Business

Explosive Petition Exposes Alleged Fraud, Tax Evasion, and Betrayal at EABL

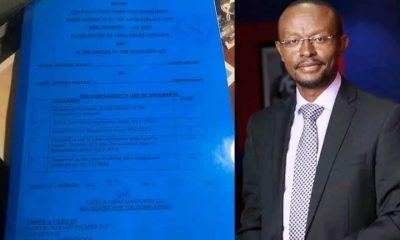

A bombshell petition presented to the Kenyan Senate has ignited calls for urgent investigations into East African Breweries Limited (EABL), one of Kenya’s oldest and most iconic companies, over allegations of fraudulent shareholding, massive tax evasion, and the systematic erosion of its Kenyan legacy.

The petition, lodged by Rono Nicholas Liom of Bomet County and tabled by Senator Wakili Hillary Sigei, paints a damning picture of corporate misconduct, regulatory failure, and a betrayal of public trust.

The Senate Standing Committee on Trade, Industrialization, and Tourism, chaired by Kajiado Senator Lenku Ole Kanar Seki, convened to deliberate on the petition, which accuses multinational drinks giant Diageo PLC and its predecessor, Guinness PLC, of orchestrating a decades-long scheme to defraud Kenyan shareholders, evade billions in taxes, and strip EABL of its assets.

The allegations, if proven, could mark one of Kenya’s largest corporate scandals.

A Controversial Takeover and Alleged Fraud

At the heart of the petition is Diageo’s contentious acquisition of EABL shares.

The petitioner alleges that in 2023, Diageo fraudulently acquired an additional 15% stake in EABL, increasing its ownership from 50.03% to 65%.

This move, the petition claims, was designed to secure shares for an onward sale to a third party—potentially Heineken or Castel Group—at a significantly inflated price, denying Kenyan shareholders the benefits of the higher valuation.

The petition traces EABL’s troubled history of foreign acquisition back to 1997, when Guinness PLC secured a significant stake through a Ksh 1.5 billion rights issue.

By 2000, an internal reorganization consolidated Guinness’ stake under Diageo, cementing foreign control despite fierce resistance from Kenyans and Parliament.

The petitioner alleges that commitments made by Guinness to cede shares back to Kenyans were never honored, and the 2023 acquisition represents a continuation of this betrayal.

Even more alarming are claims of coercion within EABL’s workforce.

The petition alleges that employees were bullied, threatened, and coerced into selling their share options to Diageo, actions that violate Kenyan labor and capital market laws.

These accusations suggest a toxic corporate culture under foreign ownership, further eroding trust in EABL’s stewardship.

A Legacy Dismantled

Founded in 1922 as Kenya Breweries Limited (KBL), EABL was once a cornerstone of Kenya’s economy, employing over 6,000 people and owning vast real estate, including staff houses, complexes, warehouses, and factories.

The petitioner claims that under Diageo’s control, EABL has been reduced to a “mere shell” of its former self.

The company has allegedly sold off its properties, with proceeds repatriated to Diageo’s overseas accounts, leaving EABL with just 600 employees and diminished local impact.

The petition argues that these actions reflect a deliberate strategy to extract wealth from Kenya while blocking benefits that should accrue to local shareholders and communities.

“The overall impact of this continued, contrived corporate action is a serious betrayal of the interest of the people of Kenya,” the petitioner stated, urging Parliament to intervene to protect the public interest.

Tax Evasion Allegations Rock EABL

Perhaps the most explosive claim in the petition involves allegations of massive tax evasion.

According to a 2020 whistleblower account cited in the petition, EABL manipulated the water and alcohol content of its products to exploit lower tax brackets, evading billions of shillings in taxes.

If substantiated, this scheme represents a significant loss of public revenue and raises questions about complicity or negligence by regulatory bodies such as the Kenya Revenue Authority (KRA).

The Senate Committee’s inquiry, which involved the Capital Markets Authority (CMA), the Competition Authority of Kenya (CAK), and the KRA, revealed systemic failures to address these red flags.

Despite the gravity of the allegations, no meaningful interventions have been made to protect Kenyan shareholders or recover lost tax revenue, according to the petitioner.

The petitioner has called for a parliamentary hearing to interrogate these events and secure Kenya’s public interest. Specific demands include:

• A thorough investigation into EABL’s shareholding practices and Diageo’s acquisitions.

• Enforcement action against EABL under the Competition Act for anti-competitive behavior.

• Amendments to the Capital Markets Authority Act to strengthen protections for shareholders and prevent future manipulations.

• Accountability for alleged tax evasion and the repatriation of EABL’s asset sale proceeds.

The Senate Committee has resolved to summon key stakeholders, including EABL, the Ministry of Investment, Trade, and Industry, the National Treasury, the CMA, the KRA, and the CAK, to testify.

Senators present at the meeting, including Esther Okenyuri, Karungo Thangwa, Crystal Asige, Jackson Mandago, Dr. Lelegwe Ltumbesi, and Andrew Omtatah, underscored the urgency of addressing these allegations.

A Nation Betrayed?

For many Kenyans, the EABL scandal is more than a corporate controversy—it is a profound betrayal of a national institution.

Once a symbol of Kenyan pride and economic self-reliance, EABL’s transformation into a diminished, foreign-controlled entity raises broader questions about the management of national assets and the role of regulatory bodies in safeguarding public interest.

The petition’s call for “renewed patriotism” in corporate governance resonates with a public increasingly wary of foreign dominance in key industries.

As the Senate prepares to delve deeper into the allegations, Kenyans are left grappling with a critical question: will justice prevail, or will this scandal fade into the shadows of impunity?

The nation awaits answers as the Senate’s investigation unfolds, with the potential to reshape Kenya’s corporate and regulatory landscape.

Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business1 week ago

Business1 week agoSAFARICOM’S M-SHWARI MELTDOWN: TERRIFIED KENYANS FLEE AS BILLIONS VANISH INTO DIGITAL BLACK HOLE

-

Business2 weeks ago

Business2 weeks agoEquity Bank CEO James Mwangi Kicked Out of Sh1 Billion Muthaiga Mansion

-

News2 weeks ago

News2 weeks agoBLOOD IN THE SKIES: Eleven Dead as West Rift Aviation’s Chickens Come Home to Roost in Kwale Horror Crash

-

News2 weeks ago

News2 weeks agoMILLER ON THE ATTACK: Lawyer Cecil Guyana Miller Sues Whistle-blower as Vigilante Blogger Maverick Aoko Sounds Alarm

-

Investigations2 weeks ago

Investigations2 weeks agoEXPLOSIVE DOSSIER: THE SECRET FILE THAT COULD DESTROY CAREERS – INSIDE KERRA’S SHOCKING CERTIFICATE SCANDAL

-

Business1 week ago

Business1 week agoLloyd Masika Probed for Fraud as Stanbic Bank Exposed for Incompetence in Due Diligence

-

News6 days ago

News6 days agoHow A Fake Firm Was Awarded A Sh230 Million Tender By Kiambu County

-

News2 weeks ago

News2 weeks agoRaila Was Aware His Time Was Coming To An End Nearly A Year Before His Death, Longtime Aide Reveals