Sports

Can’t Pay: Gor Mahia Chairman Ambrose Rachier At The Edge Of Bankruptcy

Gor Mahia FC Chairman and self declared Freemason lawyer Ambrose Rachier is at the edge of being declared bankrupt by Nairobi High Court following a bunch of suits filed against him by his creditors in July 22, 2022.

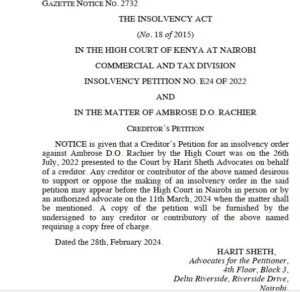

A Gazette Notice seen by Kenya Insights dated February 28th, 2024, in regards to the Commercial and Tax Division Insolvency Petition filed against Mr Rachier was publicized as it called on any other proposers and opposes of the petition against Mr Rachier to come forward as well.

“Any creditor or contributor of the above named desirous to support or oppose the making of an insolvency order in the said petition may appear before the High Court in Nairobi in person or by an authorized advocate on the 11th March 2024 when the matter shall be mentioned,” read the Notice.

According to the Constitution of Kenya, The Insolvency Act No 18 of 2015, Division 2, Section 17, a creditor may apply for bankruptcy order in respect of debtor in relation to a debt or debts owed by the debtor to the creditor or creditors.

The application may be made if at the time of the application: the amount of the debt or the aggregate of the debts is equal to or exceeds the prescribed bankruptcy level, the debt is for a liquidated amount payable to the applicant creditor/s either immediately or at some certain, future time, and is unsecured; the debt is a debt that the debtor appears either to be unable to pay or to have no reasonable prospect of being able to pay and there is no outstanding application to set aside a statutory demand in respect of the debt or any of the debts.

The Gazette Notice did not provide the nature of Mr Rachier’s debts, but simply provided the petitioner’s advocates information.

This petition against Mr Rachier comes a year after he signed a Sh 5 billion deal in the Mayfair Bank sale to Egypt’s Commercial International Bank (CIB).

According to a January 2023 report by the Business Daily, Mr Rachier was one of 32 investors who agreed to sell their combined 49% stake in the bank to CIB at $40 million (Sh 4.98 billion at the time). Mr Rachier had a direct stake equivalent of 0.98%.

Another top name among the investors is politician Peter Kenneth who is the founder of Mayfair Group who teamed up with other investors to establish the bank.

Freemason

The son of former Reverend Caon Hazron Rachier, Ambrose- a self confessed Free Mason- had a bout of success with the Kenya Premier League side club since taking over in 2008 but over the past few years, the club has been facing financial problems including paying off salaries and fines after bitterly parting ways with staff.

The lawyer, who has risen through the ranks to become a senior officer in freemasonry, disclosed in an interview that at the time of his introduction to the secret organisation, his friends talked him through, after that, he underwent an interview, got accepted and initiated.

“I was introduced to freemasonry by two friends in 1994. They talked me through it; I got interviewed, accepted, got initiated and I’ve since grown to be a senior officer,” he narrated.

In the interview, Rachier maintained that he does not regret ever joining the secret group revealing that the secret group features notable dignitaries such as the chief justices of Kenya.

He further disclosed that the members of the cult are not allowed to divulge any secrets to people on different levels in the organisation or non-members.

Freemasonry is a fraternal organization that unites men of good character who, though of different religious, ethnic or social backgrounds, share a belief in the fatherhood of God and the brotherhood of mankind.

Sh177M Debt

This won’t be the first time the lawyer is battling financial woes. In 2020, Development Bank of Kenya took him to court and wanted to attach his family’s 150-acre piece of land in Kajiado over a disputed Sh177 million loan.

Development Bank sued Mr Rachier and his four partners at the Rachier & Amollo Advocates- Otiende Amollo, Jotham Arwa, Francis Olalo and Stephen Ligunya claiming that the law firm had refused to settle overdraft facilities.

The lender also enjoined Marenyo Limited a firm owned by Mr Rachier and his sons Alvin and John. The piece of land that risks being sold is registered to Marenyo.

Rachier & Amollo Advocates then counter-sued, denying ever requesting for overdraft facilities and accusing the lender of allowing unauthorised access to the law firm’s accounts that have led to the Sh177 million debt.

The lender said that the overdrafts were guaranteed by a fixed deposit account held by Rachier & Amollo advocates, alongside a title deed for the 150-acre land. Development Bank says Marenyo has in court tried to draw attention away from the connection between its directors and Rachier & Amollo Advocates.

It argued that Marenyo director Alvin Samuel Oketch conveniently omitted his surname Rachier in affidavits sworn on behalf of the company as part of the plot.

But Marenyo filed an application within Development Bank’s suit, claiming that it did not guarantee the overdraft facilities, hence not liable for any debt claimed by the lender.

Development Bank granted the overdrafts on the strength of letters signed by the law firm’s founder, Mr Rachier.

Rachier & Amollo Advocates, however, said its contract with the lender only allowed decisions involving its accounts at Development Bank to be made through letters signed by at least two signatories.

The law firm said its bank account should have a Sh89 million deposit, and not a Sh177 million debt.

“It is therefore annoying for the plaintiff to keep presenting to this court letters allegedly signed by Mr Rachier alone, attributing to Rachier & Amollo or to the defendants the communications contained therein purporting to treat the same as lawful instructions given by or on behalf of Rachier & Amollo, or the defendants,” Stephen Ligunya, a partner at the firm said.

The overdrafts dated back to 2013 when the bank allegedly received a letter from Mr Rachier, which also requested that the loan be secured by the Kajiado land.

Two years later, Rachier & Amollo’s account at the bank received Sh22.8 million from Kitui County Government’s Central Bank of Kenya (CBK) account. The money was quickly withdrawn in cash.

The CBK then informed Development Bank that the money had been stolen from Kitui County. The lender then relayed the information to Mr Rachier, who allegedly promised to provide evidence that the law firm was entitled to the money. But he did not furnish Development Bank with evidence.

The Ethics and Anti-Corruption Commission obtained court orders freezing Rachier & Amollo’s accounts.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Grapevine2 weeks ago

Grapevine2 weeks agoRussian Man’s Secret Sex Recordings Ignite Fury as Questions Mount Over Consent and Easy Pick-Ups in Nairobi

-

News7 days ago

News7 days agoTHE FIRM IN THE DOCK: How Kaplan and Stratton Became the Most Scrutinised Law Firm in Kenya

-

Investigations1 week ago

Investigations1 week agoMulti-Million Dollar Fraud: Three Kenyans Face US Extradition in Massive Cybercrime Conspiracy

-

Economy1 week ago

Economy1 week agoIran Demands Arrest, Prosecution Of Kenya’s Cup of Joe Director Director Over Sh2.6 Billion Tea Fraud

-

Business1 week ago

Business1 week agoA Farm in Kenya’s Rift Valley Ignites a National Reckoning With Israeli Investment

-

Africa1 week ago

Africa1 week agoFBI Investigates Congresswoman Ilhan Omar’s Husband’s Sh3.8 Billion Businesses in Kenya, Somalia and Dubai

-

Grapevine3 days ago

Grapevine3 days agoA UN Director Based in Nairobi Was Deep in an Intimate Friendship With Epstein — He Even Sent Her a Sex Toy

-

Politics2 weeks ago

Politics2 weeks agoSifuna, Babu Owino Are Uhuru’s Project, Orengo Is Opportunist, Inconsequential in Kenyan Politics, Miguna Says