Business

Why Regretful Clients Are Warning Kenyans From Ever Taking Any Loan From Mogo

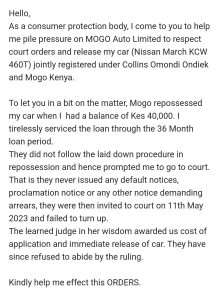

The CAK’s 2024 fine for unfair terms and hidden charges has failed to deter Mogo, as parliament and social media amplify calls for action.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News2 weeks ago

News2 weeks agoLegal Battle Erupts Over Shs 1.2 Billion School Acquisition

-

Investigations1 week ago

Investigations1 week agoHow Brokers Exploit Buyers in KD Number Plates Scam

-

News2 weeks ago

News2 weeks agoNairobi’s Land Scandal: How County Executive SG Mwangi’s Trail of Deals is Catching Up With Him

-

Investigations2 weeks ago

Investigations2 weeks agoSHA Breaks Silence Over Fraudulent Payments, Lost Data and Registry Shutdown

-

News2 weeks ago

News2 weeks agoInside Kericho’s Governor Erick Mutai’s 18 Lawyers Team Fighting Against His Impeachment

-

Politics1 week ago

Politics1 week agoOrengo Changes Tune on Ruto Exposing ODM Influence and Political Survival

-

Investigations2 weeks ago

Investigations2 weeks agoKDF Kills Five Al Shabaab Militants in Boni Forest Operation

-

Business2 weeks ago

Business2 weeks agoFlour Tycoons Rescue Savannah Cement in Sh3.8 Billion Deal