Business

Kenya Removes Longstanding Income Tax Benefits for Expatriates

Kenya serves as a major hub for expatriate workers due to its concentration of regional and international organizations.

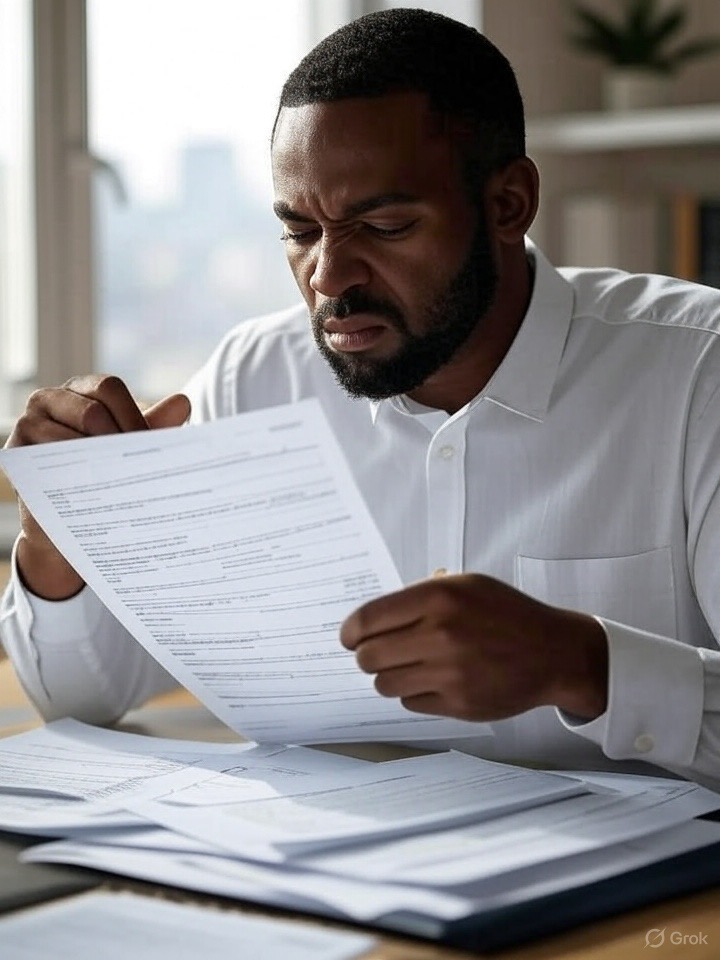

NAIROBI, Kenya – Kenya has eliminated a decades-old tax incentive that allowed expatriate workers to deduct one-third of their employment income before taxation, a move that could significantly impact the country’s appeal as a regional business hub.

The Finance Act 2025, signed into law this week, removes the preferential provision that has long benefited foreign workers employed by non-resident companies operating regional offices in Kenya.

The change means expatriate employees will now face taxation on 100% of their employment gains, potentially increasing their personal income tax liabilities substantially.

The deleted provision previously allowed partial tax relief for foreign workers who met specific criteria:

– Employment by non-resident companies or partnerships trading for profit

– Assignment to Kenya solely for duties related to the employer’s KRA-approved regional office

– Absence from Kenya for at least 120 days annually

– Income not deductible by the employer for Kenyan tax purposes

Legal experts warn the change could make Kenya less attractive to international talent. “This repeal eliminates a long-standing tax incentive designed to attract expatriate employees working in Kenya for regional offices of non-resident companies,” noted law firm Bowmans in their analysis.

The removal of the one-third deduction means affected employees face increased personal income tax burdens.

Companies may need to “gross-up” salaries to maintain employees’ net take-home pay, increasing operational costs for multinational employers.

Kenya serves as a major hub for expatriate workers due to its concentration of regional and international organizations.

While official statistics on expatriate numbers aren’t readily available, Central Bank of Kenya data reveals the scale of this workforce: foreign workers in Kenya remitted a record Sh86.99 billion to their home countries in 2023 – equivalent to Sh7.25 billion monthly and representing a 24.3% increase from the previous year.

Beyond removing expatriate benefits, the Finance Act 2025 grants the Kenya Revenue Authority (KRA) broader powers to collect taxes from non-residents with Kenyan tax obligations.

The legislation amends the Tax Procedures Act to include non-resident persons in provisions governing third-party tax collection, bank obligations, and joint account operations.

These changes extend KRA’s reach beyond resident taxpayers to encompass all non-resident persons subject to Kenyan taxation, potentially increasing compliance requirements for international workers and businesses.

The tax changes come as Kenya seeks to maximize revenue collection amid economic pressures.

The Treasury has been implementing various measures to broaden the tax base and increase collections, though this has included cutting tax targets due to economic challenges.

The elimination of expatriate tax benefits represents a significant shift in Kenya’s approach to attracting international talent and investment.

While it may boost government revenues in the short term, the long-term impact on Kenya’s competitiveness as a regional business destination remains to be seen.

For affected expatriates and their employers, the changes necessitate immediate review of compensation structures and tax planning strategies to navigate the new fiscal landscape.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business1 week ago

Business1 week ago‘They’re Criminals,’ Popular Radio Presenter Rapcha The Sayantist Accuses Electric Bike Firm Spiro of Fraudulent Practices

-

Business7 days ago

Business7 days agoIt’s a Carbon Trading Firm: What Kenyans Need to Know About Spiro’s Business Model Amid Damning Allegations of Predatory Lending

-

Business6 days ago

Business6 days agoManager Flees Safaricom-Linked Sacco As Fears Of Investors Losing Savings Becomes Imminent

-

News2 weeks ago

News2 weeks agoTemporary Reprieve As Mohamed Jaffer Wins Mombasa Land Compensation Despite Losing LPG Monopoly and Bitter Fallout With Johos

-

Investigations1 week ago

Investigations1 week agoDisgraced Kuscco Boss Arnold Munene Moves To Gag Media After Expose Linking Him To Alleged Sh1.7 Billion Fraud

-

News7 days ago

News7 days agoWoman Accused in High Defamation Blames AI As Case Exposes How Mombasa Billionaire Mohamed Jaffer Allegedly Sponsored Smear Campaign Linking Joho’s Family To Drug Trafficking

-

Investigations2 weeks ago

Investigations2 weeks agoFrom Daily Bribes to Billions Frozen: The Jambopay Empire Crumbles as CEO Danson Muchemi’s Scandal-Plagued Past Catches Up

-

Africa1 week ago

Africa1 week agoDisgraced Oil Trader Idris Taha Sneaks Into Juba as Empire Crumbles