Business

I&M Bank Denies Involvement in CBEX Crypto Fraud Scheme as Interpol and FBI Take Over Investigation

According to reports, authorities are particularly interested in tracing the money flow through traditional banking channels that enabled the scheme to operate across multiple jurisdictions.

A major Kenyan financial institution has found itself at the center of an escalating international fraud investigation, as I&M Bank fights allegations that it facilitated transactions for a cryptocurrency trading platform now accused of operating a multi-million dollar Ponzi scheme across Africa.

I&M Bank has strongly denied any involvement with CBEX, the cryptocurrency trading platform at the center of a massive fraud investigation now being conducted by Interpol and the FBI.

The bank issued a statement distancing itself from the alleged scam, which has reportedly defrauded investors across Kenya and Nigeria of millions of dollars.

“I&M Bank is not involved in the operations of CBEX,” the financial institution stated in response to allegations made by researcher Antony Kagirison, who had linked the bank to the fraudulent scheme.

However, the bank has not elaborated on whether it provided banking services to entities affiliated with CBEX or what due diligence measures were taken regarding the accounts in question.

CBEX Operations and Allegations

The Singapore-based Crypto Bridge Exchange (CBEX), which operated under various names including ST Technologies International Ltd and Smart Treasure/Super Technology, allegedly promised investors returns of up to 100 percent within 30 days.

The platform is accused of running a sophisticated Ponzi scheme that targeted victims primarily in Kenya and Nigeria.

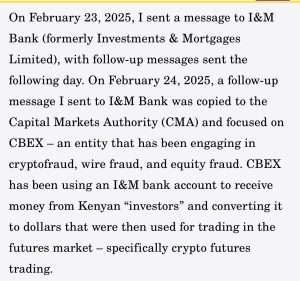

According to Kagirison’s allegations, CBEX used a multi-currency consumer-to-business account at I&M Bank to receive funds from Kenyan ‘investors’.

“CBEX has been using an I&M bank account to receive money from Kenyan ‘investors’ and converting it to dollars that were then used for trading in the futures market – specifically crypto futures trading,” Kagirison stated in documented communications allegedly with the bank.

The scheme abruptly shut down operations after failing to honor withdrawal requests from thousands of investors, many of whom later discovered their wallet balances had reverted to $0.00.

Scale of Losses and Enforcement Response

Estimates of investor losses vary significantly. While initial reports suggested losses of $6.1 million, other sources claim figures as high as $800 million across Kenya and Nigeria.

Cybersecurity experts have indicated that up to $1 million had been invested and lost by people worldwide in the scheme.

The fraud’s magnitude has triggered the involvement of international law enforcement agencies, with both Interpol and the FBI now joining local authorities in the investigation.

The collapse of the scheme has caused significant public outrage, with reports of angry investors storming and looting CBEX premises in both Kenya and Nigeria.

For victims like Bola, a Nigerian investor who went viral after a video showed her weeping outside a CBEX office, the answers can’t come soon enough. “I collected all my friends’ money, all the money, which was like USD 1,000,” she said, explaining she had lost her entire life savings to the scheme.

The CBEX case comes amid a significant increase in cryptocurrency-related fraud.

According to a recent FBI Internet Crime Complaint Center (IC3) report covering January to December 2024, crypto-related scams led to the loss of approximately $9.3 billion, with crypto-investment scams accounting for about $5.8 billion of these losses.

Overall, total losses traced to internet crimes amounted to about $16.6 billion, a 33% increase compared to the previous year. In 2024 alone, the FBI received almost 150,000 complaints related to fraudulent crypto schemes.

Regulatory Implications

Financial experts note that banks can potentially face liability for their role in facilitating fraudulent transactions, particularly if adequate anti-money laundering protocols were not followed.

A recent study from the University of California, Berkeley School of Law suggested that holding banks accountable for their role in cryptocurrency transactions “would provide greater protection for investors and customers.”

The Nigeria Securities and Exchange Commission has already denied any affiliation with CBEX, confirming the company was neither registered nor licensed to operate within the Nigerian capital market.

“The commission is working with law enforcement agencies to take legal action against CBEX, its affiliates, and promoters,” a Nigerian SEC spokesperson stated.

According to reports, authorities are particularly interested in tracing the money flow through traditional banking channels that enabled the scheme to operate across multiple jurisdictions.

“The involvement of international law enforcement signals the seriousness of this investigation,” a Nigerian publication quoted an insider source. “They’re looking at the entire ecosystem that allowed this fraud to thrive, including the banking infrastructure that processed the transactions.”

As investigations intensify, regulators across Africa are facing mounting pressure to establish stronger oversight of cryptocurrency platforms and the traditional financial institutions that service them.

The CBEX scandal has highlighted significant regulatory gaps that allowed the alleged fraud to operate unchecked despite Nigerian authorities having previously flagged 58 companies operating illegally in the country’s investment space.

I&M Bank has not responded to requests for further comment about their relationship with CBEX or any affiliated entities at the time of publication.

Common Crypto Scam Tactics

The FBI report identified several common tactics used in cryptocurrency investment scams:

Pig butchering scams : Criminals fake online relationships with victims before luring them to invest in fraudulent crypto schemes. This method often targets older adults and led to losses of over $2.8 billion.

FBI Operation Level Up identified almost 4,300 victims, with 76% unaware they had been victimized.

Investment platforms : The most lucrative scams are disguised as investment and financial grooming platforms, with almost $11 billion lost to such platforms in 2024.

Emerging techniques : New methods include QR code scams, crypto ATM fraud, stablecoin schemes, and the use of AI-generated personas to impersonate financial experts or online acquaintances.

As cryptocurrency becomes more popular globally, law enforcement agencies and cybersecurity experts are working to update their tools and educate the public about these fraudulent tactics.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

News2 weeks ago

News2 weeks agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations2 weeks ago

Investigations2 weeks agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy2 weeks ago

Economy2 weeks agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Grapevine1 week ago

Grapevine1 week agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Business2 weeks ago

Business2 weeks agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

News2 weeks ago

News2 weeks agoTragedy As City Hall Hands Corrupt Ghanaian Firm Multimillion Garbage Collection Tender

-

Arts & Culture2 weeks ago

Arts & Culture2 weeks agoWhen Lent and Ramadan Meet: Christians and Muslims Start Their Fasting Season Together

-

Business2 weeks ago

Business2 weeks agoKPC IPO Set To Flop Ahead Of Deadline, Here’s The Experts’ Take