Business

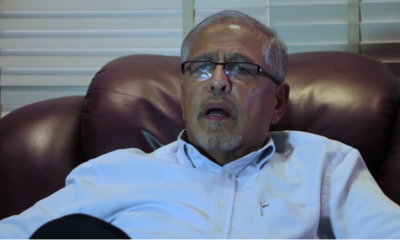

Tribunal Dismisses Nelson Havi’s Kshs. 74 Million Tax Appeal Against KRA

The decision, delivered in Tax Appeal No. E345 of 2024, brings to a close a prolonged legal battle between Havi, trading under Havi & Company Advocates, and the tax authority over a disputed tax liability amounting to Kshs. 74,020,520.49.

The Tax Appeals Tribunal has dismissed a tax appeal filed by prominent lawyer Nelson Havi against the Kenya Revenue Authority (KRA), ruling that the appeal was incompetent and improperly before the Tribunal.

The decision, delivered in Tax Appeal No. E345 of 2024, brings to a close a prolonged legal battle between Havi, trading under Havi & Company Advocates, and the tax authority over a disputed tax liability amounting to Kshs. 74,020,520.49.

Background of the Case

Nelson Havi, trading under the name Havi and Company Advocates, had challenged multiple tax assessments and demands made by the KRA between 2021 and 2023. The KRA had accused Havi of under-declaring income and failing to remit Value Added Tax (VAT) as required by law. The tax authority issued several demands, including a significant assessment of Kshs. 74 million in January 2024, which Havi contested.

Havi’s appeal was based on claims that the KRA had unilaterally adjusted his tax returns without notice or hearing, issued erroneous tax demands, and failed to consider his objections and payments made over the years. He argued that the KRA’s actions violated his right to fair administrative action and natural justice, as enshrined in the Kenyan Constitution.

Tribunal’s Ruling

In a detailed judgment delivered on February 12, 2025, the Tribunal, chaired by Christine A. Muga, found that Havi had failed to comply with statutory timelines for lodging objections to the KRA’s tax decisions. The Tribunal noted that Havi had either lodged objections outside the mandated 30-day period or failed to object at all in some instances.

The Tribunal emphasized that statutory timelines are not mere procedural technicalities but are mandatory requirements under the Tax Procedures Act (TPA). “The Appellant squandered his rights as a taxpayer to object pursuant to the provisions of the TPA,” the Tribunal stated, adding that the KRA could not be held liable for failing to make objection decisions when Havi did not comply with the statutory timelines.

The Tribunal also found that Havi had not provided sufficient evidence to support his claims, including letters of extension and formal objections. As a result, the Tribunal ruled that the appeal was incompetent and improperly before it, leading to the striking out of the case.

Findings

The Tribunal found that Havi had failed to lodge objections within the 30-day period required by the TPA. In some cases, objections were filed months after the KRA’s tax decisions, rendering them invalid.

The Tribunal noted that Havi had not provided any “appealable decisions” as required under the TPA. The documents he presented, including agency notices and tax demands, did not qualify as appealable decisions under the law.

The Tribunal reiterated that the burden of proof lies with the taxpayer to demonstrate that a tax decision is incorrect. Havi failed to discharge this burden, as he did not provide sufficient documentation to support his objections.

The Tribunal emphasized that it could not proceed with the case due to lack of jurisdiction. “Jurisdiction is everything. Without it, a court has no power to make one more step,” the Tribunal quoted from a previous court ruling.

Implications of the Ruling

With the Tribunal’s decision, the tax demands against Havi remain valid, and KRA is now free to enforce collection of the outstanding amounts.

Havi may still pursue further legal action, potentially appealing the decision in the High Court. However, given the Tribunal’s ruling on procedural grounds, he may first need to seek leave to extend the timelines for objecting to the tax decisions.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business5 days ago

Business5 days ago‘They’re Criminals,’ Popular Radio Presenter Rapcha The Sayantist Accuses Electric Bike Firm Spiro of Fraudulent Practices

-

News1 week ago

News1 week agoTemporary Reprieve As Mohamed Jaffer Wins Mombasa Land Compensation Despite Losing LPG Monopoly and Bitter Fallout With Johos

-

Sports1 week ago

Sports1 week ago1Win Games 2025: Ultimate Overview of Popular Casino, Sports & Live Games

-

Investigations1 week ago

Investigations1 week agoFrom Daily Bribes to Billions Frozen: The Jambopay Empire Crumbles as CEO Danson Muchemi’s Scandal-Plagued Past Catches Up

-

Business1 week ago

Business1 week agoHass Petroleum Empire Faces Collapse as Court Greenlights KSh 1.2 Billion Property Auction

-

Investigations6 days ago

Investigations6 days agoDisgraced Kuscco Boss Arnold Munene Moves To Gag Media After Expose Linking Him To Alleged Sh1.7 Billion Fraud

-

Africa5 days ago

Africa5 days agoDisgraced Oil Trader Idris Taha Sneaks Into Juba as Empire Crumbles

-

Investigations6 days ago

Investigations6 days agoFraud: How Sh235 Million Donor Cash For Nyamira Residents Was Embezzled Through Equity Bank Under Governor Nyaribo’s Watch