Economy

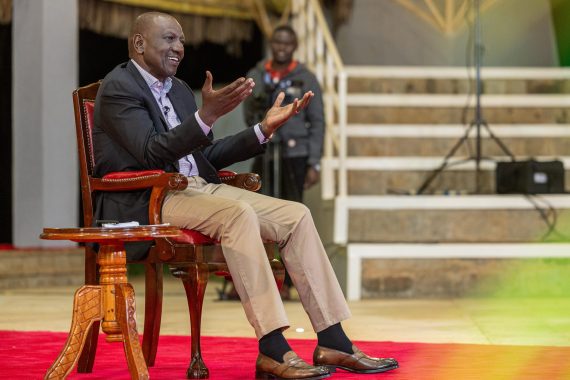

How the US-China Trade War Could Shape Kenya’s Future Under Ruto

Ruto’s administration faces a delicate balancing act. China remains a major creditor, holding a chunk of Kenya’s debt, while the U.S. offers new trade prospects.

As the trade war between the United States and China heats up, Kenya finds itself caught in the crossfire, facing both risks and opportunities under President William Ruto’s administration.

With President Donald Trump slapping Chinese goods with 104% tariffs as of Tuesday midnight and Beijing hitting back with its own measures, the global economy is teetering on the edge of stagflation—a toxic mix of sluggish growth and rising prices.

For Kenya, the stakes are high, and President William Ruto government’s next moves could define its economic legacy.

The fallout from this superpower showdown is already rippling across Africa.

If the conflict drags on, experts warn of a global slowdown that could hammer Kenya’s exports—think tea, coffee, and flowers, which rake in $200 million annually from China alone.

Meanwhile, Chinese goods, a staple for Kenyan consumers, are set to get pricier as tariffs bite, threatening to fuel inflation and weaken the shilling which surprisingly still stands strong at 129 against the dollar.

With a simmering political crisis at home, Financial Bill 2025, new protests could be on the horizon if living costs soar.

Yet, it’s not all doom and gloom. The trade war could open doors for Kenya to pivot and prosper.

China’s $8 billion in investments over the past 15 years—funding roads, railways, and more—may dwindle, but the U.S. and Europe could step in.

Kenya’s relatively stable market makes it an attractive alternative for Western goods, like German cars, that might lose ground in Asia.

And with the U.S. losing access to cheap Chinese textiles, Kenya has a shot at becoming a global sewing hub, stitching clothes for American and European buyers under the African Growth and Opportunity Act (AGOA).

Ruto’s administration faces a delicate balancing act. China remains a major creditor, holding a chunk of Kenya’s debt, while the U.S. offers new trade prospects.

During his 2022 campaign, Ruto railed against Beijing’s loans, even threatening to deport Chinese workers.

Now, pragmatism seems to be the order of the day as his administration tries to keep both giants happy. “We’ll need to be friends with everyone,” a senior official told Kenya Insights, speaking anonymously. “That’s our survival strategy.”

There’s more on the table. As global supply chains shift, Kenya’s tech ambitions—like the Konza Technopolis project—could attract U.S. and EU investment, positioning the country as an IT hub.

Regional trade through the African Continental Free Trade Area (AfCFTA) could also cushion the blow, with partners like India stepping up.

Even the Arab world and Russia might play a role: if U.S.-Russia tensions ease, Kenya could snag cheaper oil and fertilizers, a boon for its farmers.

The World Bank projects Kenya’s economy will grow by 4.9% annually through 2027, buoyed by tech and agriculture, which accounts for a third of GDP. But success isn’t guaranteed.

Inflation and a weaker shilling could spark unrest, testing Ruto’s leadership. Still, analysts are cautiously optimistic. “Kenya’s got a strong hand to play,” Mwangi says. “It’s about diplomacy and smart policies.”

If Ruto pulls it off, this trade war could be a political win, boosting his image ahead of the next election.

For now, Kenyans are watching—and hoping—the government can thread the needle between Trump’s America and Xi’s China.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine18 hours ago

Grapevine18 hours agoAlleged Male Lover Claims His Life Is in Danger, Leaks Screenshots and Private Videos Linking SportPesa CEO Ronald Karauri

-

Lifestyle4 days ago

Lifestyle4 days agoThe General’s Fall: From Barracks To Bankruptcy As Illness Ravages Karangi’s Memory And Empire

-

Americas1 week ago

Americas1 week agoEpstein Files: Bill Clinton and George Bush Accused Of Raping A Boy In A Yacht Of ‘Ritualistic Sacrifice’

-

Business2 weeks ago

Business2 weeks agoCooking Fuel Firm Koko Collapses After Govt Blocks Sh23bn Carbon Deal

-

Business1 week ago

Business1 week agoABSA BANK IN CRISIS: How Internal Rot and Client Betrayals Have Exposed Kenya’s Banking Giant

-

Investigations6 days ago

Investigations6 days agoEpstein Files: Sultan bin Sulayem Bragged on His Closeness to President Uhuru Then His Firm DP World Controversially Won Port Construction in Kenya, Tanzania

-

Business7 days ago

Business7 days agoKRA Can Now Tax Unexplained Bank Deposits

-

News1 week ago

News1 week agoAUDIT EXPOSES INEQUALITY IN STAREHE SCHOOLS: PARENTS BLED DRY AS FEES HIT Sh300,000 AGAINST Sh67,244 CAP