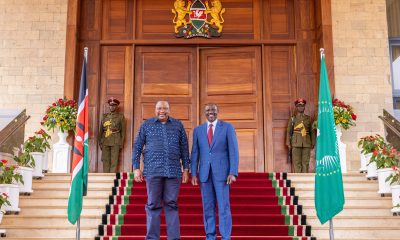

On June 25, 2014, President Kenyatta stood before the nation with what appeared to be a financial masterstroke.

Kenya had successfully floated a $2 billion sovereign bond—the country’s maiden venture into international capital markets.

The initial tranche of Sh174 billion, part of what would eventually total Sh250 billion, was meant to usher in a new era of infrastructure development while simultaneously relieving pressure on domestic borrowing.

“I want to assure you that the government will spend this money prudently,” the Uhuru declared from State House, Nairobi. Those words would later return to haunt his administration as one of the most hollow promises in Kenya’s recent political history.

The Eurobond, issued in two tranches—$1.5 billion over 10 years and $500 million over five years was deposited with JPMorgan Chase in New York.

On paper, the plan was elegant: use the proceeds for infrastructure development, provide budgetary support, and retire expensive domestic debt. In practice, it became a masterclass in how public resources can vanish without a trace.

When dreams collided with reality

The first red flags emerged not from opposition politicians or civil society, but from the economy itself. By 2015, the very outcomes the Eurobond was supposed to deliver had turned into their opposites. Interest rates, which were meant to decline due to reduced government borrowing domestically, soared to record highs of over 18%.

The Kenya Shilling, expected to strengthen with dollar inflows, weakened from 87 to the dollar in 2014 to 102 in 2015.

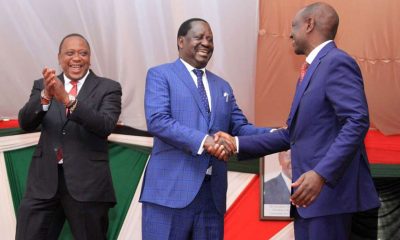

Opposition leader Raila Odinga, displaying the prescience that would later vindicate his skepticism, became the first prominent voice to question the Eurobond’s impact.

In October 2015, he posed a question that would echo for years: “Kenya’s economy cannot absorb that kind of money in one year. It is too much. If it was used to build infrastructure, we would be seeing those infrastructure developments.”

His follow-up was even more pointed: “Hiyo pesa ilijenga barabara gani? We spent Sh30 billion to build Thika highway, so the question remains where did the other Sh140 billion go?”

Treasury’s crumbling defense

Then-Treasury Cabinet Secretary Henry Rotich found himself in the unenviable position of defending the indefensible.

His initial response was dismissive: “I don’t understand why it takes so long to explain this, and the time it is consuming us to do very many important things rather than keeping on raising this. There is no money missing.”

Rotich provided what appeared to be a detailed breakdown: Sh64.4 billion for infrastructure, Sh44.6 billion for planning, Sh21.07 billion for energy and petroleum, Sh15.06 billion for water and irrigation, and Sh14.21 billion for agriculture.

Yet when pressed for specifics, the explanations crumbled. “The ministries are compiling the very specific projects that they applied on the money that we released to them,” he said—a statement that revealed the shocking absence of prior planning and oversight.

Only the Ministry of Energy provided any concrete details, with then-Principal Secretary Dr. Joseph Njoroge claiming Sh21 billion had been used for “school electrification, transmission lines, geothermal exploration and drilling.” Even then, specific project allocations remained opaque.

Enter Edward Ouko: The auditor who wouldn’t back down

Former Auditor-General Edward Ouko emerged as the unlikely hero of this saga—a forensic accountant who refused to accept political platitudes in place of financial accountability.

His office uncovered evidence that $2bn in Eurobond cash that Kenya raised in 2014 may have been misused, prompting what would become one of the most comprehensive international financial investigations in Kenya’s history.

Ouko’s determination to follow the money trail beyond Kenya’s borders drew unprecedented hostility from the executive.

When he announced plans to conduct forensic audits involving meetings with US and UK financial institutions—including JPMorgan, the Federal Reserve Bank, City Transaction Services New York, and Barclays Bank, President Kenyatta’s response was swift and brutal.

“When you say that the Eurobond money was stolen and stashed in the Federal Reserve Bank of New York, are you telling me that the Kenyan government and United States have colluded?” Kenyatta posed at an anti-corruption summit, with Ouko present. “Who’s is stupid here? And he [Ouko] says he wants to investigate the Federal Reserve Bank of New York!”

The public humiliation of the country’s chief auditor at a State House event signaled how seriously the administration viewed Ouko’s investigations—and how determined it was to shut them down.

The damning findings

By September 2016, Ouko’s investigations had produced the bombshell that opposition critics had long suspected: Sh215 billion could not be accounted for. The Auditor-General’s report revealed that none of the funds could be traced to specific development projects, a finding that contradicted every government assurance about prudent spending.

Even more damaging was Ouko’s discovery that some funds had been expended outside the government’s Integrated Financial Management Information System—effectively creating a parallel, unaccounted financial structure that bypassed normal oversight mechanisms.

The investigation, which extended to three continents and involved multiple international financial institutions, revealed systematic failures in financial management that went to the heart of government operations. As indicated in the Auditor’s Report for 2014/15, the receipt of net proceeds from commercial financing (Sovereign/Eurobond) of Sh215,469,626,035.75 accounted for in the 2014/15 financial year could not be ascertained as investigations into the receipts, issues, accounting and utilisation of the funds related to the sovereign/Eurobond was still ongoing.

Political warfare and intimidation

The Eurobond controversy became a lightning rod for broader questions about governance and accountability under the Jubilee administration.

Deputy President William Ruto, in a December 2016 Citizen TV interview, dismissed the allegations as “utter nonsense,” while President Kenyatta used the 2015 Jamhuri Day celebrations to issue a thinly veiled threat: “If you make accusations and fail to prove them, you too will also be held accountable.”

The political pressure on Ouko’s office was intense and personal.

Following publication of the audit, Dr Ouko said some of his officers had received death threats. Ouko and his team found themselves being accused of taking money from opposition parties to tarnish the record of the government.

The Ethics and Anti-Corruption Commission’s decision to grill Treasury officials, including CS Rotich and Principal Secretary Kamau Thugge, only intensified the political stakes around what had become a defining scandal of the Uhuru presidency.

The inconclusive conclusion

In a development that raised as many questions as it answered, the 2019 final audit report concluded that “There is sufficient evidence that all the proceeds of the sovereign bond were either eventually received into the Consolidated Fund or paid out for authorised purposes”. However, this conclusion came with a critical caveat that undermined its apparent exoneration: the report could not trace the funds to specific development projects.

The auditor advised that in future money raised through international sovereign bonds should be earmarked and traced to specific development projects.

He said under the circumstances, his office could not ascertain if indeed all the money raised through the sovereign bond was spent on development.

This qualified clearance satisfied neither critics nor supporters. While the government claimed vindication, the inability to demonstrate concrete development outcomes meant the fundamental questions about value for money and project delivery remained unanswered.

Broader pattern of impunity

The Eurobond controversy was not an isolated incident but part of a broader pattern of financial mismanagement that characterized the Jubilee administration.

Even as questions about the first Eurobond remained unresolved, Kenya proceeded to issue additional Eurobonds worth Sh202 billion in 2018 and over Sh200 billion in 2019, raising the country’s total Eurobond debt to over Sh650 billion.

This continued borrowing occurred despite warnings from the International Monetary Fund about Kenya’s mounting debt burden, which had reached Sh4.8 trillion by 2018. The pattern suggested a government more concerned with accessing funds than with demonstrating accountability for their use.

Edward Ouko’s legacy

In August 2019, Mr Ouko retired, closing the curtains on a magnificent yet equally controversial run in public service. His eight-year tenure had been marked by unprecedented scrutiny of government spending and a willingness to challenge the most powerful figures in the land.

The recognition of his exceptional record of public service as Auditor-General of the Republic of Kenya, and his bravery and dedication in combating corruption in the country came through the ICAEW Outstanding Achievement Award in 2024, acknowledging what many Kenyans already knew: Ouko had fought a largely solitary battle for financial accountability at the highest levels of government.

The questions that remain

As we reflect on this national scandal eight years later, several disturbing questions remain unanswered:

**Where are the infrastructure projects?** Despite claims that billions were spent on development, Kenya’s infrastructure gaps remain glaring. The promised transformation of the country’s physical landscape never materialized in proportion to the massive borrowing.

Why the parallel systems? The discovery that funds were disbursed outside the Integrated Financial Management Information System suggests deliberate attempts to avoid oversight. Who authorized these parallel disbursement mechanisms, and why?

What happened to accountability? Despite clear evidence of systemic failures in financial management, no senior officials faced consequences. The culture of impunity that allowed the Eurobond mystery to persist unchecked remains intact.

How much did Kenya actually benefit? Beyond the arithmetic of money in and money out, what tangible value did ordinary Kenyans receive from this massive borrowing? The economic indicators suggest the answer is disappointingly little.

The unlearned lessons

Perhaps most troubling of all is what the Eurobond saga reveals about Kenya’s approach to public finance. Despite numerous investigations, including one by the Auditor General, Edward Ouko, the exact whereabouts of the missing Eurobond money remain a mystery. The scandal underscored the lack of accountability in Kenya’s financial management and raised concerns about the country’s debt.

The government’s response to legitimate questions about public resource management set a dangerous precedent. By attacking the messenger rather than addressing the message, the Uhuru administration normalized a culture where accountability is seen as political persecution and transparency is treated as betrayal.

A national reminder

As Kenya grapples with an unprecedented debt crisis that threatens to undermine economic sovereignty, the Eurobond mystery serves as a sobering reminder of how we arrived at this precipice.

The Sh250 billion that vanished into the bureaucratic ether represents more than missing money—it represents a missed opportunity to build a more prosperous and equitable society.

The infrastructure projects that never materialized, the accountability mechanisms that were deliberately circumvented, and the public trust that was systematically eroded all constitute a legacy that extends far beyond the Uhuru administration.

Future governments will inherit not just the debt burden but the institutional weaknesses that made such massive financial disappearances possible.

Lest we forget, the Eurobond scandal is not ancient history but a contemporary cautionary tale about the costs of political acquiescence and bureaucratic impunity.

Until Kenya develops robust mechanisms for tracking public resources from procurement to delivery, and until citizens demand real accountability from their elected leaders, the country remains vulnerable to even larger financial scandals.

The question “Where did the Sh250 billion go?” may never receive a satisfactory answer.

But the more important question—“How do we prevent this from happening again?”—still awaits a response from Kenya’s political leadership.

The cost of continued silence grows higher with each passing day, measured not just in shillings and cents but in the trust between citizens and their government.

In the end, Edward Ouko’s investigations may not have recovered the missing billions, but they established an invaluable precedent: that even the most powerful figures in government are not above scrutiny.

Whether future auditors will have the courage to follow his example and whether the Kenyan public will support them when they do, will determine whether this national reminder serves as a cautionary tale or a blueprint for continued impunity.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Grapevine1 week ago

Grapevine1 week agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

Investigations5 days ago

Investigations5 days agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy4 days ago

Economy4 days agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Investigations2 weeks ago

Investigations2 weeks agoEpstein’s Girlfriend Ghislaine Maxwell Frequently Visited Kenya As Files Reveal Local Secret Links With The Underage Sex Trafficking Ring

-

News3 days ago

News3 days agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Business4 days ago

Business4 days agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Business2 weeks ago

Business2 weeks agoM-Gas Pursues Carbon Credit Billions as Koko Networks Wreckage Exposes Market’s Dark Underbelly