News

Kenya’s Risk Of Debt Distress Moves From Moderate To High According To IMF

The International Monetary Fund has raised Kenya’s risk of debt distress to high from moderate because of the impact of the coronavirus crisis, the IMF said in an assessment published on Tuesday.

The East African nation’s debt stood at 61.7% of gross domestic product at the end of last year, up from 50.2% at the end of 2015, the IMF said, driven up by budget deficits caused by large infrastructure projects, such as a new railway line.

“The risk of debt distress has moved to high from moderate due to the impact of the global COVID-19 crisis, which exacerbated existing vulnerabilities,” the fund said.

Officials at the finance ministry were not immediately available for a comment.

The debt load, however, still remained sustainable, the fund said in its debt sustainability analysis. Last week, it approved $739 million in emergency funding for Kenya to help it cope with the COVID-19 crisis.

The government has responded to the coronavirus crisis with a range of fiscal measures to try to limit the damage to the economy, including cuts to value-added and income taxes, which have worsened a number of indicators, the IMF said.

Among the worst-hit sectors in Kenya by the virus crisis are tourism and fresh produce exports, which are key sources of hard currency.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Investigations24 hours ago

Investigations24 hours agoCity Tycoons, MD Under Probe Over Multibillion Kenya Power Tender Scam

-

Development6 days ago

Development6 days agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations2 weeks ago

Investigations2 weeks agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Investigations2 weeks ago

Investigations2 weeks agoHow Close Ruto Allies Make Billions From Affordable Housing Deals

-

Entertainment2 weeks ago

Entertainment2 weeks agoKRA Comes for Kenyan Prince After He Casually Counted Millions on Camera

-

Investigations2 weeks ago

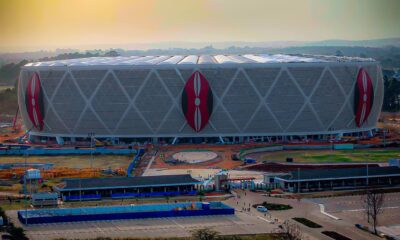

Investigations2 weeks agoTalanta Stadium Construction Cost Inflated By Sh11 Billion, Audit Reveals

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal