Business

CBK Flags 15 Banks in Suspicious Forex Transfers

Most of these transactions are tied to foreign currency repatriation and supporting the liquidity needs of subsidiaries abroad.

Fifteen commercial banks operating in Kenya have been identified as key channels for ferrying large volumes of foreign currency out of the country.

This development has raised concerns over potential money laundering, currency volatility, and regulatory loopholes in the country’s financial system.

According to a Central Bank of Kenya (CBK) survey conducted among 38 licensed commercial banks, 39.4 per cent—or 15 institutions—admitted to regularly transporting physical cash across the country’s borders.

Most of these transactions are tied to foreign currency repatriation and supporting the liquidity needs of subsidiaries abroad.

“The movement of large amounts of physical cash across borders, whether legitimate or illicit, continues to pose significant risks not only to Kenya but to the global financial system,” CBK said in the report.

“Despite existing regulatory measures, smuggling and courier-based cash movement present enforcement and oversight challenges,” the apex bank added.

It said the main destination countries for the cash are the United Kingdom, United States, Germany, Switzerland, South Sudan, and the Democratic Republic of Congo.

The currencies involved are primarily US dollars, Euros, and British pounds. Banks said most of this cash originates from customer deposits and group subsidiaries.

While 87 per cent of the 15 banks involved claimed to have policies guiding cross-border cash handling—including cash declaration forms and identification of couriers—CBK warned that loopholes remain.

The central bank pointed out that although a majority of the banks claim to conduct Know Your Customer (KYC) and Customer Due Diligence (CDD) checks, there are still significant gaps in technology use and inter-institutional cooperation that create room for illicit transactions.

“There is still insufficient technological capacity to detect smuggling attempts, and in some cases, banks have reported uncooperative clients or receiving institutions. These shortcomings hinder the ability to track and verify the legitimacy of cash flows,” CBK added.

Transaction reports

From 2022 to 2024, only four suspicious transaction reports (STRs) linked to cross-border cash were filed with the Financial Reporting Centre (FRC), raising questions over enforcement rigour.

Most of the flagged institutions said they rely on internal investigations, with only 36 per cent referring irregular cases to law enforcement agencies.

The current system is heavily reliant on physical inspections and documentation, making it vulnerable to exploitation.

Stakeholders in the financial sector have called for stronger oversight and enhanced cooperation between banks and regulators.

They are pushing for centralised databases of cash declarations at all ports of entry and real-time access for licensed financial institutions.

The CBK survey further noted that 67 per cent of the banks had experienced at least one instance of cash smuggling or irregularities in cross-border reporting in recent years, though such incidents were described as rare.

To address the challenges, the CBK recommended that financial institutions conduct annual audits of cross-border cash handling, train frontline staff to detect suspicious transactions and automate monitoring processes.

Enhanced due diligence for high-risk profiles and mandatory reporting of all repatriated cash at the point of entry were among the key proposals.

The bank has urged the creation of a unified framework that would allow financial institutions to verify declarations made at the country’s ports of entry, especially as global scrutiny over financial transparency intensifies.

Kenya’s strategic position as a financial and logistics hub in East Africa makes it particularly vulnerable to cash-based crimes.

The country has already strengthened its anti-money laundering laws in recent years, but CBK says enforcement remains uneven.

“This is a wake-up call,” the CBK concluded in the report.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Investigations1 day ago

Investigations1 day agoCity Tycoons, MD Under Probe Over Multibillion Kenya Power Tender Scam

-

Development6 days ago

Development6 days agoKenya Strips Dutch Climate Body of Diplomatic Immunity Amid Donor Fraud Scandal and Allegations of Executive Capture

-

Investigations2 weeks ago

Investigations2 weeks agoHow Mexico Drug Lord’s Girlfriend Gave Him Away

-

Investigations2 weeks ago

Investigations2 weeks agoHow Close Ruto Allies Make Billions From Affordable Housing Deals

-

Investigations2 weeks ago

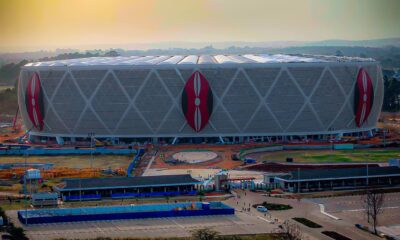

Investigations2 weeks agoTalanta Stadium Construction Cost Inflated By Sh11 Billion, Audit Reveals

-

Business2 weeks ago

Business2 weeks agoAmerican Investor Claims He Was Scammed Sh225 Million in 88 Nairobi Real Estate Deal

-

News3 days ago

News3 days agoEx-Inchcape Kenya CEO Sanjiv Shah Charged With Bank Fraud