Business

Safaricom Losing Market Dominance as Airtel Closes In, Report Shows

Safaricom PLC, Kenya’s telecom giant, is facing increasing pressure as rival Airtel Networks Kenya Ltd narrows the gap in the country’s fiercely competitive mobile market, according to the latest industry data.

The Communications Authority of Kenya (CA) released its Second Quarter Sector Statistics Report for the 2024/2025 financial year, covering October to December 2024, revealing that while Safaricom retains its lead, Airtel is gaining ground with aggressive pricing and faster growth in key services.

The report, published on the CA website, shows Safaricom commanding a 65.2% share of mobile subscriptions, with Airtel holding 27.2%.

Total active mobile subscriptions rose by 2.0% to 71.4 million, driven by festive season demand, pushing the penetration rate to 138.5%.

However, beneath these figures lies a shifting landscape: Airtel’s growth in voice and SMS traffic outpaces Safaricom’s, signaling a potential erosion of the latter’s long-held dominance.

“Safaricom remains the market leader, but Airtel’s momentum is undeniable,” said a telecom analyst based in Nairobi. “The festive season boost helped both, but Airtel’s gains suggest it’s winning over cost-conscious customers.”

Traffic Growth Highlights Competition

Airtel’s outgoing voice traffic surged by 8.3% to 9.83 billion minutes, compared to Safaricom’s 2.6% increase to 17.45 billion minutes.

Similarly, Airtel’s SMS traffic jumped 13.5% to 1.70 billion messages, dwarfing Safaricom’s 2.0% rise to 12.40 billion.

These figures, detailed in the report, reflect Airtel’s growing appeal, particularly among users making longer calls—its on-net minutes per call averaged 2.7, versus Safaricom’s 1.6.

Airtel’s pricing strategy appears to be a key driver. The report lists its average pay-as-you-go voice tariff at KES 2.78 per minute, significantly lower than Safaricom’s KES 4.87.

SMS tariffs are comparable at KES 1.20, but Airtel’s data rate of KES 4.50 per MB undercuts Safaricom’s KES 4.87, offering a compelling alternative for budget-minded consumers.

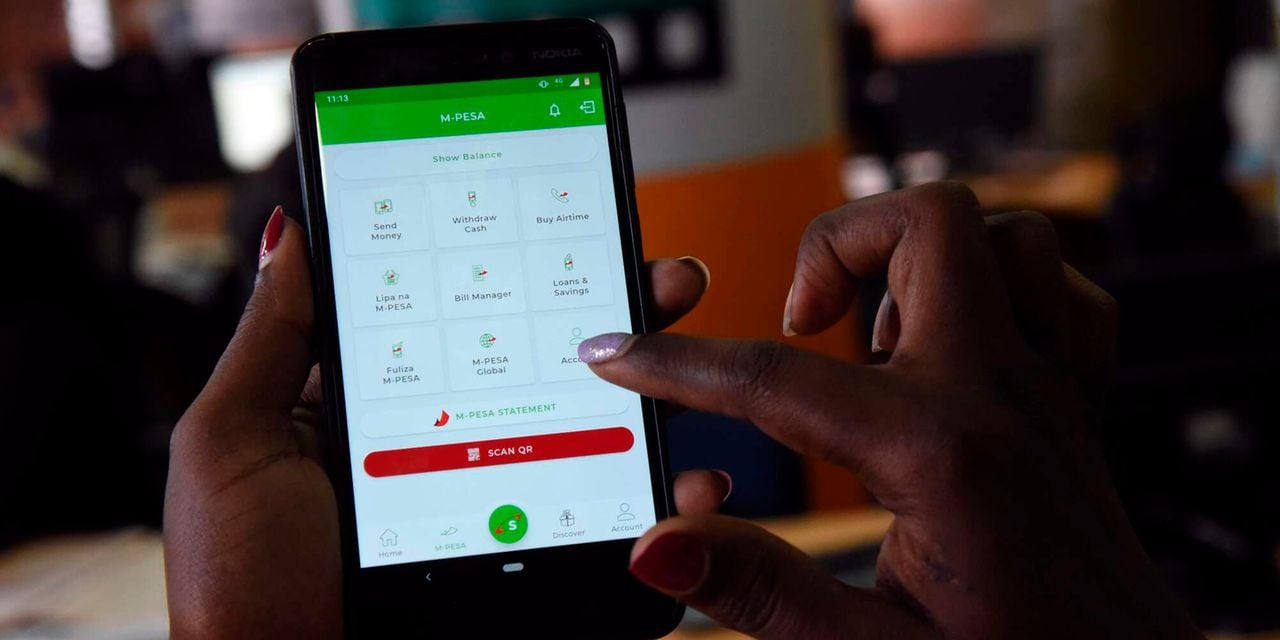

Airtel Money remains the more affordable option for transactions, which could also explain why it’s eating into M-PESA’s market.

Sending KES 1,000 ($7.7) to other networks costs KES 11 (0.085) on Airtel Money, compared to M-PESA’s KES 13 ($0.093), while withdrawing the same amount costs KES 29 ($0.22) on Airtel Money—KES 2 less than M-PESA.

The quarter saw mobile broadband subscriptions soar by 12.3% to 44.77 million, with smartphone penetration climbing to 80.5%. Safaricom’s extensive 4G and 5G network, covering 97% of the population, keeps it ahead in this space.

However, Airtel’s focus on mobile services and competitive bundles—like doubled data for KES 1,000 and KES 2,000 with rollover options—has analysts predicting further gains.

“Safaricom’s infrastructure is unmatched, but Airtel’s pricing and innovation are resonating,” noted a market observer. “The shift to higher-speed internet is a battleground where Airtel could close the gap.”

Fixed Services: Safaricom’s Edge

While Airtel challenges Safaricom in mobile, the latter holds a strong position in fixed data services. Table 12 shows Safaricom leading with 621,149 subscriptions, or 36.1% of the market, while Airtel barely registers among the top 10 providers. This diversification bolsters Safaricom’s resilience, even as mobile competition heats up.

The CA report shows a broader trend: Kenya’s telecom sector is evolving rapidly, fueled by demand for affordable, high-speed connectivity.

Airtel’s aggressive expansion, echoed in industry analyses from TechCabal and TechAfrica News, contrasts with Safaricom’s scale and brand strength.

With total cyber threats rising 27.2% to 840.9 million and satellite internet uptake growing—Starlink now holds 1.1% of fixed data subscriptions—the market is poised for further disruption.

For now, Safaricom’s 65.2% mobile share dwarfs Airtel’s 27.2%, but the gap is narrowing. If Airtel sustains its momentum, analysts say, Kenya’s telecom titan could face its toughest challenge yet.

Sector Statistics Report Q2 2024-2025Kenya Insights allows guest blogging, if you want to be published on Kenya’s most authoritative and accurate blog, have an expose, news TIPS, story angles, human interest stories, drop us an email on [email protected] or via Telegram

-

Business3 days ago

Business3 days agoCooking Fuel Firm Koko Collapses After Govt Blocks Sh23bn Carbon Deal

-

Business2 weeks ago

Business2 weeks agobetPawa Empire Crumbles: Mr Eazi’s Betting Gambit Unravels Amid Partner’s Shadowy Deals

-

Business1 week ago

Business1 week agoMinnesota Fraud, Rice Saga, Medical Equipment Deal: Why BBS Mall Owner Abdiweli Hassan is Becoming The Face of Controversial Somali Businessman in Nairobi

-

Politics1 week ago

Politics1 week agoYour Excellency! How Ida’s New Job Title From Ruto’s Envoy Job Is Likely to Impact Luo Politics Post Raila

-

Investigations2 weeks ago

Investigations2 weeks agoEXPOSED: SHA Officials Approve Higher Payments for Family, Friends as Poor Patients Pay Out of Pocket

-

News1 week ago

News1 week agoKenya Stares At Health Catastrophe As US Abandons WHO, Threatens Billions In Disease Fighting Programmes

-

Business2 days ago

Business2 days agoABSA BANK IN CRISIS: How Internal Rot and Client Betrayals Have Exposed Kenya’s Banking Giant

-

News2 weeks ago

News2 weeks agoDCI Probes Meridian Equator Hospital After Botched Procedure That Killed a Lawyer