Business

KRA Announces Strict Requirements for Betting Firms on License Renewal Amid Crackdown

In a recent directive, BCLB flagged at least 58 betting websites, accusing them of operating illegally within Kenya’s internet domain.

As the debate on the regulation of betting and gaming firms rages on, the Kenya Revenue Authority (KRA) has published a set of rules which the companies must meet before their operating licenses are renewed

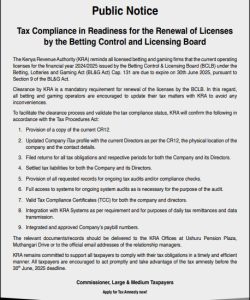

In a notice published in MyGov on Tuesday, May 6, 2025, KRA indicated that all licenses issued to betting and gaming operators for the financial year 2024/25 issued by the Betting Control & Licensing Board (BCLB) will expire on June 30, 2025.

Those willing to continue their operations in the country are therefore expected to apply for license renewal.

“The Kenya Revenue Authority (KRA) reminds all licensed betting and gaming firms that the current operating licenses for the financial year 2024/2025 issued by the Betting Control & Licensing Board (BCLB) under the Betting, Lotteries and Gaming Act (BL&G Act) Cap. 131 are due to expire on 30th June 2025, pursuant to Section 9 of the BL&G Act,” the notice read in part.

“Clearance by KRA is a mandatory requirement for renewal of the licenses by the BCLB. In this regard, all betting and gaming operators are encouraged to update their tax matters with KRA to avoid any inconveniences,” KRA further indicated.

The requirements

To facilitate the clearance process and validate the tax compliance status, KRA notified the betting and gaming firms to prepare a copy of their current CR12, an official document issued by the Registrar of Companies, providing details of a company’s directors, shareholders, and their respective shareholdings. It’s often required in legal, banking, and business transactions to verify company ownership and management.

The firms would also be expected to update their iTax profile with the current Directors as per the CR12, the physical location of the company and the contact details.

On top of that, they will be expected to have filed returns for all tax obligations, with their directors also fully compliant.

Additionally, the betting firms would be allowed to renew their licences once they have settled tax liabilities for both the company and its directors.

“Provision of all requested records for ongoing tax audits and/or compliance checks, full access to systems for ongoing system audits as is necessary for the purpose of the audit, and Valid Tax Compliance Certificates (TCC) for both the company and directors,” the taxman listed other requirements.

Betting firms would also be required to integrate with KRA systems as per requirements and for purposes of daily tax remittances and data transmission.

Finally, they will be expected to provide integrated and approved paybill numbers.

Recent crackdown

The notice comes against the backdrop of a recent crackdown on betting and gaming firms operating unlawfully in the country.

In a recent directive, BCLB flagged at least 58 betting websites, accusing them of operating illegally within Kenya’s internet domain.

The board has also ordered the immediate shutdown of their operations. BCLB said the sites lure gamblers by accepting deposits but then refuse to pay out winnings, leaving users vulnerable to financial exploitation.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business1 week ago

Business1 week agobetPawa Empire Crumbles: Mr Eazi’s Betting Gambit Unravels Amid Partner’s Shadowy Deals

-

News5 days ago

News5 days agoDCI Probes Meridian Equator Hospital After Botched Procedure That Killed a Lawyer

-

Business1 week ago

Business1 week agoKRA Boss Humphrey Watanga In Big Trouble In Sh5.5 Billion Rice Import Scandal

-

Investigations2 weeks ago

Investigations2 weeks agoKERRA Homa Bay Region Manager Calvince Thomas Accused of Swindling Businessman Ksh 2 Million in Phantom Tender Deal

-

Business4 days ago

Business4 days agoMinnesota Fraud, Rice Saga, Medical Equipment Deal: Why BBS Mall Owner Abdiweli Hassan is Becoming The Face of Controversial Somali Businessman in Nairobi

-

Business1 week ago

Business1 week agoState Set to Demolish Pastor Ng’ang’a’s Church in Sh28 Billion Railway City Push

-

Business2 weeks ago

Business2 weeks agoTreasury’s Sh40 Billion Safaricom Gamble Could Cost Kenya Trillions, Auditor Warns

-

Business6 days ago

Business6 days agoControversial Turkish Firm Celebi Canceled in India Over Security Concerns Acquires Strategic Property in Nairobi’s Main Airport